Question

In: Accounting

Current Year Preceding Year Balance Sheet: Cash $24,000 $25,000 Short-term Investments 17,000 28,000 Net Accounts Receivables...

| Current Year | Preceding Year | ||

| Balance Sheet: | |||

| Cash | $24,000 | $25,000 | |

| Short-term Investments | 17,000 | 28,000 | |

| Net Accounts Receivables | 42,000 | 86,000 | |

| Merchandise Inventory | 72,000 | 60,000 | |

| Prepaid Expenses | 16,000 | 9,000 | |

| Total Current Assets | 171,000 | 208,000 | |

| Total Current Liabilities | 130,000 | 87,000 | |

| Income Statement: | |||

| Net Credit Sales | $470,000 | ||

| Cost of Goods Sold | 317,000 | ||

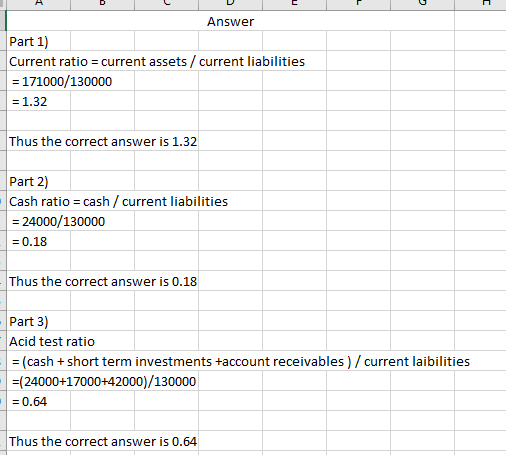

a. Compute the current ratio for the current year. (Abbreviations used: STI = Short-term investments. Round your answer to two decimal places, X.XX.)

|

Current ratio |

= |

|

= |

b. Compute the cash ratio for the current year. (Round your answer to two decimal places, X.XX.)

|

Cash ratio |

= |

= |

c. Compute the acid-test ratio for the current year. (Round your answer to two decimal places, X.XX.)

|

Acid-test ratio |

= |

= |

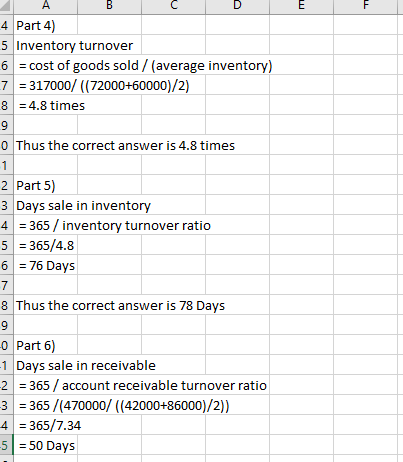

d. Compute the inventory turnover for the current year. (Round your answer to two decimal places, X.XX.)

|

Inventory turnover |

= |

= |

times |

e. Compute the days' sales in inventory for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to the nearest whole day.)

|

Days' sales in inventory |

= |

= |

days |

f. Compute the days' sales in receivables for the current year. (Round intermediary calculations to two decimal places, X.XX and round your final answer to nearest whole day.)

|

Days' sales in receivables |

= |

= |

days |

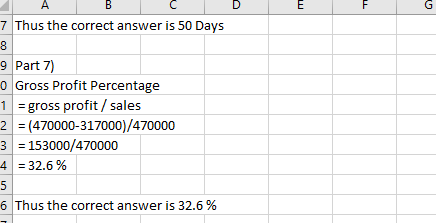

g. Compute the gross profit percentage for the current year. (Round your answer to one tenth of a percent, X.X%.)

|

Gross profit percentage |

= |

= |

% |

Solutions

Expert Solution

The answer has been presneted in the supporting sheet. For detaield answer refer to the supporting sheet.

Related Solutions

Balance sheet December 31 Assets 2007 2006 Cash $25,000 $40,000 Short term investments 15,000 60,000 Accounts...

I.The balance sheet for Shaver Corporation reported the following: cash, $10,000; short-term investments, $15,000; net accounts...

Gaines Company Comparative Balance Sheet December 31 20X3 20X2 Assets Cash 25,000 40,000 Short-term Investments 15,000...

The comparative balance sheet for Astro Company for the current year and the preceding year are...

Balance Sheet 2014 2015 2016 Assets Cash $9,000 $7,282 $14,000 Short-term investments 48,000 20,000 71,632 Accounts...

Assets 2018 2019 Cash $17,000 $12,400 Short-term investments. 48,600 18,000 Accounts receivable 351,200 632,160 Inventories 710,200...

FERRIS COMPANY HAS CASH OF $70,000, SHORT-TERM INVESTMENTS OF 60,000, NET ACCOUNTS RECEIVABLE OF $86,000, INVENTORY...

Spartan Sportswear's current assets consist of cash, short-term investments, accounts receivable, and inventory. The following data...

Rutner Rope – Balance Sheet Current Assets (Thousands) Cash 23.2 Net Receivables 109.5 Inventories 68.6 Other...

2019 Balance sheet for company XYZ Cash 3820 Accounts payable 13610 Receivables 9140 Long-term debt 32950...

- Aniline hydrochloride, [C6H5NH3]Cl, is a weak acid. Its conjugate base is the weak base aniline, C6H5NH2....

- Explain the RAAS by listing (and briefly describing) several steps that occur in this process. What...

- 1.What will the result of this form be? (cadr ‘(1 2 3 4 5 6)) a....

- Question 5. Why do macroeconomist require tools to bring forth policies? What are these tools? (10...

- In C++ Write an IterativeMergeSort function given these parameters and following the prompt IterativeMergeSort(vector<int> v, int...

- Current Year Preceding Year Balance Sheet: Cash $24,000 $25,000 Short-term Investments 17,000 28,000 Net Accounts Receivables...

- If the interest rate is 11%, what is the Equivalent Annual Cost (EAC) of the following...

ekkarill92 answered 11 hours ago

ekkarill92 answered 11 hours ago