Question

In: Finance

You have been asked to value a private company using Method of Comparables. You believe you...

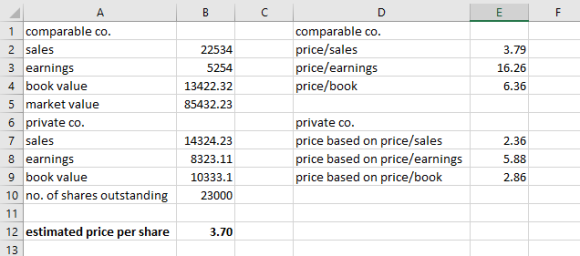

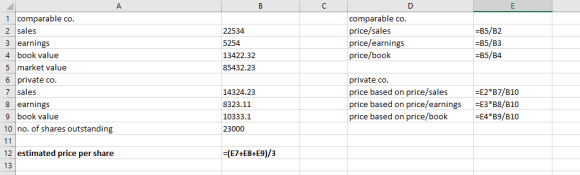

You have been asked to value a private company using Method of Comparables. You believe you have found a comparable publiccompany with the following data (in millions):

|

Sales |

$22,534.00 |

|

Earnings |

$5,254.00 |

|

Book value |

$13,422.32 |

|

Market value |

$85,432.23 |

You were given the following data of the private company (in millions):

|

Sales |

14,324.23 |

|

Earnings |

8,323.11 |

|

Book value |

10,333.10 |

|

Number of shares outstanding |

23,000.00 |

Please use Price/Sales, Price/Earnings, and Price/Book to calculate the estimated price per share for the private company. Please use equal weighting of all the ratios to calculate the estimate price per share.

|

$3.70 per share |

||

|

$5.11 per share |

||

|

$7.54 per share |

||

|

$9.11 per share |

Solutions

Expert Solution

the price per share is estimated using the price/sales ratio , price/earnings ratio, price/book ratio for the comparable co.

then the average of the prices computed using the above ratio is taken since the ratios are assumed to be equally weighted, and we get the estimated price per share for the private company

Related Solutions

You have been asked to value Ausbiz, a private company, using an excess earnings method, given...

Discuss the merits and limitations of using the method of comparables as a valuation method.

Discuss and explain the merits and limitations of using the method of comparables as a valuation...

You have been asked by an investor to value a restaurant using discounted cash flow valuation....

You have been asked to value the assets of a privately held consulting company. You can...

To demonstrate the practical implementation of the public\private encryption, you have been asked to compete the...

As a financial analyst for Muffin Construction, you have been asked to recommend the method of...

You are an analyst in charge of valuing common stocks. You have been asked to value...

In that regard, you have been asked to join in as a consultant for a company...

Assume that you have been asked to place a value on the acquisition of Briarwood Hospital....

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

jeff jeffy answered 3 years ago

jeff jeffy answered 3 years ago