Question

In: Accounting

The income statement of Oriole Company for the month of July shows net income of $3,490...

The income statement of Oriole Company for the month of July shows net income of $3,490 based on Service Revenue $7,630, Salaries and Wages Expense $2,370, Supplies Expense $980, and Utilities Expense $790. In reviewing the statement, you discover the following: 1. Insurance expired during July of $550 was omitted. 2. Supplies expense includes $410 of supplies that are still on hand at July 31. 3. Depreciation on equipment of $290 was omitted. 4. Accrued but unpaid wages at July 31 of $440 were not included. 5. Service performed but unrecorded totaled $740. Prepare a correct income statement for July 2022.

Solutions

Expert Solution

Solution :

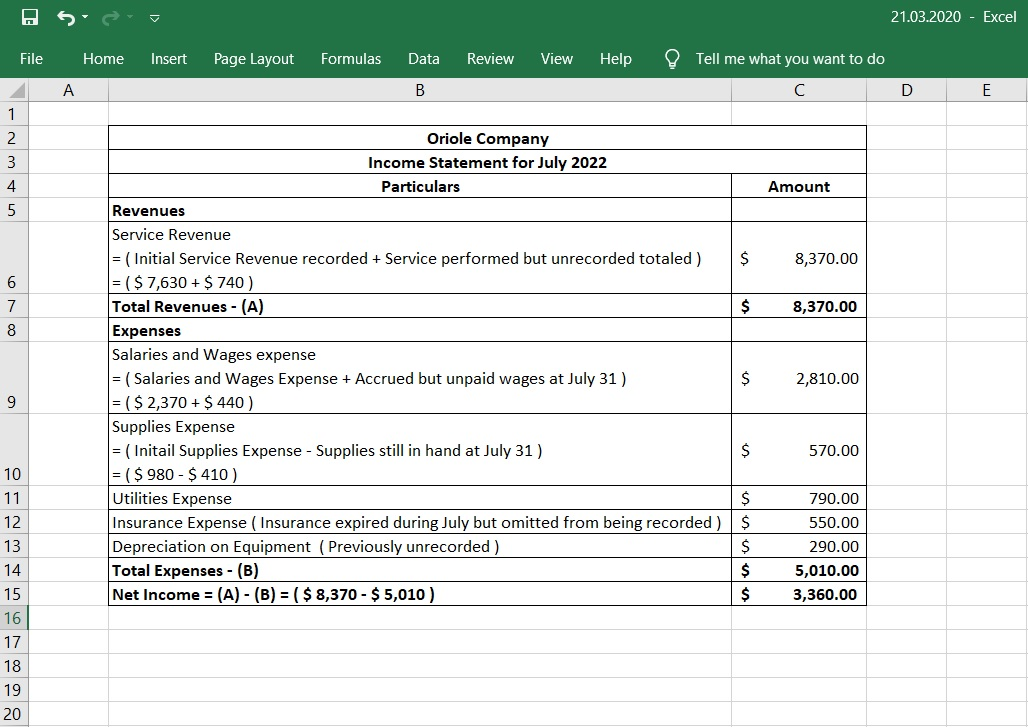

The Net Income as per the corrected Income statement for July 2022 is = $ 3,360

Please find the attached screenshot of the excel sheet containing the detailed calculation for the solution.

Related Solutions

The condensed income statement for the Oriole and Paul partnership for 2020 is as follows. Oriole...

1. Hotel has submitted an income statement for the end of the month that shows a...

Oriole Company reported the following on its income statement: Income before income taxes $730000 Income tax...

Profit or Loss Account (Income Statement) of a business shows a net profit of 500,000. The...

Variable Costing Income Statement On July 31, the end of the first month of operations, Rhys...

Variable Costing Income Statement On July 31, 2016, the end of the first month of operations,...

Variable Costing Income Statement On July 31, the end of the first month of operations, Rhys...

Income Statement An inexperienced accountant for Prestwick Company prepared the following income statement for the month...

S&J Plumbing, Incorporated's income statement shows a net profit before tax of $468 and net sales...

The comparative statements of Oriole Company are presented here. ORIOLE COMPANY Income Statements For the Years...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 2 months ago

ekkarill92 answered 2 months ago