Question

In: Finance

pension fund manager is considering three mutual funds. The first is a stock fund, the second...

pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a sure rate of 5.4%. The probability distributions of

the risky funds are:

| Expected Return | Standard Deviation | |

| Stock fund (S) | 15% | 44% |

| Bond fund (B) | 8% | 38% |

The correlation between the fund returns is 0.0684.

What is the Sharpe ratio of the best feasible CAL? (Do not round intermediate calculations. Round your answer to 4 decimal places.)

Solutions

Expert Solution

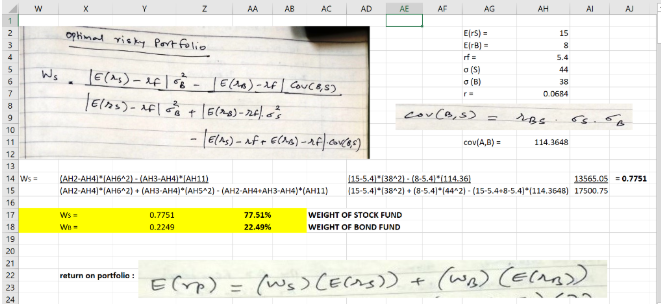

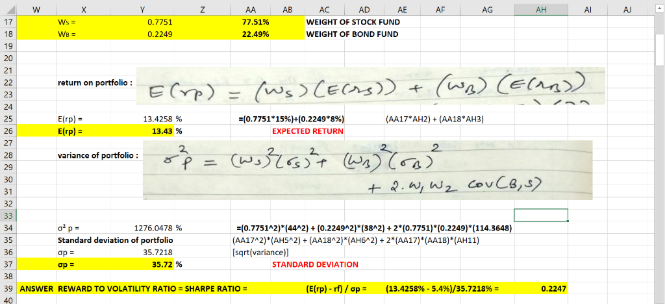

I have answered the question below using excel and have attached the image below.

Please up vote for the same and thanks!!!

Do reach out in the comments for any queries

Answer:

Related Solutions

pension fund manager is considering three mutual funds. The first is a stock fund, the second...

pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a sure rate of 4.7%. The probability distributions of

the risky funds are: Expected Return Standard Deviation Stock fund

(S) 17 % 37 % Bond fund (B) 8 % 31 % The correlation between the

fund returns is .1065. Suppose now that your portfolio must...

A pension fund manager is considering three mutual funds. The first is a stock fund,...

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5%. The stock fund has an expected return of 15% and a standard deviation of 23%. The bond fund has an expected return of 9% and a standard deviation of 23%. The correlation between the fund returns is.15. a) What...

A pension fund manager is considering three mutual funds. The first is a stock fund, the...

A pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a sure rate of 5.5%. The probability distributions of

the risky funds are:

Expected Return

Standard Deviation

Stock fund (S)

16%

45%

Bond fund (B)

7%

39%

The correlation between the fund returns is 0.0385.

What is the expected return and standard deviation for...

A pension fund manager is considering three mutual funds. The first is a stock fund, the...

A pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a sure rate of 5.5%. The probability distributions of

the risky funds are:

Expected Return

Standard Deviation

Stock fund (S)

16%

45%

Bond fund (B)

7%

39%

The correlation between the fund returns is 0.0385.

What is the expected return and standard deviation for...

A pension fund manager is considering three mutual funds. The first is a stock fund, the...

A pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a sure rate of 4.7%. The probability distributions of

the risky funds are:

Expected Return

Standard Deviation

Stock fund (S)

17%

37%

Bond fund (B)

8%

31%

The correlation between the fund returns is 0.1065.

What is the Sharpe ratio of the best feasible...

A pension fund manager is considering three mutual funds. The first is a stock fund, the...

A pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a rate of 8%. The probability distribution of the risky

funds is as follows:

Expected Return

Standard Deviation

Stock fund (S)

17

%

30

%

Bond fund (B)

11

22

The correlation between the fund returns is 0.10.

a-1. What are the investment proportions...

A pension fund manager is considering three mutual funds. The first is a stock fund, the...

A pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a sure rate of 5.8%. The probability distributions of

the risky funds are:

Expected Return Standard Deviation

Stock fund (S) 19% 48%

Bond fund (B) 9% 42%

The correlation between the fund returns is 0.0762.

What is the Sharpe ratio of the best feasible...

A pension fund manager is considering three mutual funds. The first is a stock fund, the...

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are:Expected ReturnStandard DeviationStock fund (S)15%32%Bond fund (B)9%23%The correlation between the fund returns is .15 What is the expected return and standard deviation for the minimum-variance portfolio of the two risky funds? (Do not...

A pension fund manager is considering three mutual funds. The first is a stock fund, the...

A pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a sure rate of 4.1%. The probability distributions of

the risky funds are:

Expected Return

Standard Deviation

Stock fund (S)

11

%

33

%

Bond fund (B)

8

%

25

%

The correlation between the fund returns is .1560.

Suppose now that your portfolio...

A pension fund manager is considering three mutual funds. The first is a stock fund, the...

A pension fund manager is considering three mutual funds. The

first is a stock fund, the second is a long-term government and

corporate bond fund, and the third is a T-bill money market fund

that yields a sure rate of 5.9%. The probability distributions of

the risky funds are:

Expected Return

Standard Deviation

Stock fund (S)

20%

49%

Bond fund (B)

9%

43%

The correlation between the fund returns is 0.0721.

What is the expected return and standard deviation for...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

ADVERTISEMENT

jeff jeffy answered 2 months ago

jeff jeffy answered 2 months ago