Question

In: Accounting

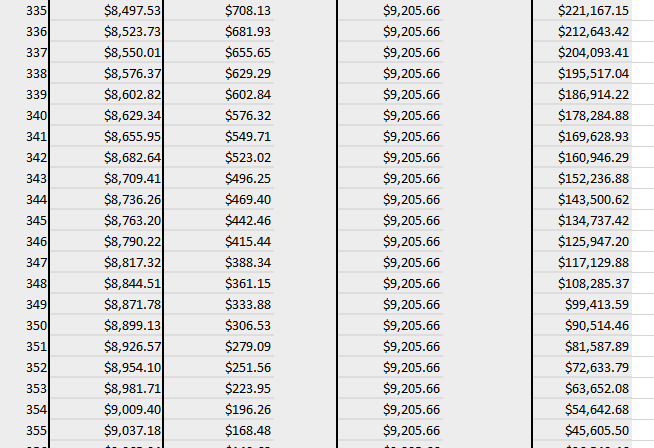

A property has an underwritten net cash flow of $2 million. A first mortgage is sized...

A property has an underwritten net cash flow of $2 million. A first mortgage is sized using a 3.7% interest rate, 30-year amortization, and a net cash flow debt service coverage ratio of 1.45x. What is the maximum loan it qualifies for using a NCF DSCR sizing constraint?

- $32,855,018

- $24,744,430

- $24,972,144

- $37,278,658

Solutions

Expert Solution

Calculation of Amortization Interest and amount on loan

:-

-----------------------------------------------------------------------------------------------------------------------------------------------------------------

note:-

my ans is 2285543 ,I calculated multiple times but my ans is not match with given option..

Related Solutions

Differentiate between net cash flow and accounting profit. A firm has net income of $5 million....

Differentiate between net cash flow and accounting profit. A

firm has net income of $5 million. Assuming that depreciation of $1

million is its only noncash expense, what is the firm’s net cash

flow?

A property that can be purchased for $1.7 million has an expected first-year net operating income...

A property that can be purchased for $1.7 million has an

expected first-year net operating income of $190,000. An investor

is considering two loan alternatives:

LOAN A: a 70% loan-to-value ratio, with interest at 7.5% per

annum; the loan will require level monthly payments to amortize the

principal over 20 years.

LOAN B: an 80% loan-to-value ratio, with interest at 8% per

annum; this loan will require level monthly payments to amortize

the principal over 25 years.

For each loan,...

Assume that the net cash flow of a potential $7.25 million investment is $1.1 million in...

Assume that the net cash flow of a potential $7.25 million

investment is $1.1 million in year 1, then $1.25 million in year 2,

$1.4 million in year 3, $2.2 million in year 4 and year 5, and then

sold at the end of year 5 for $850,000. Further assume that in each

year cash flows (excluding initial investment) could be as much as

$400,000 less than forecast, or $400,000 more than forecast.

Suppose you assess the “low net cash...

Assume that the net cash flow of a potential $7.25 million investment is $1.1 million in...

Assume that the net cash flow of a potential $7.25 million

investment is $1.1 million in year 1, then $1.25 million in year 2,

$1.4 million in year 3, $2.2 million in year 4 and year 5, and then

sold at the end of year 5 for $850,000. Further assume that in each

year cash flows (excluding initial investment) could be as much as

$400,000 less than forecast, or $400,000 more than forecast.

Suppose you assess the “low net cash...

Suppose your father has spare cash of $3 million (he also owns a free-of-mortgage property) and...

Suppose your father has spare cash of $3 million (he also owns a

free-of-mortgage property) and he asks you, as a student of

financial services, to give him some recommendations for asset

allocation. Based on what you have learnt so far from this program,

what are your suggestions to him (you may make any necessary

assumptions) ? Justify your asset allocation decision. Having

proposed an asset allocation strategy, explain under what

circumstances will you recommend changes to the asset allocation...

Suppose a property can be bought for $2,500,000 and it will provide $200,000/year net cash flow...

Suppose a property can be bought for $2,500,000 and it will

provide $200,000/year net cash flow forever, and you can borrow a

perpetual interest-only mortgage secured by that property at a 7%

interest rate, up to an amount of $950,000. (a) Does this present

“positive” or “negative leverage,” and (b) why? (c) Do you think

that the use of leverage, in this case, will increase the NPV of

the investment for the equity investor in the property? (d) Why or...

can the cash balance be less than net cash flow for first year when this happens?

can the cash balance be less than net cash flow for first year

when this happens?

A property is encumbered as follows: First mortgage, A: $300,000 Second mortgage, B: $40,000 Third mortgage,...

A property is encumbered as follows:

First mortgage, A: $300,000

Second mortgage, B: $40,000

Third mortgage, C: $10,000

What is the minimum that mortgagee B has to pay to acquire the

property at a foreclosure sale?

2) PROJECT CASH FLOW Colsen Communications is trying to estimate the first-year cash flow (at Year...

2) PROJECT CASH FLOW

Colsen Communications is trying to estimate the first-year cash

flow (at Year 1) for a proposed project. The financial staff has

collected the following information on the project:

Sales revenues

$25 million

Operating costs (excluding

depreciation)

17.5 million

Depreciation

5 million

Interest expense

5 million

The company has a 40% tax rate, and its WACC is 11%.

Write out your answers completely. For example, 13 million

should be entered as 13,000,000.

What is the project's cash...

Question 2 Which of these would increase in the net cash flow to the company? a)...

Question 2

Which of these would increase in the net cash flow to the

company?

a)

Increasing inventory by $100,000

b)

Selling bonds

c)

Decreasing sales

d)

None of the above would increase the net cash flow

Question 6

Agency theory is of most concern in what type of business

structure?

a)

Sole proprietorship

b)

Partnership

c)

Corporation

d)

In all three equally

Question 8

Calculated free cash flow considers each of...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ADVERTISEMENT

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago