Question

In: Accounting

PROBLEM FOUR - DEPRECIATION Borel Inc., a calendar year company, purchased a large truck for transporting...

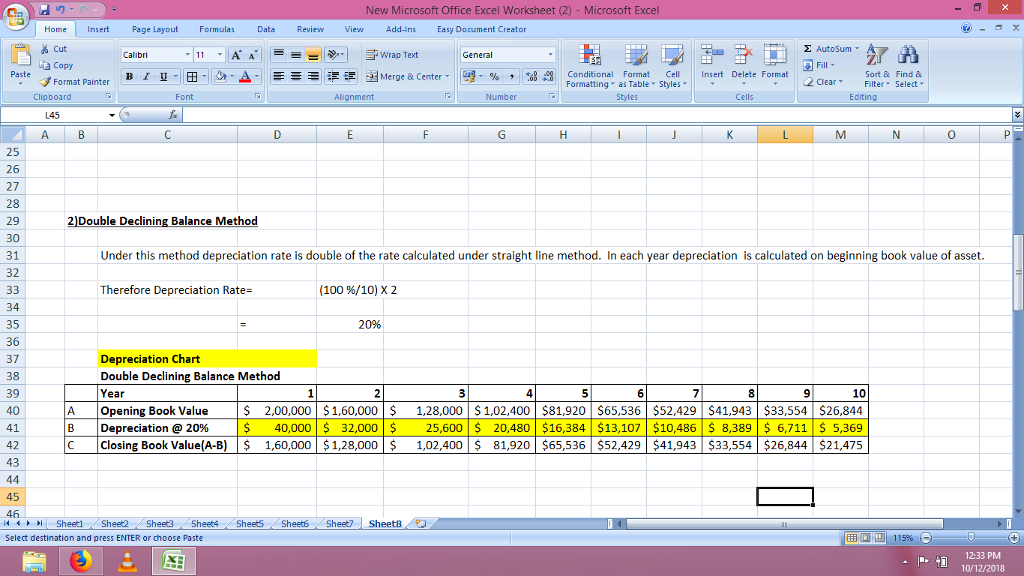

PROBLEM FOUR - DEPRECIATION

Borel Inc., a calendar year company, purchased a large truck for transporting racehorses. The cost of the trailer was $200,000 and was purchased on March 31, 2018. The dealer stated the truck would provide 10 good years with $20,000 in salvage value. What would be the depreciation expense during the first three years of ownership if Borel Inc. adopted the following depreciation methods: Straight Line; sum-of-the-years digits; and Double Declining Balance?

Solutions

Related Solutions

Question 2: Revised depreciation – betterment Nova Scotia Telecom Company had a truck that was purchased...

Question 2: Revised depreciation – betterment

Nova Scotia Telecom Company had a truck that was purchased on July

7, 2018, for $36000. The PPE subledger shows the following

information regarding the truck:

A customized tool carrier was constructed and permanently fitted to

the truck on July 3, 2020 at a cost of $9600 cash. The tool carrier

adds to the economic value of the truck. It will be used for the

truck’s remaining life and have a zero-residual value. The...

Depreciation for Partial Periods Chambers Delivery Company purchased a new delivery truck for $46,200 on April...

Depreciation for Partial Periods

Chambers Delivery Company purchased a new delivery truck for

$46,200 on April 1, 2016. The truck is expected to have a service

life of 10 years or 130,800 miles and a residual value of $4,680.

The truck was driven 9,700 miles in 2016 and 13,400 miles in 2017.

Chambers computes depreciation to the nearest whole month.

Required:

Compute depreciation expense for 2016 and 2017 using the

For interim computations, carry amounts out to two decimal places....

Depreciation for Partial Periods Storm Delivery Company purchased a new delivery truck for $66,000 on April...

Depreciation for Partial Periods

Storm Delivery Company purchased a new delivery truck for

$66,000 on April 1, 2019. The truck is expected to have a service

life of 5 years or 90,000 miles and a residual value of $3,000. The

truck was driven 12,000 miles in 2019 and 14,000 miles in 2020.

Storm computes depreciation expense to the nearest whole month.

Required:

Compute depreciation expense for 2019 and 2020 using the

following methods: (Round your answers to the nearest

dollar.)...

Depreciation for Partial Periods Clifford Delivery Company purchased a new delivery truck for $54,600 on April...

Depreciation for Partial Periods

Clifford Delivery Company purchased a new delivery truck for

$54,600 on April 1, 2016. The truck is expected to have a service

life of 10 years or 109,200 miles and a residual value of $4,800.

The truck was driven 11,300 miles in 2016 and 12,700 miles in 2017.

Clifford computes depreciation to the nearest whole month.

Required:

Compute depreciation expense for 2016 and 2017 using the

For interim computations, carry amounts out to two decimal places....

Depreciation for Partial Periods Bar Delivery Company purchased a new delivery truck for $52,200 on April...

Depreciation for Partial Periods

Bar Delivery Company purchased a new delivery truck for $52,200

on April 1, 2016. The truck is expected to have a service life of

10 years or 144,000 miles and a residual value of $1,920. The truck

was driven 9,200 miles in 2016 and 11,300 miles in 2017. Bar

computes depreciation to the nearest whole month.

Required:

Compute depreciation expense for 2016 and 2017 using the

For interim computations, carry amounts out to two decimal places....

Depreciation for Partial Periods Bar Delivery Company purchased a new delivery truck for $36,000 on April...

Depreciation for Partial Periods

Bar Delivery Company purchased a new delivery truck for $36,000

on April 1, 2019. The truck is expected to have a service life of

10 years or 180,000 miles and a residual value of $3,000. The truck

was driven 12,000 miles in 2019 and 16,000 miles in 2020. Bar

computes depreciation expense to the nearest whole month.

Required:

Compute depreciation expense for 2019 and 2020 using the

following methods: (Round your answers to the nearest

dollar.)...

On January 1, Year 1, Friedman Company purchased a truck that cost $52,000. The truck had...

On January 1, Year 1, Friedman Company purchased a truck that

cost $52,000. The truck had an expected useful life of 200,000

miles over 8 years and an $9,000 salvage value. During Year 2,

Friedman drove the truck 27,000 miles. Friedman uses the

units-of-production method. What is depreciation expense in Year 2?

(Do not round intermediate calculations.): rev:

11_10_2018_QC_CS-147760

Multiple Choice

$5,805

$7,020

$5,375

$6,500

17)Dinkins Company purchased a truck that cost $72,000. The

company expected to drive the truck...

Straight-Line Depreciation Irons Delivery Inc. purchased a new delivery truck for $42,000 on January 1, 2019....

Straight-Line Depreciation Irons Delivery Inc. purchased a new

delivery truck for $42,000 on January 1, 2019. The truck is

expected to have a $2,020 residual value at the end of its 5-year

useful life. Irons uses the straight-line method of depreciation.

Required: Prepare the journal entry to record depreciation expense

for 2019 and 2020. 2019 Dec. 31 Depreciation Expense Accumulated

Depreciation (Record straight-line depreciation expense) 2020 Dec.

31 Depreciation Expense Accumulated Depreciation (Record

straight-line depreciation expense)

Units-of-Production Depreciation Irons Delivery Inc. purchased a new delivery truck for $42,000 on January 1, 2019....

Units-of-Production Depreciation Irons Delivery Inc. purchased a

new delivery truck for $42,000 on January 1, 2019. The truck is

expected to have a $2,000 residual value at the end of its 5-year

useful life. Irons uses the units-of-production method of

depreciation. Irons expects the truck to run for 150,000 miles. The

actual miles driven in 2019 and 2020 were 40,000 and 36,000,

respectively. Required: Prepare the journal entry to record

depreciation expense for 2019 and 2020. Round your answers to...

Your company has purchased a large new truck-tractor for over the road use. It has a...

Your company has purchased a large new truck-tractor for over

the road use. It has a cost basis of $209,697. Its MV at the end of

18 years is estimated as $1,271. Assume it will be depreciated

using DDB method and the depreciation period is 18 years. What is

the depreciation payment in year 4?

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ADVERTISEMENT

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago