Question

In: Finance

You have been looking around for a nice car and have found the car you want...

You have been looking around for a nice car and have found the car you want for the right price. All along, you have told the dealer that you want to purchase the car. It will cost you $45,000 out the door. You will put 25% down and take out a 4-year car loan. The interest rate you got from a local bank is 2.99% for 48 months.

You made the deal and now you need to “finalize” the paperwork with the dealer’s finance officer. He offers you an opportunity to lease the car and save you money every month! What a deal!! Here are the terms:

- Capitalized cost $4,500

- Lease payments $399

- Security deposit = 2 lease payments

- Lease term: 48 months

- Mileage cap: 10,000

- Mileage charge if over the cap: $0.25/mile

- Residual value: $22,500

Your savings account pays you 0.80% per year. You typically drive 13,000 miles per year. You plan on bringing the car back in perfect condition and expect to get your deposit back.

- Based on pure numbers, should you buy or lease? Why?

Solutions

Expert Solution

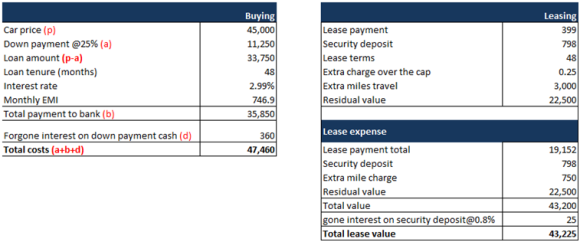

Answer: Please refer the below tables calculation:

we have assumed that at the end of the lease tenure the person will Buy the car at residual value. Clearly the leasing is a bit costlier compared to buying a car using finance. I would buy a car instead of leasing.

Note: here capitalised cost is $4,500 which is less than residual value - it seems like a typo. Capitalised cost can't be lower than residual value

Related Solutions

There have been some very nice discussions recently centered around the question of whether gravity and...

For a nice house for $300,000 (inclusive of closing costs) that you have selected, you want...

This is a nice question when you find it out, and I am really looking for...

You graduated college and as a graduation gift to yourself you want to buy a nice...

You want to buy a house. You have found the house you like and have agreed...

u are looking for a car and have narrowed it down to two options. You can...

Assume you have found a USB memory stick in a car park, and you plugged the...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy a car which will cost you $10,000. You do not have sufficient...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

jeff jeffy answered 2 years ago

jeff jeffy answered 2 years ago