Question

In: Accounting

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter.

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter.

The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter:

a. Budgeted monthly absorption costing income statements for April-July are:

|

|

April |

May |

June |

July |

|

Sales ... |

$600,000 |

$900,000 |

$500,000 |

$400,000 |

|

Cost of goods sold ... |

420,000 |

630,000 |

350,000 |

280,000 |

|

Gross margin ... |

180,000 |

270,000 |

150,000 |

120,000 |

|

Selling and administrative expenses: |

||||

|

Selling expense ... |

79,000 |

120,000 |

62,000 |

51,000 |

|

Administrative expense* ... |

45,000 |

52,000 |

41,000 |

38,000 |

|

Total selling and administrative |

|

|

|

|

|

expenses ... |

124,000 |

172,000 |

103,000 |

89,000 |

|

Net operating income ... |

$56,000 |

$98,000 |

$47,000 |

$31,000 |

|

*Includes $20,000 of depreciation each month. |

||||

b. Sales are 20% for cash and 80% on account.

c. Sales on account are collected over a three-month period with 10% collected in the month of sale; 70% collected in the first month following the month of sale; and the remaining 20% collected in the second month following the month of sale. February's sales totaled $200,000, and March's sales totaled $300,000.

d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March total $126,000.

e. Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise inventory at March 31 is $84,000.

f. Dividends of $49,000 will be declared and paid in April.

g. Land costing $16,000 will be purchased for cash in May.

h. The cash balance at March 31 is $52,000; the company must maintain a cash balance of at least $40,000 at the end of each month.

i. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $200,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Required:

1. Prepare a schedule of expected cash collections for April, May, and June, and for the quarter in total.

2. Prepare the following for merchandise inventory:

a. A merchandise purchases budget for April, May, and June.

b. A schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total.

3. Prepare a cash budget for April, May, and June as well as in total for the quarter.

Solutions

Expert Solution

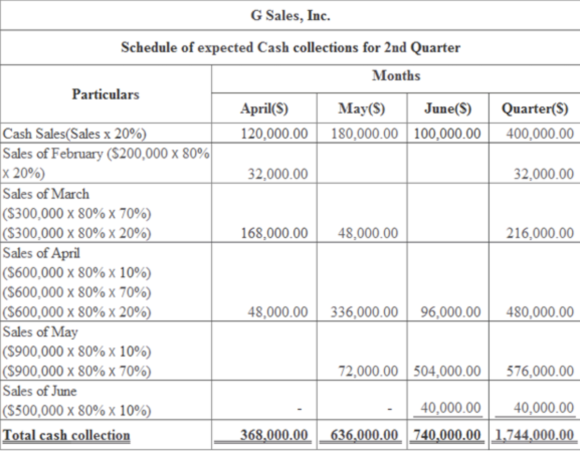

(1)

Prepare a schedule of expected cash collections for April, May, June and for the quarter in total:

The schedule of expected cash collections is a statement that provides information about the collection of cash from accounts receivable. Generally, companies follow collection policy over its accounts receivable. The credit sales will be collected in certain percentages in month over month.

It is given that percentage of sales collected in the month of the sale is 10%, percentage of sales collected in the second month following the sale is 70% and the percentage of sales collected in the second month following sale is 20%. Use these percentages in the following table to prepare the schedule of expected cash collections for the second quarter as shown below:

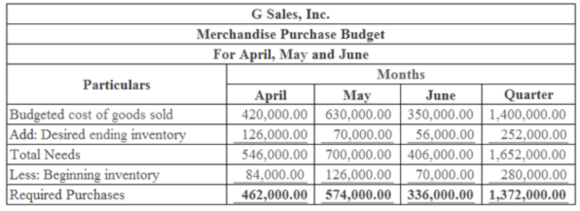

(2a)

Prepare a merchandize purchases budget for April, May and June:

The material purchase budget is prepared to determine the amount of purchases to be made in the quarter. The required purchases are calculated as the difference between the total needs and the beginning inventory. The total needs, is the sum of budgeted cost of goods sold and the desired ending inventory.

Use the following table to prepare the merchandize purchases budget as below:

Working Notes:

Compute Desired Ending Inventory as follows:

$$ \begin{aligned} \text { April } &=20 \% \times \text { cost of Goods sold } \\ &=20 \% \times \$ 630,000 \\ &=\$ 126,000 \\ \text { May } &=20 \% \times \text { cost of Goods sold } \\ &=20 \% \times \$ 350,000 \\ &=\$ 70,000 \\ \text { June } &=20 \% \times \text { cost of Goods sold } \\ &=20 \% \times \$ 280,000 \\ &=\$ 56,000 \end{aligned} $$

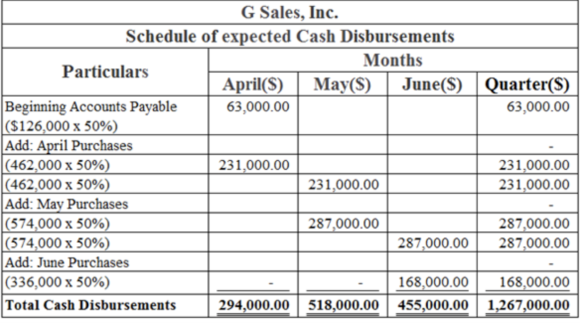

(2b)

Prepare a schedule of expected cash disbursements for merchandize purchases for April, May, June and for the quarter in total:

The schedule of expected cash disbursements is prepared to determine the amount paid for purchases for the months of purchase. It is given that 50% of month's inventory purchase is paid during the month of purchase and 50% of month's inventory purchase is paid during the month following purchase.

Use the following table to prepare the schedule of expected cash disbursements as below:

(3)

Prepare a Cash Budget for April, May, June and total for the Quarter:

The cash budget would be prepared to determine the ending cash balance for each month. Generally, the companies will have a policy to maintain to minimum cash balance. In order to maintain the minimum cash balance, the company may finance funds.

Further, the company should pay interest on the funds borrowed to maintain the minimum cash balances. Use the following table to prepare the cash budget as shown below:

Note:

Closing cash balance of April becomes the opening balance of May and so on.

Related Solutions

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter....

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

Dr. OWL answered 5 years ago

Dr. OWL answered 5 years ago