Question

In: Accounting

Many high-end earners such as athletes, entertainers and surgeons have a maximum federal tax rate of...

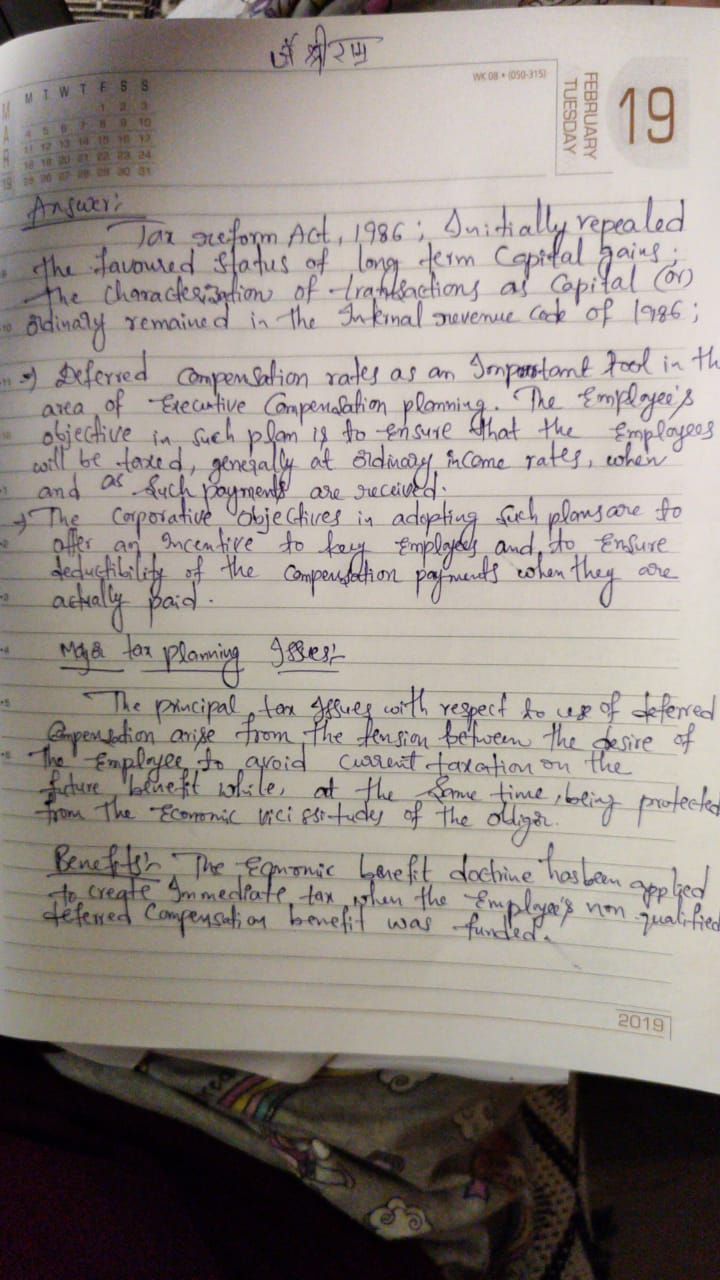

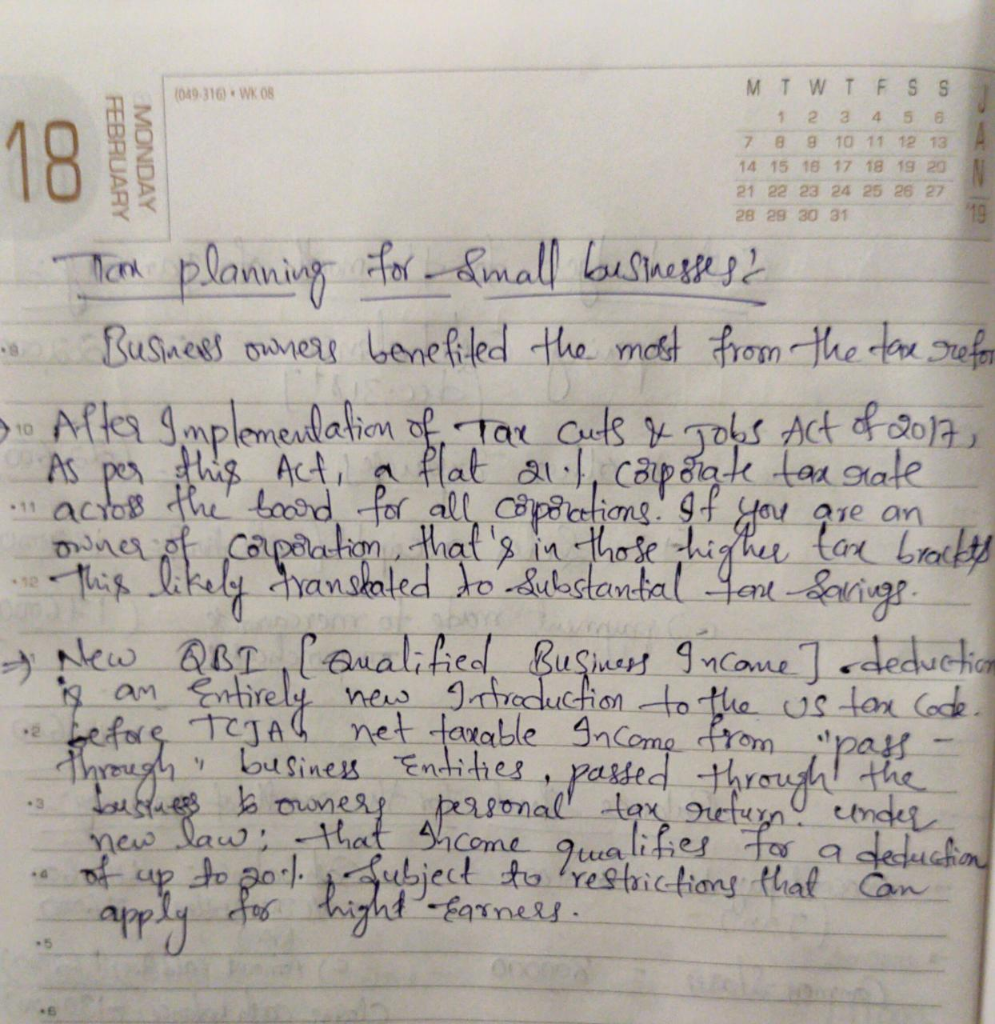

Many high-end earners such as athletes, entertainers and surgeons have a maximum federal tax rate of up to 40.5% with the Medicare surtax, while entrepreneurs and business executives can often structure their compensation to get capital gains treatment and pay a maximum tax rate virtually half of that at 23.8%. Discuss the equity, risks and opportunities involved in tax planning executive compensation using some the the laws and tools you learned in chapters 5 & 6. Once again label and citations you use and clearly state opinions as such. Alternatively you may discuss tax planning for small business owners and how to best maximize tax savings utilizing the new QBI deduction and managing itemized deductions.

Solutions

Related Solutions

Many countries experience a high rate of growth but still have many poor people, living in...

Many countries experience a high rate of growth but

still have many poor people, living in poor and environmentally

deteriorated conditions. Discuss and explain the concept, its

limitations and compare and contrast it with other such concepts

(note these other concepts will need to be searched online and

discussed briefly). Explain this using only macro economic

concepts.

Nutritional intake among Canadian high-performance male athletes. Since previous studies have reported that elite athletes are...

Nutritional intake among Canadian high-performance male

athletes. Since previous studies have reported that elite

athletes are often deficient in their nutritional intake, a group

of researchers decided to evaluate Canadian high-performance

athletes. For one part of the study, n = 114 male athletes

from eight Canadian sports centers were surveyed. Their average

caloric intake was 3077.0 kilocalories per day (kcal/d) with a

standard deviation of 987.0. The recommended amount is 3427. At the

5% significance level, is there evidence that...

You have gross earnings of $2,370 per week and a Federal Income Tax rate of 24%....

You have gross earnings of $2,370 per week and a Federal Income

Tax rate of 24%. You have voluntary deductions.

What are your net earnings per week?

A major overhaul of the Federal Tax structure was enacted at the end of 2017, effective...

A major overhaul of the Federal Tax structure was enacted at the

end of 2017, effective beginning with the 2018 tax year. This

assignment consists of calculations to gauge effects on situations

as described.

In all cases, for this assignment, assume that the tax being

calculated is for a “Married couple filing jointly” who do not

itemize deductions, and have no other additions, subtractions, or

any tax situations not specifically stated. Complete the table

below, finding the difference between the...

Tatun Inc. pays state income tax at a 5% rate and federal income tax at a...

Tatun Inc. pays state income tax at a 5% rate and federal income

tax at a 21% rate. Tatun recently engaged in a transaction in

Mexico, which levied a $25,200 income tax on the transaction.

Tatun's pretax net income for the current year is $1,913,900.

Compute Tatun's total income tax burden assuming that:

The Mexican tax is nondeductible for state and federal tax

purposes.

The Mexican tax is deductible for state and federal tax

purposes.

2 Sociologists and sports psychologists have noticed that in many sports, the athletes who make it...

2 Sociologists and sports psychologists have noticed that in

many sports, the athletes who make it to the professional level in

their respective sport were the older participants in the sport as

a youth. That is, the athlete’s birthdate is early in the “sport

year”. This phenomenon has been noticed around the world in various

sports such as soccer (Europe), hockey (Canada), and baseball

(USA). In youth baseball leagues, the “sport year” begins on August

1, so children born in...

2) Assume that the Social Security tax rate is 6% and the Social Security maximum is...

2) Assume that the Social Security tax rate is 6% and

the Social Security maximum is $140,000 per year.

A) What is the effective tax rate on someone with a

$70,000 salary?

$4200

B) What is the effective tax rate on someone with a

$140,000 salary?

$8400

C) What is the effective tax rate on someone with a

$1,400,000 salary?

Can a country have high investment if it doesn't not have a high rate of domestic...

Can a country have high investment if it doesn't not have a high

rate of domestic savings? Please explain.

Women athletes at the a certain university have a long-term graduation rate of 67%. Over the...

Women athletes at the a certain university have a long-term

graduation rate of 67%. Over the past several years, a random

sample of 36 women athletes at the school showed that 19 eventually

graduated. Does this indicate that the population proportion of

women athletes who graduate from the university is now less than

67%? Use a 1% level of significance. a)What is the level of

significance? b)State the null and alternate hypotheses. H0: p =

0.67; H1: p > 0.67...

Women athletes at the a certain university have a long-term graduation rate of 67%. Over the...

Women athletes at the a certain university have a long-term

graduation rate of 67%. Over the past several years, a random

sample of 40 women athletes at the school showed that 21 eventually

graduated. Does this indicate that the population proportion of

women athletes who graduate from the university is now less than

67%? Use a 1% level of significance.

(a) State the null and alternate hypotheses.

H0: p = 0.67; H1: p ≠ 0.67

H0: p < 0.67; H1:...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ADVERTISEMENT

ekkarill92 answered 1 month ago

ekkarill92 answered 1 month ago