Question

In: Computer Science

Develop a C++ program that will determine the gross pay and netpay (after taxes). Each...

Develop a C++ program that will determine the gross pay and net pay (after taxes). Each employee pays a flat tax of 150.00 on the first 1000.00 dollars earned. If the employee earns less than 1000.00 dollars then he/she pays no taxes. Taxes are computed at 15.5% on all earnings over 1000.00 dollars if the number of dependents is 3 or less and 12.5% if the number of dependents are 4 or more.

Solutions

Expert Solution

Program:

//header file

#include

using namespace std;

//main function

int main()

{

//variable data type declrations

double earnings, gross_pay, net_pay;

int n_dependent;

//ask to input data

cout<<"Enter the Employee Earning: ";

cin>>earnings;

cout<<"Enter the number of dependents: ";

cin>>n_dependent;

//if number of depenedent <=3 and earnings is > 1000

if(n_dependent <=3 && earnings > 1000)

{

//calculate gross pay

gross_pay = earnings - 150;

//calculate earnings

earnings = earnings - 1000;

//calculate net_pay

net_pay = earnings - (earnings * 15.5)/100 - 150;

}

//if number of depenedent >3 and earnings is > 1000

else if(n_dependent > 3 && earnings > 1000)

{

//calculate gross pay

gross_pay = earnings - 150;

//calculate taxable earnings

earnings = earnings - 1000;

//calculate net pay

net_pay = earnings - (earnings * 12.5)/100 - 150;

}

//if earning is less than 1000

else

{

gross_pay = earnings;

net_pay = earnings;

}

//display the gross pay and netpay

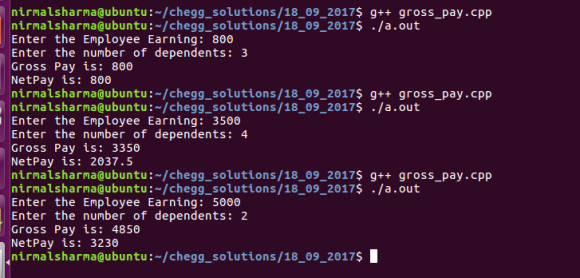

cout<<"Gross Pay is: "< cout<<"NetPay is: "< return 0; }//end of the program here i have attached various sample run in a single screen shot.

You can also try and execute the program with different data. Output:

------------------------------------------------------------------------------------------------------------------------------------------

Related Solutions

Develop a C++ program that will determine the gross pay and net pay (after taxes). Each...

Please use C++ program. uses a while statement to determine the gross pay for each of...

In C Program #include Create a C program that calculates the gross and net pay given...

Develop a Java program that determines the gross pay for an employee. The company pays hourly...

Develop a Java application that determines the gross pay for each of three employees.

my program should work for ANY NUMBER OF WORKERS..after all worker gross and net pay have...

PSc 2-7 Calculate Gross Pay with Commissions Calculate gross pay for each of the following employees....

For each employee, first calculate gross pay. Then determine taxable income used to calculate federal income...

For each employee, first calculate gross pay. Then determine taxable income used to calculate federal income...

For each employee, first calculate gross pay. Then determine taxable income used to calculate federal income...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

venereology answered 3 years ago

venereology answered 3 years ago