Question

In: Accounting

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

|

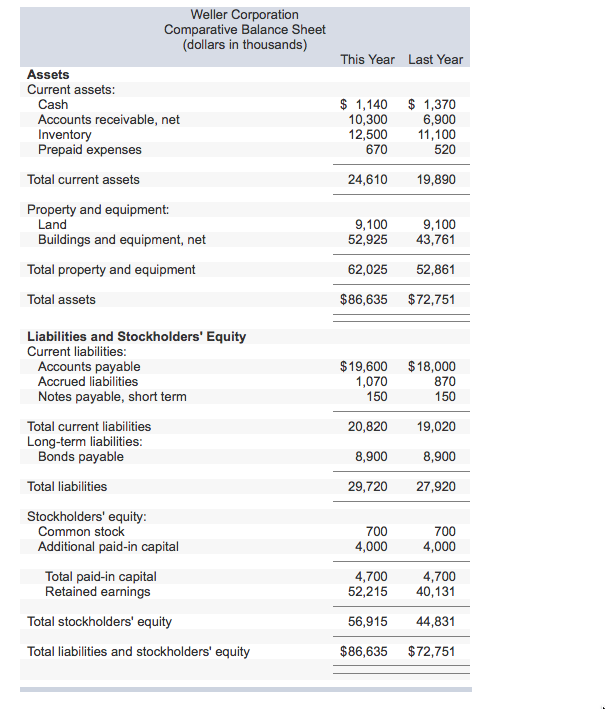

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 700,000 shares of common stock were outstanding. The interest rate on the bonds, which were sold at their face value, was 10%. The income tax rate was 40% and the dividend per share of common stock was $0.40 this year. The market value of the company’s common stock at the end of the year was $27. All of the company’s sales are on account. |

| Weller Corporation Comparative Balance Sheet (dollars in thousands) |

||||||

| This Year | Last Year | |||||

| Assets | ||||||

| Current assets: | ||||||

| Cash | $ | 1,170 | $ | 1,310 | ||

| Accounts receivable, net | 10,700 | 6,500 | ||||

| Inventory | 13,900 | 11,000 | ||||

| Prepaid expenses | 630 | 550 | ||||

| Total current assets | 26,400 | 19,360 | ||||

| Property and equipment: | ||||||

| Land | 10,600 | 10,600 | ||||

| Buildings and equipment, net | 47,353 | 43,830 | ||||

| Total property and equipment | 57,953 | 54,430 | ||||

| Total assets | $ | 84,353 | $ | 73,790 | ||

| Liabilities and Stockholders' Equity | ||||||

| Current liabilities: | ||||||

| Accounts payable | $ | 20,500 | $ | 18,400 | ||

| Accrued liabilities | 1,060 | 750 | ||||

| Notes payable, short term | 300 | 300 | ||||

| Total current liabilities | 21,860 | 19,450 | ||||

| Long-term liabilities: | ||||||

| Bonds payable | 10,000 | 10,000 | ||||

| Total liabilities | 31,860 | 29,450 | ||||

| Stockholders' equity: | ||||||

| Common stock | 700 | 700 | ||||

| Additional paid-in capital | 4,000 | 4,000 | ||||

| Total paid-in capital | 4,700 | 4,700 | ||||

| Retained earnings | 47,793 | 39,640 | ||||

| Total stockholders' equity | 52,493 | 44,340 | ||||

| Total liabilities and stockholders' equity | $ | 84,353 | $ | 73,790 | ||

| Weller Corporation Comparative Income Statement and Reconciliation (dollars in thousands) |

||||||

| This Year | Last Year | |||||

| Sales | $ | 79,120 | $ | 66,000 | ||

| Cost of goods sold | 46,065 | 33,000 | ||||

| Gross margin | 33,055 | 33,000 | ||||

| Selling and administrative expenses: | ||||||

| Selling expenses | 10,900 | 11,000 | ||||

| Administrative expenses | 7,100 | 6,000 | ||||

| Total selling and administrative expenses | 18,000 | 17,000 | ||||

| Net operating income | 15,055 | 16,000 | ||||

| Interest expense | 1,000 | 1,000 | ||||

| Net income before taxes | 14,055 | 15,000 | ||||

| Income taxes | 5,622 | 6,000 | ||||

| Net income | 8,433 | 9,000 | ||||

| Dividends to common stockholders | 280 | 700 | ||||

| Net income added to retained earnings | 8,153 | 8,300 | ||||

| Beginning retained earnings | 39,640 | 31,340 | ||||

| Ending retained earnings | $ | 47,793 | $ | 39,640 | ||

| Required: | |

| Compute the following financial data for this year: |

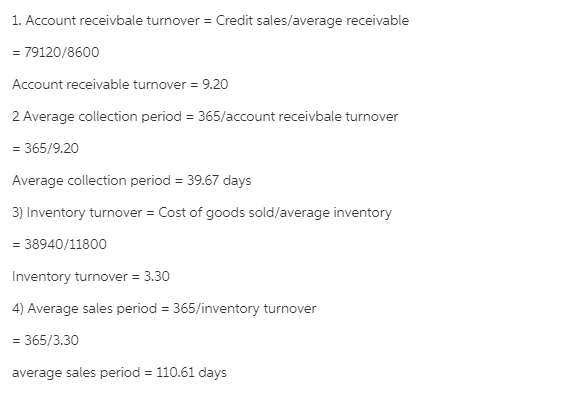

| 1. |

Accounts receivable turnover. (Assume that all sales are on account.) (Round your answer to 2 decimal places.) |

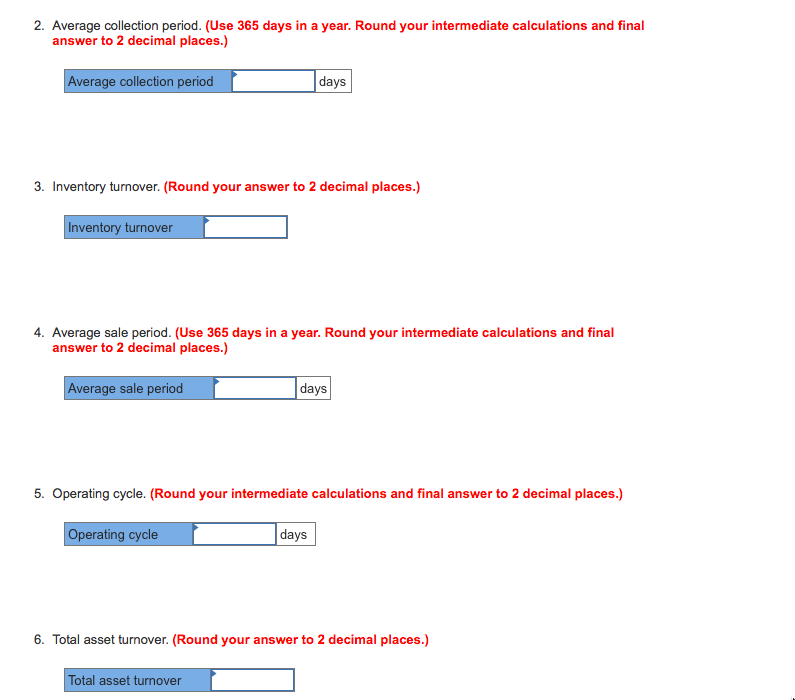

| 2. |

Average collection period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 decimal places.) |

| 3. |

Inventory turnover. (Round your answer to 2 decimal places.) |

| 4. |

Average sale period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 decimal places.) |

| 5. |

Operating cycle. (Round your intermediate calculations and final answer to 2 decimal places.) |

| 6. |

Total asset turnover. (Round your answer to 2 decimal places.) |

Solutions

Related Solutions

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

ekkarill92 answered 1 month ago

ekkarill92 answered 1 month ago