Question

In: Economics

Think about a housing market where demand for housing is downward sloping and supply of housing...

Think about a housing market where demand for housing is downward sloping and supply of housing is vertical. Draw a graph and show the equilibrium. What is the elasticity of supply of new housing? Now suppose if the government wants people to buy more houses, it announces a tax credit policy for new home buyers. Which curve will shift? Will it lead to an increase in houses purchased?

Solutions

Expert Solution

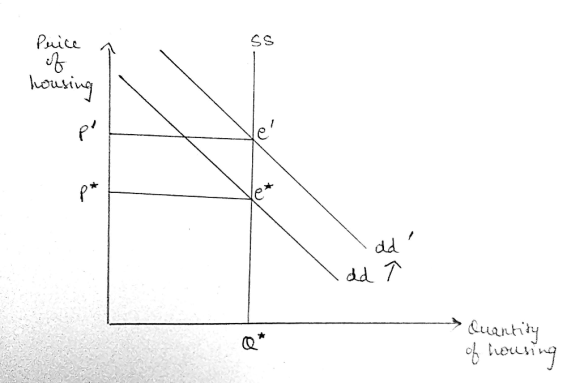

The original equilibrium is at e* where equilibrium quantity and price of housing are Q* and P* respectively.

Elasticity of supply of new housing is inelastic because houses cannot be built quickly in response to a sudden increase in demand, construction of new houses takes time. It is also constrained by the limited availability of land and labour.

If govt announces tax credit for new home buyers, the demand for housing will increase which will shift the demand curve to the right to dd'. Since supply of housing is fixed in the short run, an increase in demand will increase the equilibrium price of houses. New equilibrium is at e' where equilibrium quantity and price of housing are Q* and P' respectively.

Related Solutions

Suppose that the market for flu shots has downward sloping demand and upward sloping supply and...

Assume that the labor market is competitive, where the labor demand curve is strictly downward sloping...

Suppose that in the market for widgets, the supply curve is the typical upward-sloping line, and the demand curve is the typical downward-sloping line.

The market for milk is initially in equilibrium with a downward-sloping demand line and an upward-sloping...

Given downward-sloping demand for labor and upward-sloping supply of labor, explain if wage increases, decreases, or...

Suppose the demand is a typical downward sloping linear curve and the supply curve is perfectly...

What is the labor demand curve? Where is it derived from? Why is it downward sloping?...

The market demand curve of a particular good is downward-sloping. Based on this information, which of...

The market demand curve of a particular good is downward-sloping. Based on this information, which of...

13. A. Why is the labor demand curve downward sloping? B. Why is the labor supply...

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

Rahul Sunny answered 3 years ago

Rahul Sunny answered 3 years ago