Question

In: Accounting

You are a cost accountant for a company that assembles, distributes and sells automobiles. Your competition...

You are a cost accountant for a company that assembles, distributes and sells automobiles. Your competition provides a superior product with a similar product line. There has been a significant shakeup in senior management. The new regime is committed to improving the company’s perceived and actual quality. Senior management is especially interested in capturing the costs in (1) preventing low quality; (2) product testing and appraisal; (3) the cost of manufactured products failing before shipment and (4) the cost of a low-quality product being sold to a customer.

Question: How would you design an accounting system to capture the costs improving the quality of your company’s product? What types of activities (costs) would you intend to capture in these four categories. What sort of internal control procedures would you put in place to ensure compliance with capturing these costs.

Solutions

Expert Solution

I think as a cost accountant, the following measures of compliance would be useful to the Senior management in capturing costs in (1) preventing low quality; (2) product testing and appraisal; (3) the cost of manufactured products failing before shipment and (4) the cost of a low-quality product being sold to a customer.

Solution:

Many companies have expressed frustration with arbitrary allocations associated with traditional costing methods. This has led to increased utilization of a uniquely different approach called activity-based costing (ABC). A simplified explanation of ABC is that it divides production into core activities, defines costs for those activities, and allocates those costs to products based on consumption of the activities. Consider that traditional costing methods divide costs into product costs and period costs. The period costs include selling, general, and administrative items that are charged against income in the period incurred. Product costs are the familiar direct materials, direct labor, and factory overhead. These costs are traced/allocated to production under both job and process costing techniques. However, some managers reject this methodology as conceptually flawed. It can be argued that a finished product should include not only the cost of direct materials, but also a portion of the administrative cost necessary to buy the materials (e.g., many companies have a separate unit in charge of purchasing). Conversely, the cost of a plant security guard is part of factory overhead, but some managers fail to see a correlation between that activity and a finished product; after all, the guard will be needed no matter how many units are produced.

Benefits Of ABC:

Activity-based costing attempts to overcome the perceived deficiencies in traditional costing methods by more closely aligning activities with products. This requires abandoning the traditional division between product and period costs, instead seeking to find a more direct linkage between activities, costs, and products. This means that products will be charged with the costs of manufacturing and nonmanufacturing activities. It also means that some manufacturing costs will not be attached to products. This is quite a departure from traditional thought.

With ABC a product is only charged with the cost of capacity utilized. Idle capacity is isolated and not charged to a product or service. Under traditional approaches, some idle capacity may be incorporated into the overhead allocation rates, thereby potentially distorting the cost of specific output. This may limit the ability of managers to truly understand and identify the best business decisions about product pricing and targeted production levels.

A Closer Look At ABC Concepts

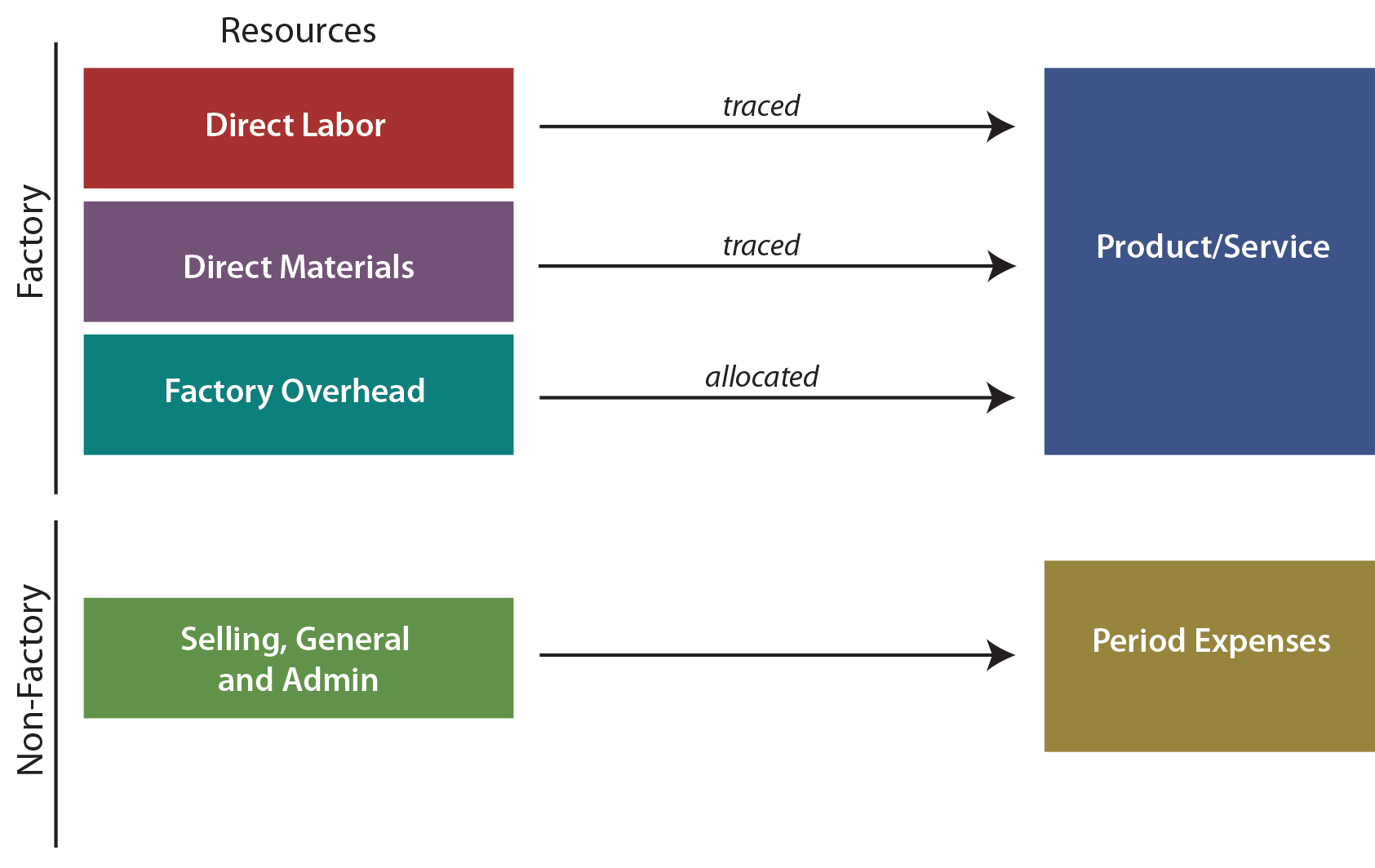

With traditional costing methods, prime costs are traced to output while factory overhead is allocated to output. Non-factory costs do not get assigned to a product:

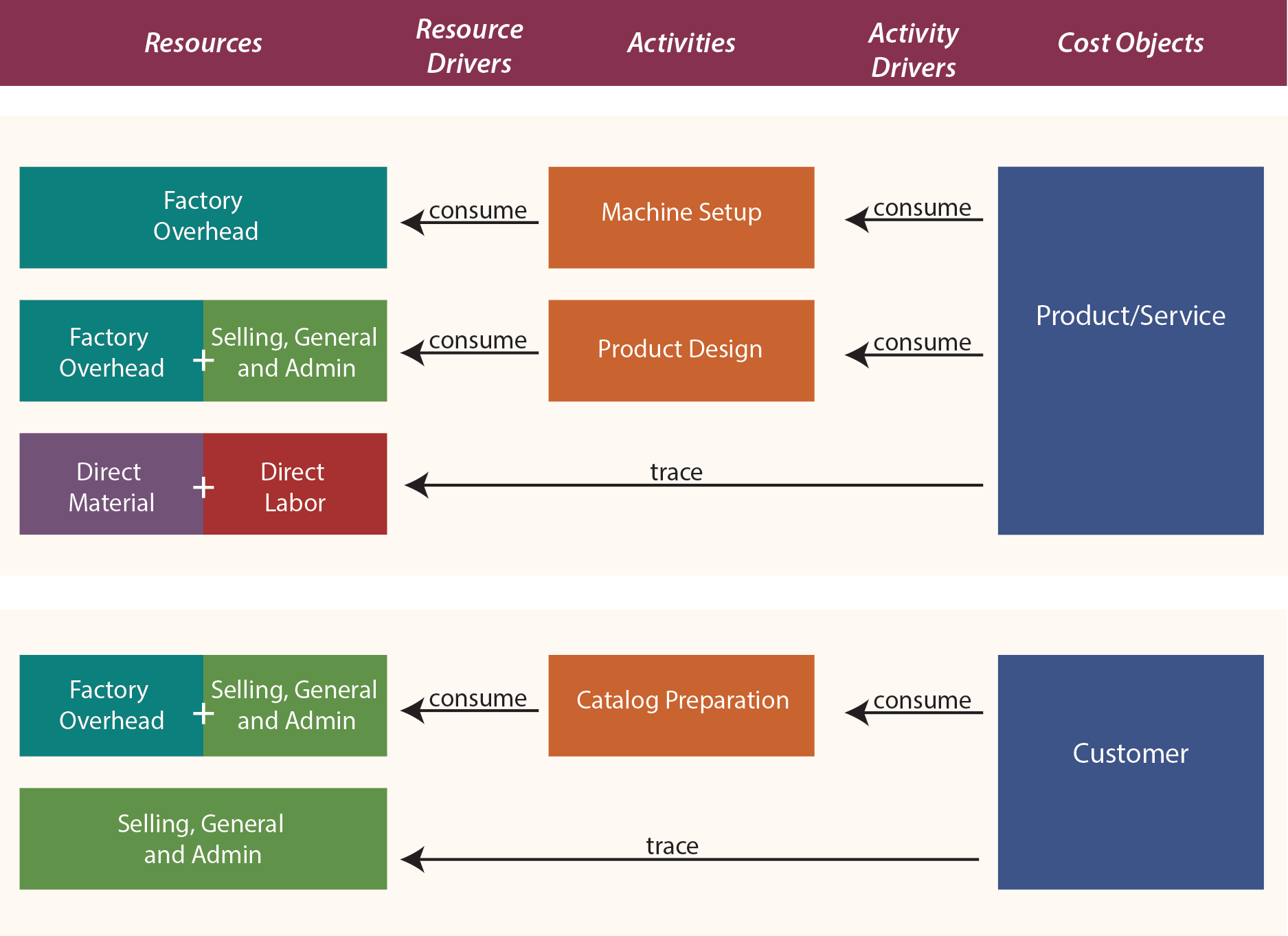

Compare this traditional logic to ABC, and one sees a reversal of the thought process. With ABC, cost objects are broadened to include not only products/services, but also other objects like customers, markets, and so on. These “cost objects” are seen as consuming activities. The activity driver is the event that causes consumption of an activity. For instance, each customer may receive a catalog, whether he or she orders or not during a period. Preparation and distribution of the catalog is the “activity” that is being driven by the number of customers. Activities necessarily consume resources. Thus, preparation of a catalog will require labor, printing, office space, etc. Thus, activities drive the need for resources and are said to be resource drivers. The following graphic reveals the conceptual notion of ABC for two types of cost objects, which is quite different and much more involved than the traditional costing approaches. In reviewing the graphic, notice that costs that are directly traced to a cost object need not be “routed” through an activity:

A business might have dozens of cost objects, hundreds of activities, and numerous resource pools to evaluate. A diagram of the interconnectivity can reveal multiple cost objects feeding off of many shared activities that in turn use up various resources.

Related Solutions

As a cost accountant of a company that manufactures a single product, would you advise your...

Imagine if you were cost accountant of the company. How would you prepare your income statement...

You are employed as an accountant for Innovative Computing. Your company is in the process of...

You are employed as an accountant for Innovative Computing. Your company is in the process of...

You have just joined a company as a new staff accountant. Your company is in an...

The DiForio Motor Car Company is a small manufacturer of automobiles and sells to three distributors...

Eurowatch company assembles expensive wristwatches and then sells them to retailers throughout europe. The watches are...

EuroWatch Company assembles expensive wristwatches and then sells them to retailers throughout Europe. The watches are...

A company assembles and sells skateboards. One popular model is the "ICE". The final assembly plan...

Case 5.1EuroWatch Company EuroWatch Company assembles expensive wristwatches and then sells them to retailers throughout Europe....

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 2 years ago

ekkarill92 answered 2 years ago