Question

In: Accounting

Assume that the current ratio for Arch Company is 3.5, its acid-test ratio is 2.0, and...

Assume that the current ratio for Arch Company is 3.5, its

acid-test ratio is 2.0, and its working capital is $370,000. Answer

each of the following questions independently, always

referring to the original information.

Required:

- How much does the firm have in current liabilities? (Do not round intermediate calculations.)

- If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts Receivable, and Merchandise Inventory, how much does the firm have in Merchandise Inventory? (Do not round intermediate calculations.)

- If the firm collects an account receivable of $117,000, what will its new current ratio and working capital be? (Round "Current ratio" to 1 decimal place.)

- If the firm pays an account payable of $56,000, what will its new current ratio and working capital be? (Do not round intermediate calculations. Round "Current ratio" to 1 decimal place.)

- If the firm sells inventory that was purchased for $50,000 at a cash price of $61,000, what will its new acid-test ratio be? (Do not round intermediate calculations. Round your answer to 1 decimal place.)

My answers for C and D are wrong!

c =

Current Ration 2.71

Working Capital $253,000

D .- Current Ratio 5.6

Working capital $426,000

Solutions

Expert Solution

- How much does the firm have in current liabilities? (Do not round intermediate calculations.)

- If the only current assets shown on the balance sheet for Arch

Company are Cash, Accounts Receivable, and Merchandise Inventory,

how much does the firm have in Merchandise Inventory? (Do

not round intermediate calculations.)

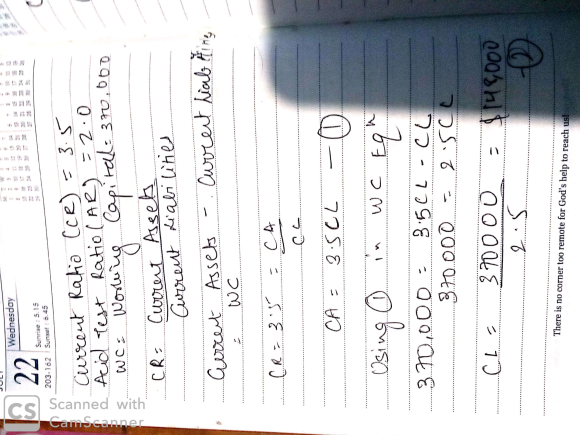

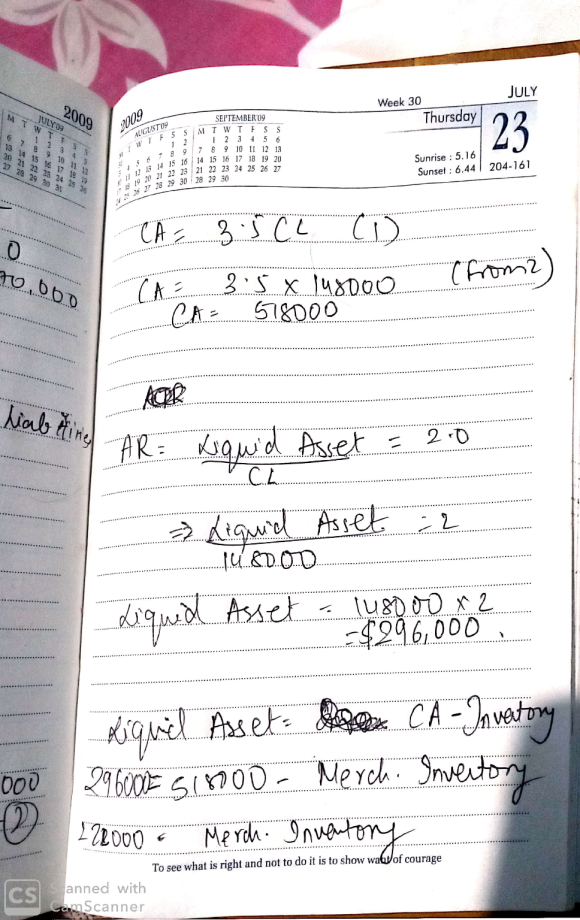

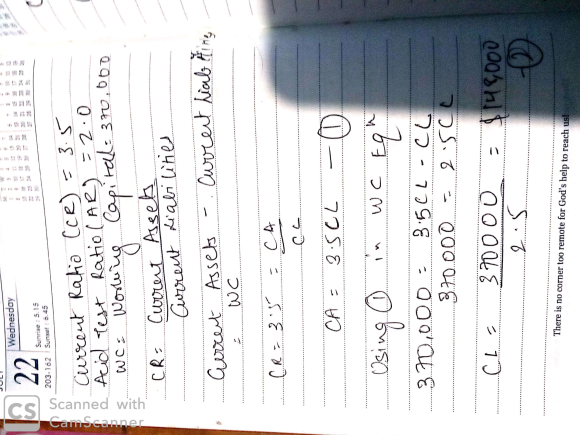

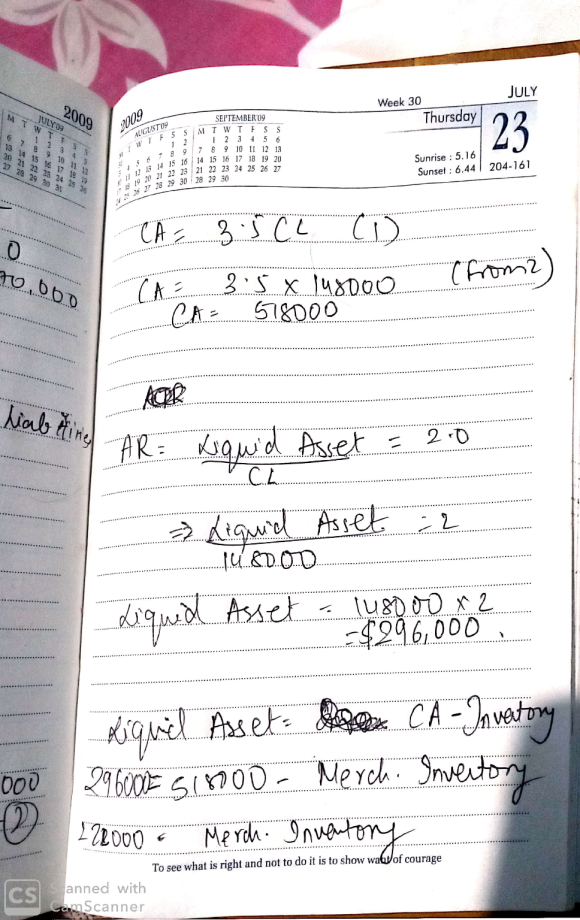

Ans for 1 and 2 in images.

Acid Test Ratio = Liquid Assets=/ Current Liabilities = 2.0 (given)

Liquid Assets= Curreent Assets- Merchandise Inventory

3. If the firm collects an account receivable of $117,000, what will its new current ratio and working capital be? (Round "Current ratio" to 1 decimal place.)

Collection of accounts receivable will decrease the current assets however it will also increase cash or bank balance of current assets, therefore, NO CHANGE in Current Assets amount will be required.

New Current Ratio = New Current Assets/ Current Liabilities = 518000/148000 = 3.5

Working Capital = New Current Assets - Current Liabilities =518000 - 148000 = $370,000

4. If the firm pays an account payable of $56,000, what will its new current ratio and working capital be?

Paying an accounts payable will decrease Current Liability and there will be cash outflow, thereby reducing the current liabilities as well.

Therefore, New Current Assets = 518000-56000 =$462000,

New Current Liabilities = 148000-56000 =$92000

New Current Ratio = New Current Assets/ New Current Liabilities= 462000/92000 = 5.02

New Working Capital = New Current Assets - New Current Liabilities =462000 -92000 = 370,000

If the firm sells inventory that was purchased for $50,000 at a cash price of $61,000, what will its new acid-test ratio be?

Selling inventory will decrease the Current Assets by -50000

but, will also receive cash, and that will increase the Current Assets by +61000

overall change in Current Assets = +11000

New Current Assets = 518000+11000 = 529000

New merchandise inventory = 222,000-50000 = 172000

New Liquid Assets = Curreent Assets- Merchandise Inventory = 529000-172000 = 357000

Current Liabilities= 148000 (no Change)

New Acid Test Ratio = New Liquid Assets/ New Current Liabilities= 357000/148000 = 2.41

Related Solutions

Assume that the current ratio for Arch Company is 3.5, its acid-test ratio is 1.5, and...

Assume that the current ratio for Arch Company is 3.0, its acid-test ratio is 1.5, and...

(a) The current ratio of a company is 6:1 and its acid-test ratio is 1:1. If...

Current Ratio and Quick (Acid-Test) Ratio Upton Company has current assets equal to $2,885,000. Of these,...

A company’s current ratio and its acid-test ratio are both greater than 1. Payment of an...

The Kretovich Company had a quick ratio of 1.1, a current ratio of 3.5, a days'...

What is its acid-test (quick) ratio?

Assuming a current ratio of 1.4 and an acid-test ratio of 0.78, how will the cash...

If a firm has a high current ratio but a low acid-test ratio, one can conclude...

Hi, I need to find the current ratio and the acid-test ratio. I know the equations...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago