Question

In: Statistics and Probability

In 2011, when the Gallup organization polled investors, 34% rated gold the best long-term investment. However,...

In 2011, when the Gallup organization polled investors, 34% rated gold the best long-term investment. However, in April of 2013 Gallup surveyed a random sample of U.S. adults. Respondents were asked to select the best long-term investment from a list of possibilities. Only 241 of the 1005 respondents chose gold as the best long-term investment.

• Compute and describe a 95% confidence interval in the context of the case.

Solutions

Expert Solution

We have given,

x=241

n=1005

Estimate for sample proportion=0.2398

Level of significance is =0.05

Z critical value(using Z table)=1.96

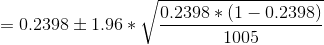

Confidence interval formula is

=(0.2134,0.2662)

Lower limit for confidence interval=0.2134

Upper limit for confidence interval=0.2662

| We are 95% confident that population proportion gold the best long-term investment is between 21.34% to 26.62% |

Related Solutions

In 2011, when the Gallup organization polled investors, 34% rated gold the best long-term investment. But...

In 2011, when the Gallup organization polled investors, 34% rated gold the best long-term investment. In...

In 2011, when the Gallup organization polled investors, 34% rated gold the best long-term investment. In...

When the gallup organization polled investors, 34% rated gold the best long-term investment.... Question: In 2011,...

In 2011, when the Gallup organization polled investors, 31% rated gold the best long-term investment. But...

n 2011, when the Gallup organization polled investors, 26% rated gold the best long-term investment. But...

In 2011, when the Gallup organization polled investors, 34% rated gold the best long-term investment. But in April of 2013 Gallup surveyed a random sample of U.S. adults.

In 2011, when the Gallup organization polled a random sample of investors, 34% rated gold the...

Steps a long-term care organization should go about when selecting an information system

1.When would the equity method be used to account for a long-term investment in stocks? (Be...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

orchestra answered 3 years ago

orchestra answered 3 years ago