Question

In: Economics

Part I and Part II are independent. Please answer both parts. Part I: During a year...

Part I and Part II are independent. Please answer both parts.

Part I: During a year of operation, a firm collects $450,000 in revenue and spends $100,000 on labor expense, raw materials, rent and utilities. The firm’s owner has provided $750,000 of her own money instead of investing the money and earning a 10 percent annual rate of return.

1A. The accounting costs of the firm are

1B. The opportunity cost is

1C. Total economic costs are

1D. Accounting profits are

1E. Economic profits are

The answers I have for these are:

1A. The accounting costs of the firm are $100,000

The accounting costs of the firm, or the explicit costs were

expressed in the question as $100,000.

1B. The opportunity cost is $75,000

The opportunity cost, or implicit cost is calculated as the owner’s

own money*the rate of return (both expressed in the question).

$750,000*.10=$75,000

1C. Total economic costs are $175,000

The total economic cost is calculated as the implicit cost (1B)

+ the explicit cost (1A).

$75,000+$100,000=$175,000

1D. Accounting profits are $350,000

Accounting profits are calculated as the revenue

(from the question)-explicit cost (1A).

$450,000-$100,000=$350,000

1E. Economic profits are $275,000

Economic profits are calculated as revenue

(from the question)-economic cost (1C).

$450,000-$175,000=$275,000

Part II: Higher personal taxes in the U.S. will affect personal disposable income which in turn will affect the domestic demand for goods and services. Costs of production and inputs however continue declining. What do you expect the U.S. output and prices in the near future. Assume we are moving from the old equilibrium to a new equilibrium. Please state clearly your assumptions and include a graph to support your answer.

Solutions

Expert Solution

1A. The accounting costs of the firm are $100,000

The accounting costs of the firm, or the explicit costs were

expressed in the question as $100,000.

1B. The opportunity cost is $75,000

The opportunity cost, or implicit cost is calculated as the owner’s

own money*the rate of return (both expressed in the question).

$750,000*.10=$75,000

1C. Total economic costs are $175,000

The total economic cost is calculated as the implicit cost (1B)

+ the explicit cost (1A).

$75,000+$100,000=$175,000

1D. Accounting profits are $350,000

Accounting profits are calculated as the revenue

(from the question)-explicit cost (1A).

$450,000-$100,000=$350,000

1E. Economic profits are $275,000

Economic profits are calculated as revenue

(from the question)-economic cost (1C).

$450,000-$175,000=$275,000

Hence first part is correctly answered.

Part two:

Assumptions:

1. Ceteris paribus: Other factors remaining constant.

2. Technology and other income factors remain constant.

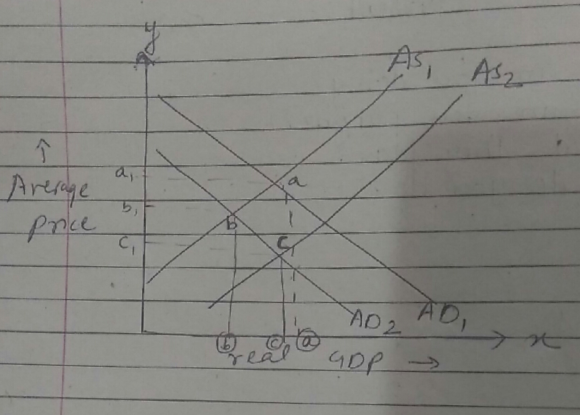

Due to high taxes, people are left with less income and hence aggregate demand shifts to the left from AD1 to AD2. a new equilibrium is made at point b with lower price levels. However, low costs of production shift supply curve to right from AS1 to AS2 and a new equilibrium is attained at point c. Price levels go down further. Final impact depends upon whether income drop is stronger or supply increase is stronger in this case. Respective price levels and real GDP levels are also shown in the diagram.

Related Solutions

Part 1 and Part II are independent. Please answer both parts. Part I: You are advising...

I NEED THE ANSWER FOR BOTH THE PARTS PLEASE Part (I) Year Investment A Investment B...

Please answer both parts of this question. Please answer both parts of this question. Question: a)...

Please answer both parts for upvote part a) Consider the shape of the distribution of each...

This question has two parts. Please answer both, thank you! Part A.) On the first day...

PLEASE COMPLETE BOTH PARTS (LANGUAGE: C++ if necessary) Part I For the following example, determine the...

Can you explain and answer part e and part f please? I already understand parts c...

Please complete both parts. Part I (1) Jill, a supervisor at a construction company, distributes payroll...

Please answer both the parts of the answer. Sex determination in Drosophila is determined by the...

Please answer all parts of this question for both parts!! Prompt: In our study of the...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

Rahul Sunny answered 2 years ago

Rahul Sunny answered 2 years ago