Question

In: Accounting

8-36 Cost estimation: Ethan Manufacturig Inc. produces floor mats for automobiles. Joseph Ethan has asked you...

8-36 Cost estimation: Ethan Manufacturig Inc. produces floor mats for automobiles. Joseph Ethan has asked you to assit in estimating maintenance costs. Together you and Joseph determine that the single best cost driver for maintenance costs is machine hours. These data are from the previous fiscal year for maintenance expense and machine hours.

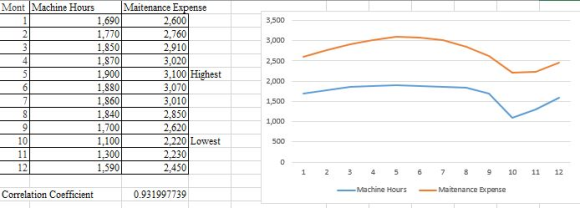

Month Maitenance expense Machine hours

1 2,600 1,690

2 2,760 1,770

3 2,910 1,850

4 3,020 1,870

5 3,100 1,900

6 3,070 1,880

7 3,010 1,860

8 2,850 1,840

9 2,620 1,700

10 2,220 1,100

11 2,230 1,300

12 2,450 1,590

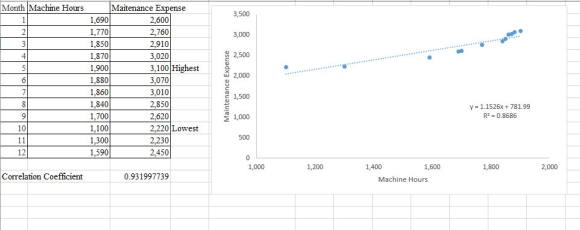

Requirment 1: what is the cost equation for maintenance using the high-low method? Graph the data points to check for outliners, alos do the single linear regression chart method and the caclulation method using the data Analysis tool in excel

Please attach answers as an excel doc attchment that is viewable!

Solutions

Expert Solution

| Step 1: Select the activity with the highest and lowest amounts | ||||

| Highest Machine Hrs worked | 1,900 | |||

| Lowest Machine Hrs worked | 1,100 | |||

| Step 2: Select the costs adjacent to those activities: 3,100 and 2,220 | ||||

| Step 3: Determine the slope (the variable cost per unit): | ||||

| [3100-2220]/[1900-1100] = 1.10 | ||||

| Step 4: Plug the variable cost from step 3 and the activity (Machine Hours) and total cost from either the high or the low point into the total cost equation, to solve for fixed costs (FC): | ||||

| Total Cost = Variable Cost x Activity + Fixed cost | ||||

| 3100 = 1.10*1900 + Fixed Cost | ||||

| Fixed Cost = 1010 | ||||

| Cost Equation = 1.10x + 1010 | ||||

Related Solutions

Felinas Inc. produces floor mats for cars and trucks. The owner, Kenneth Felinas, asked you to...

Special Order: High-Low Cost Estimation SafeRide, Inc. produces air bag systems that it sells to North...

Special Order: High-Low Cost Estimation SafeRide, Inc. produces air bag systems that it sells to North...

Cost Estimation; High-low Method; MAPE: Horton Manufacturing Inc. produces blinds and other window treatments for residential...

It is budget time and the CEO has asked you to develop a presentation on cost...

A company produces a product which has a standard variable production cost of $8 per unit...

You are the new controller for Banana, Inc.. The company CFO has asked you to develop...

You are the new controller for Banana, Inc.. The company CFO has asked you to develop the...

You are the new controller for Banana, Inc.. The company CFO has asked you to develop...

The president of Receding Airlines has asked you to calculate the company's cost of capital....

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 2 years ago

ekkarill92 answered 2 years ago