Question

In: Accounting

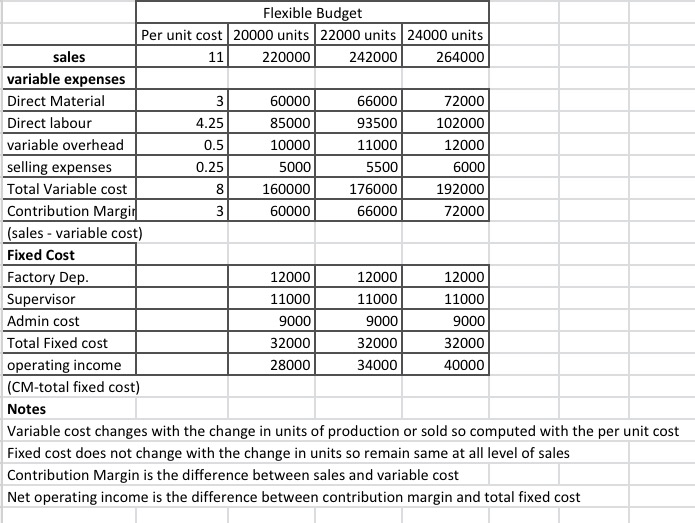

Perkins Company provides the following data developed for its master budget: Sales price 11.00 per unit...

Perkins Company provides the following data developed for its master budget:

Sales price 11.00 per unit

Costs:

Direct materials 3.00 per unit

Direct labor 4.25 per unit

Variable overhead 0.50 per unit

factory depreciation is 12,000 per month

supervision is 11,000 per month

selling expense is 0.25 per unit

administrative cost 9,000 per month

Required:

Prepare flexible budgets for sales of 20,000, 22,000 and 24,000

units. Use a contribution margin format.

Solutions

Related Solutions

Intercontinental, Inc., provides you with the following data for its single product: Sales price per unit...

Intercontinental, Inc., provides you with the following data for

its single product:

Sales price per unit

$

51.00

Fixed costs (per month):

Selling, general, and administrative (SG&A)

900,000

Manufacturing overhead

1,800,000

Variable costs (per unit):

Direct labor

6.00

Direct materials

13.00

Manufacturing overhead

9.00

SG&A

5.00

Number of units produced per month

300,000

units

Required:

Compute the amounts for each of the following assuming that both

production levels are within the relevant range. (Do not

round intermediate calculations. Round your...

Intercontinental, Inc., provides you with the following data for its single product: Sales price per unit...

Intercontinental, Inc., provides you with the following data for

its single product:

Sales price per unit

$

50.00

Fixed costs (per month):

Selling, general, and administrative (SG&A)

1,800,000

Manufacturing overhead

2,700,000

Variable costs (per unit):

Direct labor

7.00

Direct materials

12.00

Manufacturing overhead

9.00

SG&A

4.00

Number of units produced per month

300,000

units

Required:

Compute the amounts for each of the following assuming that both

production levels are within the relevant range. (Do not

round intermediate calculations. Round your...

Intercontinental, Inc., provides you with the following data for its single product: Sales price per unit...

Intercontinental,

Inc., provides you with the following data for its single

product:

Sales price per

unit

$

51.00

Fixed costs (per

month):

Selling,

general, and administrative (SG&A)

1,800,000

Manufacturing

overhead

2,700,000

Variable costs

(per unit):

Direct

labor

7.00

Direct

materials

12.00

Manufacturing

overhead

9.00

SG&A

6.00

Number of units

produced per month

300,000

units

Required:

Compute the amounts

for each of the following assuming that both production levels are

within the relevant range. (Do not round intermediate

calculations. Round your...

Polk Company developed the following information for its product: Per unit Sales price $90 Variable cost...

Polk Company developed the following information for its

product: Per unit Sales price $90 Variable cost 63 Contribution

margin $27 Total fixed costs $1,080,000 Instructions Answer the

following independent questions and show computations using the

contribution margin technique to support your answers. 1. How many

units must be sold to break even? 2. What is the total sales that

must be generated for the company to earn a profit of $60,000? 3.

If the company is presently selling 45,000 units,...

A company has the following information: Unit sales 13,400 Sales price per unit $...

A company has the following information:

Unit sales

13,400

Sales price per unit

$ 90.00

Variable costs per unit $ 40.00

Fixed costs $

500,000

A. What is the company’s contribution margin per unit? B. What

is the company’s total contribution margin? C. What is the

company’s operating income? D. What is the company’s margin of

safety in units? E. If the company had a target operating income of

$636,000, what would be the target sales in...

Pargo Company is preparing its master budget for 2017. Relevant data pertaining to its sales, production,...

Pargo Company is preparing its master budget for 2017. Relevant

data pertaining to its sales, production, and direct materials

budgets are as follows.

Sales. Sales for the year are expected to total 1,000,000

units. Quarterly sales are 18%, 23%, 23%, and 36%, respectively.

The sales price is expected to be $38 per unit for the first three

quarters and $43 per unit beginning in the fourth quarter. Sales in

the first quarter of 2018 are expected to be 10% higher...

Pargo Company is preparing its master budget for 2020. Relevant data pertaining to its sales, production,...

Pargo Company is preparing its master budget for 2020. Relevant

data pertaining to its sales, production, and direct materials

budgets are as follows.

Sales. Sales for the year are expected to total

2,000,000 units. Quarterly sales are 18%, 26%, 23%, and 33%,

respectively. The sales price is expected to be $38 per unit for

the first three quarters and $45 per unit beginning in the fourth

quarter. Sales in the first quarter of 2021 are expected to be 15%

higher...

Pargo Company is preparing its master budget for 2017. Relevant data pertaining to its sales, production,...

Pargo Company is preparing its master budget for 2017. Relevant

data pertaining to its sales, production, and direct materials

budgets are as follows.

Sales. Sales for the year are expected to total 1,900,000

units. Quarterly sales are 22%, 26%, 27%, and 25%, respectively.

The sales price is expected to be $41 per unit for the first three

quarters and $44 per unit beginning in the fourth quarter. Sales in

the first quarter of 2018 are expected to be 15% higher...

Oak Creek Company is preparing its master budget for 2020. Relevant data pertaining to its sales,...

Oak Creek Company is preparing its master budget for 2020.

Relevant data pertaining to its sales, production, and direct

materials budgets are as follows.

Sales: Sales for the year are expected to total 1,000,000

units. Quarterly sales are 20%, 25%, 25%, and 30%, respectively.

The sales price is expected to be $40 per unit for the first three

quarters and $46 per unit beginning in the fourth quarter. Sales in

the first quarter of 2021 are expected to be 10%...

Leaf Industries is preparing its master budget for 2013. Relevant data pertaining to its sales budget...

Leaf Industries is preparing its master budget for 2013.

Relevant data pertaining to its sales budget are as follows:

Sales for the year are expected to

total 8,000,000 units. Quarterly sales are 25%, 30%, 15%, and 30%,

respectively. The sales price is expected to be $2.00 per unit for

the first quarter and then be increased to $2.20 per unit in the

second quarter.

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Total for Yr

Unit Sales

8,000,000

Unit Selling...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

- how to operate a business?

ADVERTISEMENT

ekkarill92 answered 4 weeks ago

ekkarill92 answered 4 weeks ago