Question

In: Accounting

X Company currently buys 7,500 units of a part each year from a supplier for $7.60...

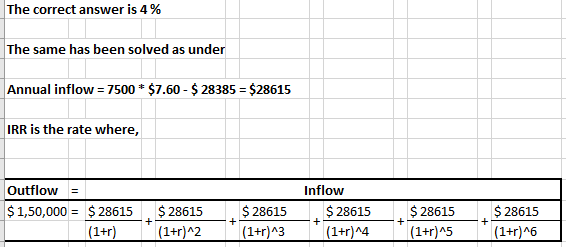

X Company currently buys 7,500 units of a part each year from a

supplier for $7.60 per part, but it is considering making the part

instead. In order to make the part, X Company will have to buy

equipment that will cost $150,000. The equipment will last for 6

years, at which time it will have zero disposal value. X Company

estimates that it will cost $28,385 a year to make all 7,500

units.

What is the approximate rate of return if X Company makes the part

instead of buying it from the supplier? [Note: 0.03 means 3%,

etc.]

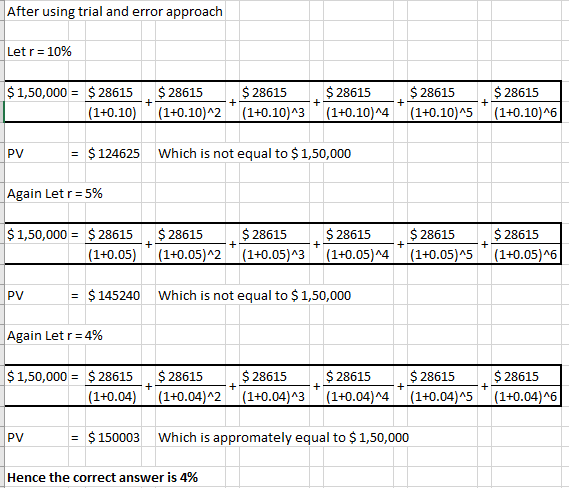

Solutions

Expert Solution

| I have provided a detailed solution hope this will help | ||

| Please do upvote if you found the answer useful. | ||

| Feel free to reach in the comment section in case of any clarification or queries. |

Related Solutions

X Company currently buys 7,000 units of a part each year from a supplier for $8.30...

X Company currently buys 7,000 units of a part each year from a

supplier for $8.30 per part, but it is considering making the part

instead. In order to make the part, X Company will have to buy

equipment that will cost $150,000. The equipment will last for 6

years, at which time it will have zero disposal value. X Company

estimates that it will cost $29,485 a year to make all 7,000

units.

What is the approximate rate of...

9. X Company currently buys 10,000 units of a component part each year from a supplier...

9. X Company currently buys 10,000 units of a component part

each year from a supplier for $7.10 each but is considering making

them instead. Variable costs of making would be $4.90 per unit;

additional annual fixed costs would be $6,000. Equipment would have

to be purchased for $33,000 and will last for 7 years, at which

time it will have a disposal value of $5,000. Assuming a discount

rate of 4%, what is the net present value of making...

X Company currently makes 7,500 units of a component part each year, but is considering buying...

X Company currently makes 7,500 units of a component part each

year, but is considering buying it from a supplier for $7.60 each.

The current annual cost of making the part is $60,500. The supplier

wants X Company to sign a contract for the next five years. If X

Company buys the part, it will be able to sell the equipment that

it currently uses to make the part for $20,000, but the equipment

will have no salvage value at...

X Company currently makes 7,500 units of a component part each year, but is considering buying...

X Company currently makes 7,500 units of a component part each

year, but is considering buying it from a supplier for $7.60 each.

The current annual cost of making the part is $60,500. The supplier

wants X Company to sign a contract for the next five years. If X

Company buys the part, it will be able to sell the equipment that

it currently uses to make the part for $20,000, but the equipment

will have no salvage value at...

A pencil company currently produces 200,000 units a year. It buys pencil tops from an outside...

A pencil company currently produces 200,000 units a year. It

buys pencil tops from an outside supplier at a price of $2 per top.

The plant manager believes that it would be cheaper to make these

tops rather than buy them. Direct production costs are estimated to

be only $1.50 per top. The necessary machinery would cost $150,000.

This investment could be written off for tax purposes using

straight-line depreciation over 8 years with no salvage value. The

plant manager...

X Company currently makes a part and is considering buying it next year from a company...

X Company currently makes a part and is considering buying it

next year from a company that has offered to supply it for $17.70

per unit. This year, total costs to produce 66,000 units were:

Direct materials

$435,600

Direct labor

382,800

Variable overhead

297,000

Fixed overhead

264,000

If X Company buys the part, $47,520 of the fixed overhead is

avoidable. The resources that will become idle if they choose to

buy the part can be used to increase production of...

X Company currently makes a part and is considering buying it next year from a company...

X Company currently makes a part and is considering buying it

next year from a company that has offered to supply it for $17.02

per unit. This year, total costs to produce 66,000 units were:

Direct materials

$534,600

Direct labor

270,600

Variable overhead

257,400

Fixed overhead

297,000

If X Company buys the part, $246,510 of the fixed overhead is

unavoidable. The resources that will become idle if they choose to

buy the part can be used to increase production of...

X Company currently makes a part and is considering buying it next year from a company...

X Company currently makes a part and is considering buying it

next year from a company that has offered to supply it for $15.19

per unit. This year, total costs to produce 66,000 units were:

Direct materials

$376,200

Direct labor

297,000

Variable overhead

283,800

Fixed overhead

323,400

If X Company buys the part, $58,212 of the fixed overhead is

avoidable. The resources that will become idle if they choose to

buy the part can be used to increase production of...

X Company currently makes a part and is considering buying it next year from a company...

X Company currently makes a part and is considering buying it

next year from a company that has offered to supply it for $16.99

per unit. This year, total costs to produce 68,000 units were:

Direct materials

$516,800

Direct labor

326,400

Variable overhead

251,600

Fixed overhead

333,200

If X Company buys the part, $59,976 of the fixed overhead is

avoidable. The resources that will become idle if they choose to

buy the part can be used to increase production of...

X Company currently makes a part and is considering buying it next year from a company...

X Company currently makes a part and is considering buying it

next year from a company that has offered to supply it for $16.11

per unit. This year, total costs to produce 70,000 units were:

Direct materials

$497,000

Direct labor

329,000

Variable overhead

245,000

Fixed overhead

350,000

If X Company buys the part, $304,500 of the fixed overhead is

unavoidable. The resources that will become idle if they choose to

buy the part can be used to increase production of...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- MINIMUM MAIN.CPP CODE /******************************** * Week 4 lesson: * * finding the smallest number * *********************************/...

- Do you think President Eisenhower had a successful presidency?

- Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known...

- C PROGRAMMIMG I want to check if my 2 input is a number or not all...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

ADVERTISEMENT

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago