Question

In: Finance

Anna is a Vice President at the J Corporation. The company is considering investing in a...

| Anna is a Vice President at the J Corporation. The company is considering | |||||||||||

| investing in a new factory and Anna must decide whether it is a feasible | |||||||||||

| project. In order to assess the viability of the project, Anna must first calculate | |||||||||||

| the rate of return that equity holders expect from the company stock. The | |||||||||||

| annual returns for J Corp. and for a market index are given below. Currently, | |||||||||||

| the risk-free rate of return is | 1.2% | and the market risk-premium is | 3.1% | . | |||||||

| a) What is the beta of J Corp.'s stock? | Enter Answer | ||||||||||

| (1 Mark)(Round your answer to two decimal places) | |||||||||||

| b) Using the CAPM model, what is the expected rate of return on J Corp. stock for the coming year? | Enter Answer | ||||||||||

| (Round your answer to one one-hundreth of a percent) | ↑ | ||||||||||

| Year | J Corp. Return (%) | Market Return (%) | Enter your Final Answer Here | ||||||||

| 1 | -12.38 | -6.10 | |||||||||

| 2 | 17.44 | 8.81 | |||||||||

| 3 | 24.14 | 12.16 | |||||||||

| 4 | 28.14 | 14.16 | |||||||||

| 5 | -32.98 | -16.40 | |||||||||

| 6 | 31.46 | 15.82 | |||||||||

| 7 | 9.26 | 4.72 | |||||||||

| 8 | 25.94 | 13.06 | |||||||||

| 9 | 18.02 | 9.10 | |||||||||

| 10 | 19.44 | 9.81 | |||||||||

| 11 | -10.96 | -5.39 | |||||||||

| 12 | -16.98 | -8.40 | |||||||||

Solutions

Expert Solution

Beta coefficient is a measure of volatility of a stock in comparison with the market. It measures how the stock price will move in comparison to the market. If beta is equal to 1, it means stock price will move parallel to the changes in the market. Beta less than 1 means stock price is less volatile in comparison to the market. Means a slight fluctuation in market will result in greater movement in the stock price. Similarly, a beta less than 1 means stock is less volatile in comparison to the market fluctuations. This means that even a bigger fluctuation in market will result in only a slight change in the stock price.

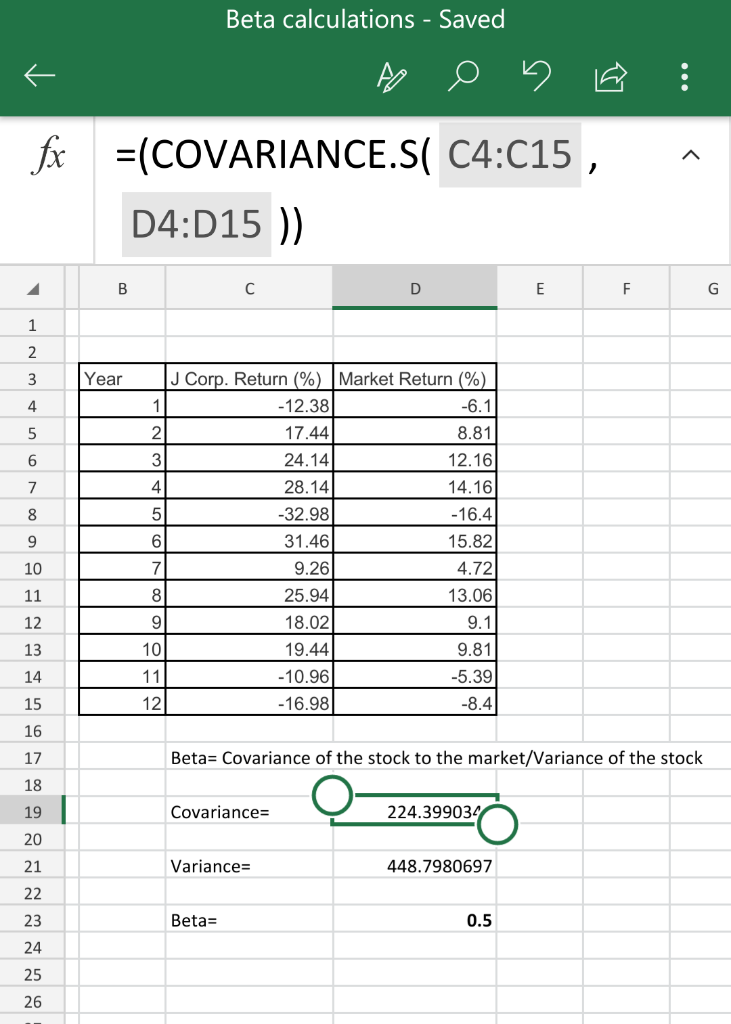

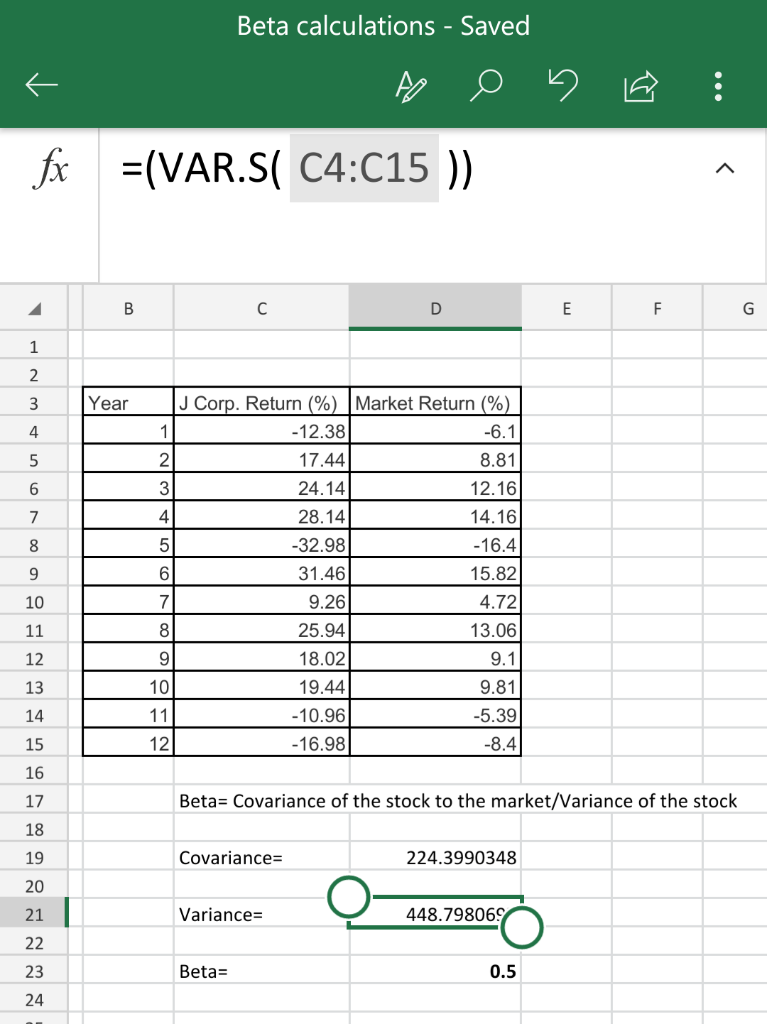

The calculation for beta of the stock is done as in the picture below:

Hence, value of beta is 0.5.

Now, using the Capital Asset Pricing Model(CAPM), we will calculate the expected rate of return on the stock.

As per CAPM, e(r) = rf + β(rm - rf)

β is the beta of the stock.

rm is the expected return on the market.

rf is the risk free rate.

e(r) is the expected return on the stock

(rm - rf ) is the market risk premium

Here, risk free rate is 1.2% and market risk premium is 3.1%

Also, beta of the stock is 0.5 as per above calculations.

So, e(r) = 1.2% + 0.5(3.1%)

= 0.0275 = 2.75%

Related Solutions

Anna is a Vice President at the J Corporation. The company is considering investing in a...

Anna is a Vice President at the J Corporation. The company is considering investing in a...

Anna is a Vice President at the J Corporation. The company is considering investing in a...

The ABC company is considering the establishment of production and distribution facilities abroad. The vice-president for...

You are the vice president of finance of Crane Corporation, a retail company that prepared two...

Exercise 8-16 You are the vice president of finance of Swifty Corporation, a retail company that...

Exercise 8-16 You are the vice president of finance of Novak Corporation, a retail company that...

Given that you are a vice-president of a corporation and you will need to explain to...

The Vice President for Sales and Marketing at Waterways Corporation is planning for production needs to...

The Vice President for Sales and Marketing at Waterways Corporation is planning for production needs to...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 4 weeks ago

jeff jeffy answered 4 weeks ago