Question

In: Accounting

Cortez Company is planning to introduce a new product that will sell for $107 per unit....

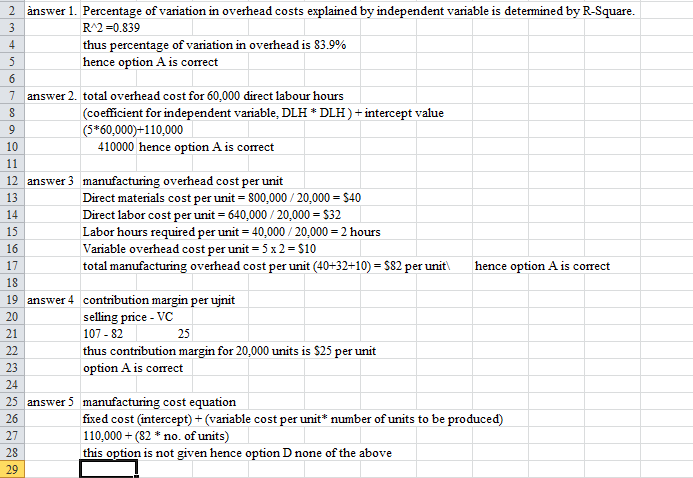

Cortez Company is planning to introduce a new product that will sell for $107 per unit. The following manufacturing cost estimates have been made on 20,000 units to be produced the first year: Direct materials $ 800,000 Direct labor 640,000 (= $16 per hour × 40,000 hours) Manufacturing overhead costs have not yet been estimated for the new product, but monthly data on total production and overhead costs for the past 24 months have been analyzed using simple linear regression. The following results were derived from the simple regression and provide the basis for overhead cost estimates for the new product. Simple Regression Analysis Results Dependent variable—Factory overhead costs Independent variable—Direct labor-hours Computed values Intercept $ 110,000 Coefficient on independent variable $ 5.00 Coefficient of correlation .916 R2 .839 Required: a. What percentage of the variation in overhead costs is explained by the independent variable? 83.90% 92.30% 100.70% 75.50% None of the above b. What is the total overhead cost for an estimated activity level of 60,000 direct labor-hours? $410,000 $420,000 $400,000 $430,000 None of the above c. How much is the variable manufacturing cost per unit, using the variable overhead estimated by the regression (assuming that direct materials and direct labor are variable costs)? $82.00 $90.00 $98.00 $74.00 None of the above d. What is the expected contribution margin per unit to be earned during the first year on 20,000 units of the new product? (Assume that all marketing and administrative costs are fixed.) $25.00 $28.00 $30.00 $23.00 None of the above e. What is the manufacturing cost equation implied by these results? Total cost = $640,000 + ($5.00 × Number of units) Total cost = $110,000 + ($107.00 × Number of units) Total cost = $110,000 + ($16.00 × Number of units) None of the above Next Visit question mapQuestion 3 of 5 Total3 of 5

Solutions

Related Solutions

Cortez Company is planning to introduce a new product that will sell for $106 per unit....

The management of a firm wants to introduce a new product. The product will sell for...

Hereford Company is planning to introduce a new product with an 80 percent learning rate for...

Hereford Company is planning to introduce a new product with an 80 percent learning rate for...

Huntington Manufacturing manufactures a single product that it will sell for $83 per unit. The company...

Creative Ideas Company has decided to introduce a new product. The new product can be manufactured...

Creative Ideas Company has decided to introduce a new product. The new product can be manufactured...

A manufacturing company is evaluating two options for new equipment to introduce a new product to...

A manufacturing company is evaluating two options for new equipment to introduce a new product to...

Why is it dangerous to introduce a new product?

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 2 months ago

ekkarill92 answered 2 months ago