Question

In: Finance

Ans: _____________________ You just graduated from Notre Dame de Namur University (2020) and accepted a job...

Ans: _____________________

- You just graduated from Notre Dame de Namur University (2020) and accepted a job with Facebook in their Finance department. Your salary is $50,000 per year. You are considering investing $500 per month in your company’s 401K and given your risk profile your targeted rate of return is 4.5 percent. What will be the value of your 401K in 35 years (2055)?

Additional 2 bonus points...

Joe, a colleague of yours decided to wait for five years to begin setting aside $500 per month until 2055. His risk profile is like yours, 4.5%. How much will Joe have in 30 years (2055)?

And...”what’s the moral of this story>?

Ans: _______________________

The moral is: _____________________

Solutions

Expert Solution

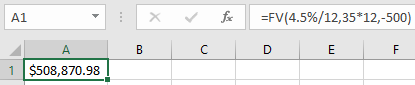

Value of your 401K in 35 years is calculated using FV function in Excel :

rate = 4.5%/12 (converting annual rate into monthly rate)

nper = 35 * 12 (total number of monthly deposits = number of years * 12)

pmt = -500 (Monthly deposit. This is entered with a negative sign because it is a cash outflow)

FV is calculated to be $508,870.98

Value of your 401K in 35 years is $508,870.98

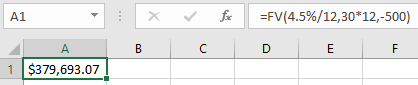

Value of Joe's 401K in 30 years is calculated using FV function in Excel :

rate = 4.5%/12 (converting annual rate into monthly rate)

nper = 30 * 12 (total number of monthly deposits = number of years * 12)

pmt = -500 (Monthly deposit. This is entered with a negative sign because it is a cash outflow)

FV is calculated to be $379,693.07

The moral of this story is that if you start investing earlier, you will have a much higher ending value of your investments due to the effect of compounding

Related Solutions

Derek and Meagan Jacoby recently graduated from State University and Derek accepted a job in business...

Derek and Meagan Jacoby recently graduated from State University and Derek accepted a job in business...

Derek and Meagan Jacoby recently graduated from State University and Derek accepted a job in business...

You just graduated college with your Bachelors Degree and accepted a job offer at your dream...

Paul Jordan has just graduated from high school and has accepted the job of help desk...

Suppose you have just graduated Harvard and accepted a job with a $100,000 salary. Your 401(K)...

Grady Zebrowski, age 25, just graduated from college, accepted his first job with a $45 comma...

Grady Zebrowski, age 25, just graduated from college, accepted his first job with a $47,000 salary,...

Congratulations! You have just graduated from your University. Your first day on your new job involves...

NAME Resolving Ethical Business Challenges Charlie just graduated from Michigan University and landed a job as...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

jeff jeffy answered 4 weeks ago

jeff jeffy answered 4 weeks ago