Question

In: Accounting

I'm working on the worksheet aspect of this practice set and my adjustments are not lining...

I'm working on the worksheet aspect of this practice set and my adjustments are not lining up with the adjusted trial balance. Could someone please help me with the adjusting entries? I'll post them and the original entries for reference, thank you.

ORIGINAL ENTRIES:

DECEMBER TRANSACTION DATA

Dec 1 Homer’s pays $1,200 for a one year insurance policy. The term of the policy is from 12/1/19 through 11/30/20.

Dec 1 Homer’s purchases Equipment (a forklift) for $10,000, paying $5,000 in cash and signing a 5 year, $5,000, Long Term Note Payable for the remaining amount. Don’t record any interest yet!

Dec 1 Homer’s purchases additional Equipment for $2,000, paying cash. Don’t combine this purchase with the previous purchase. Make a separate entry

Dec 4 Homer’s purchases inventory for $27,000 from AMPAS. As you recall from November, HH established a $10,000 credit limit with AMPAS, so HH puts $10,000 on account and pays cash for the remaining amount.

Dec 5 Homer’s pays this month’s $200 rent.

Dec 15 Homer’s pays $300 in advance for three months of advertising. The ads will run from 12/15/19 thru 3/15/20.

Dec 15 Homer’s pays off (with Cash) the $537.18 account payable amount owed to the attorneys from November.

Dec 15 After losing the Best Actress Oscar to Olivia Colman, Glenn Close decides to try to avoid the spotlight for awhile and return to her first love of painting. She rents some of HH’s property to use as an outdoor studio. Homer’s receives $600 Cash in advance from Close for 4 month’s rent. The rental agreement starts on 12/15/19. Hint: Use a liability account for the credit.

Dec 16 Homer’s sells Green Book Company three acres of Land. HH receives $5,000 Cash and a $10,000 Note Receivable in exchange for the 3 acres.

STEP 1: DIVIDE the TOTAL AMOUNT Homer’s originally recorded as their COST ($70,000) on November 15th by the TOTAL number of ACRES HH purchased (20 acres). This represents Homer’s “COST per ACRE.”

STEP 2: MULTIPLY HH’s “Cost per Acre” from Step 1 times the # of acres they sold (3 acres).This amount represents HH’s COST of the 3 acres sold.

STEP 3: COMPARE HH’s COST of the 3 ACRES sold to the TOTAL dollar AMOUNT HH RECEIVES from the sale (the Cash amount PLUS the amount of the Note Receivable). The difference will represent either a GAIN or LOSS.

You will need to allow four lines to journalize this transaction. There will be two Debit accounts (representing what Homer’s receives) and two Credit accounts (based on the cost of what HH gives up). Review the Chart of Accounts. Hint: This is not to be recorded like a “sale of merchandise on account.” Land is NOT considered part of HH’s “Inventory!”

Dec 17 Homer’s purchases $250 worth of office supplies, paying cash. Hint: The office supplies should provide a benefit to HH for several months.

Dec 18 Homer’s set a fire to burn some trash that had accumulated near the back of the store. The fire gets out of control and destroys $1,800 worth of inventory. Unfortunately, the insurance company does not honor HH’s claim. Homer’s must record the decrease in inventory and the other appropriate account. Hint: Inventory is gone but since it was not “sold” we can’t use the COGS account. Look at the Chart of Accounts to find an appropriate account title that seems to match these circumstances.

Dec 28 Homer’s pays cash of $5,248 in Salary and Wages Expense for salaries earned by employees up to and including 12/28.

Dec 31 During the month of December, Homer’s sells a combined total of $45,600 of inventory on account. Homer’s cost of the inventory was $25,650. Record this just like you did for the individual sales HH made on account in November.

Dec 31 The HH Board of Directors declares a dividend of $.05 / share. A total of 40,000 shares of Common Stock were issued from November 1 through December 31st and are eligible to participate in the dividend. Remember, this is just the declaration of the dividend. The payment will not be made until January. Be sure to use the appropriate dividend accounts to record this transaction. Review the Chart of Accounts.

Dec 31 Homer’s collected $36,700 in cash from its customers on account.

&& THE ADJUSTING ENTRIES

December adjustment data:

(a) MAKE THE SALARY ACCRUAL ADJUSTMENT. December 28th was the last payday for the month of December. On that date, employees were paid for work through the 28th. The two staff employees and the manager all worked Dec. 29, 30 and 31. The two staff employees are paid $12.00 per hour each and the manager receives $17.00 per hour. All employees work an eight-hour day.

(b) MAKE THE ADJUSTMENT FOR OFFICE SUPPLIES. A count of the office supplies shows that $180 worth of office supplies remain on hand.

(c) MAKE THE PREPAID INSURANCE ADJUSTMENT for the amount of insurance that has expired as of 12/31.

(d) MAKE THE DEPRECIATION ADJUSTMENT FOR BOTH THE FORKLIFT AND THE OTHER EQUIPMENT ACQUIRED ON 12/1. Use the straight-line method. The $10,000 forklift (equipment) has an estimated useful life of 10 years and no salvage value. The other ($2,000) equipment has a 5 year estimated useful life and no salvage value. These are two different types of Equipment, so calculate the amount of depreciation for each asset separately, then COMBINE the two separate amounts into ONE total and make ONE adjusting entry for the combined amount. HINT: Since HH has only had these assets for one month, you will need to pro-rate the annual amount of depreciation for just the month of December - 1/12 of a year. Do NOT ROUND the amount to the nearest $.

(e) MAKE THE PREPAID ADVERTISING ADJUSTMENT. As always, pay careful attention to the date of the original transaction. HINT: You don’t have to count out the exact number of days -- you may just use ½ of the monthly amount.

(f) MAKE THE ADJUSTMENT FOR THE UNEARNED RENTAL REVENUE that has now been earned from Glenn Close. As always, pay careful attention to the date of the original transaction. HINT: You don’t have to count out the exact number of days -- you may just use ½ of the monthly amount.

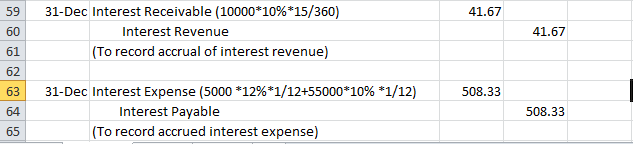

(g) MAKE THE ADJUSTMENT FOR THE INTEREST ACCRUED ON THE $10,000, 10% APR NOTE RECEIVABLE that HH received on 12/16 from the sale of land. REMEMBER: HH is using a 360 day year for all interest calculations, so use 15/360 OR ½ of 1/12 as the “T” in the (P x I x T) formula.

(h) MAKE THE ADJUSTMENT FOR THE INTEREST ACCRUED in DECEMBER on both (A) the $55,000, 10% APR LONG-TERM NOTE PAYABLE from NOVEMBER and (B) the $5,000, 12% APR L-T NOTE PAYABLE from the 12/1 FORKLIFT PURCHASE. Calculate interest on each note separately using 30/360 (or 1/12) as the time factor. Then, add the amounts together and enter that amount as one adjusting entry.

Solutions

Related Solutions

Complete a worksheet from a trial balance and adjustment data. Enter the adjustments in the adjustments...

only two adjustments appear in the adjustments column of a worksheet for Winona Mfg: one to...

Hi guys, I'm working on an assignment for my Java II class and the narrative for...

Why is it necessary to make consolidation adjustments for intragroup transactions? In making consolidation worksheet adjustments,...

Inventory Costing Worksheet Practice &

transcription and translation practice worksheet

Hi, I am struggling to understand this worksheet my professor gave us for practice. Could someone...

Happy Saturday. I'm working on my accounting homework ch. 11 and would liek to know if...

Hey everyone I'm working through my homework which involves creating a ER diagram based of certain...

It is now 30 June and our business is preparing adjustments via a worksheet. Complete the...

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago