Question

In: Accounting

The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing Company.

The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing Company.

| Account Title | Debits | Credits | |||||

| Cash | $ | 69,000 | |||||

| Accounts receivable | 164,000 | ||||||

| Inventory | 287,000 | ||||||

| Prepaid expenses | 152.000 | ||||||

| Equipment | 324,000 | ||||||

| Accumulated depreciation | $ | 112,000 | |||||

| Investments | 144,000 | ||||||

| Accounts payable | 62,000 | ||||||

| Interest payable | 22,000 | ||||||

| Deferred revenue | 82,000 | ||||||

| Income taxes payable | 32,000 | ||||||

| Notes payable | 210,000 | ||||||

| Allowance for uncollectible accounts | 18,000 | ||||||

| Common stock | 402,000 | ||||||

| Retained earnings | 200,000 | ||||||

| Totals | $ | 1,140,000 | $ | 1,140,000 | |||

Additional information:

1. Prepaid expenses include $124,000 paid on December 31, 2021, for a two-year lease on the building that houses both the administrative offices and the manufacturing facility.

2. Investments include $32,000 in Treasury bills purchased on November 30, 2021. The bills mature on January 30, 2022. The remaining $112,000 is an investment in equity securities that the company intends to sell in the next year.

3. Deferred revenue represents customer prepayments for magazine subscriptions. Subscriptions are for periods of one year or less.

4. The notes payable account consists of the following:

a. a $42,000 note due in six months.

b. a $102,000 note due in six years.

c. a $66,000 note due in three annual installments of $22,000 each, with the next installment due August 31, 2022.

5. The common stock account represents 402,000 shares of no par value common stock issued and outstanding. The corporation has 804,000 shares authorized.

Required: Prepare a classified balanced sheet for the Welsmuller Publishing Company at December 31, 2021.

Solutions

Expert Solution

Answer:

| WEISMULLER PUBLISHING COMPANY | ||

| Balance Sheet | ||

| At December 31,2021 | ||

| Assets | ||

| Current assets: | ||

| Cash and Cash equivalents | $69,000 | |

| Short-term Investments | $144,000 | |

| Accounts receivable | $164,000 | |

| Allowance for uncollectible accounts | ($18,000) | $146,000 |

| Inventory | $287,000 | |

| Prepaid expenses [152,000-62,000] | $90,000 | |

| Total current assets | $736,000 | |

| Property,plant,and Equipment: | ||

| Equipment | $324,000 | |

| Accumulated depreciation | ($112,000) | |

| Net property,plant and equipment | $212,000 | |

| Other assets: | ||

| Prepaid expenses [124,000 x 1/2] | $62,000 | |

| Total assets | $1,010,000 | |

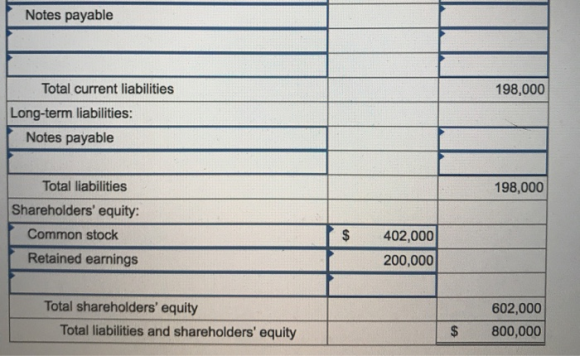

| Liabilities and Stockholders' equity | ||

| Current liabilities: | ||

| Accounts payable | $62,000 | |

| Interest payable | $22,000 | |

| Deferred revenue | $82,000 | |

| Income taxes payable | $32,000 | |

| Notes payable | $66,000 | |

| Total current liabilities | $264,000 | |

| Long-term liabilities: | ||

| Notes payable | $144,000 | |

| Total liabilities | $408,000 | |

| Stockholders' Equity: | ||

| Common stock | $402,000 | |

| Retained earnings | $200,000 | |

| Total stockholders' equity | $602,000 | |

| Total liabilities and stockholders' equity | $1,010,000 | |

Explanations:

| Prepaid expenses: | |

| Total prepaid expenses | $152,000 |

| (less): Long-term portion (124,000/2) | ($62,000) |

| Current portion | $90,000 |

Total investments to be realized on next year. So, all investments are short-term

Deferred revenue is current liabilities because it is related for less than a year.

| Current liabilities of notes payable: | |

| Due in six months | $42,000 |

| Installment due in 2022 | $22,000 |

| Total current liabilities of notes payable | $64,000 |

| Long-term notes payable: | |

| Total notes payable | $210,000 |

| (Less): Current liabilities of notes payable | ($64,000) |

| Total Long-term notes payable | $146,000 |

Related Solutions

The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2018 for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2018 for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2018 for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2018 for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2018 for the Weismuller Publishing...

The following is the ending balances of accounts at December 31, 2021, for the Vosburgh Electronics...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago