Question

In: Accounting

Baird Company has provided the following 2018 data: Budget Sales $ 517,000 Variable product costs 186,000...

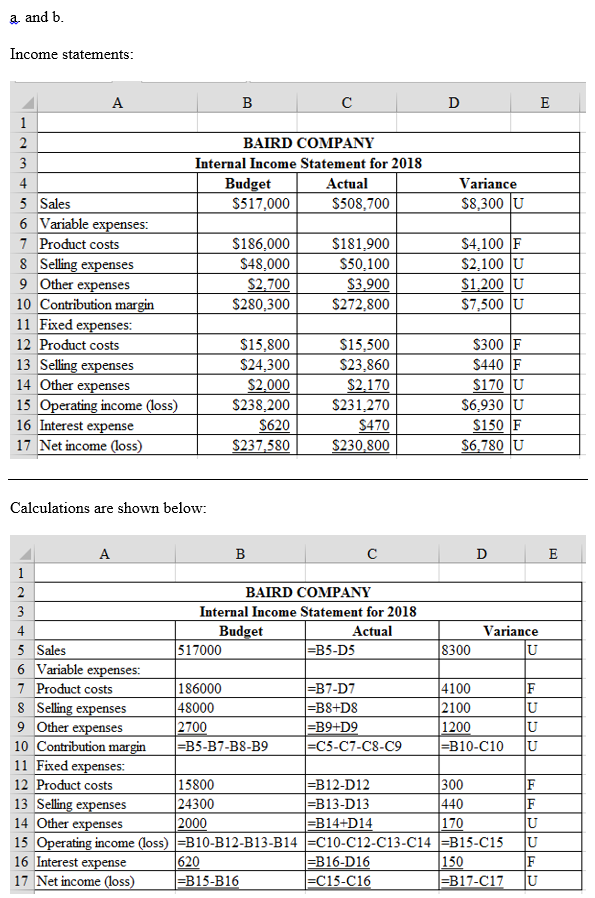

Baird Company has provided the following 2018 data: Budget Sales $ 517,000 Variable product costs 186,000 Variable selling expense 48,000 Other variable expenses 2,700 Fixed product costs 15,800 Fixed selling expense 24,300 Other fixed expenses 2,000 Interest expense 620 Variances Sales 8,300 U Variable product costs 4,100 F Variable selling expense 2,100 U Other variable expenses 1,200 U Fixed product costs 300 F Fixed selling expense 440 F Other fixed expenses 170 U Interest expense 150 F Required a. & b. Prepare a budgeted and actual income statement for internal use. Separate operating income from net income in the statements. Calculate variances and identify them as favorable (F) or unfavorable (U) by comparing the budgeted and actual amounts determined. (Select "None" if there is no effect (i.e., zero variance).)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Solutions

Related Solutions

KOGURYU Corporation, a merchandising company, has provided the following budget data: Purchases Sales January ...

1.A company has provided the following data: Sales 12,000 units Sales price $100 per unit Variable...

Lee Company, which has only one product, has provided the following data for...

QUESTION 3 The sales budget is provided below for the product of Company ABC. Jan 10,000...

Sosa Company has provided the following budget information for the first quarter of 2016 Total sales...

Baird Manufacturing Company makes a product that sells for $75 30 per unit Manufacturing costs for the product

Sales Budget XYZ Company 2018 sales forecast is as follows: Quarter 1: 7,000 Product Ace units....

Flexible Budget for Varying Levels of Activity Nashler Company has the following budgeted variable costs per...

Flexible Budget for Varying Levels of Activity Nashler Company has the following budgeted variable costs per...

Flexible Budget for Varying Levels of Activity Nashler Company has the following budgeted variable costs per...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

ekkarill92 answered 2 months ago

ekkarill92 answered 2 months ago