Question

In: Accounting

Presented Below is Information related to Matrix Company at December 31,2018 the end of its first...

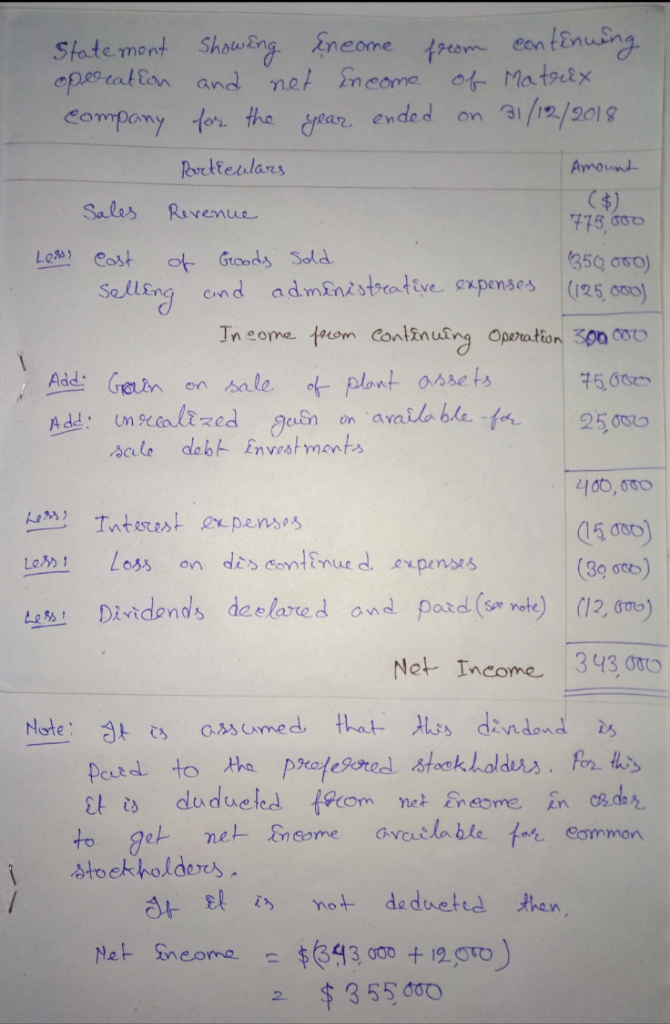

Presented Below is Information related to Matrix Company at December 31,2018 the end of its first year of operations:

Account Balance

| Sales Revenue | $775,000 |

| Cost of Goods Sold | $350,000 |

| Selling and administrative expenses | $125,000 |

| Gain on sale of plant assets | $75,000 |

| Unrealized gain on available-for sale debt investments | $25,000 |

| Interest expense | $15,000 |

| Loss on discontinued expense | $30,000 |

| Dividends declared and paid | $12,000 |

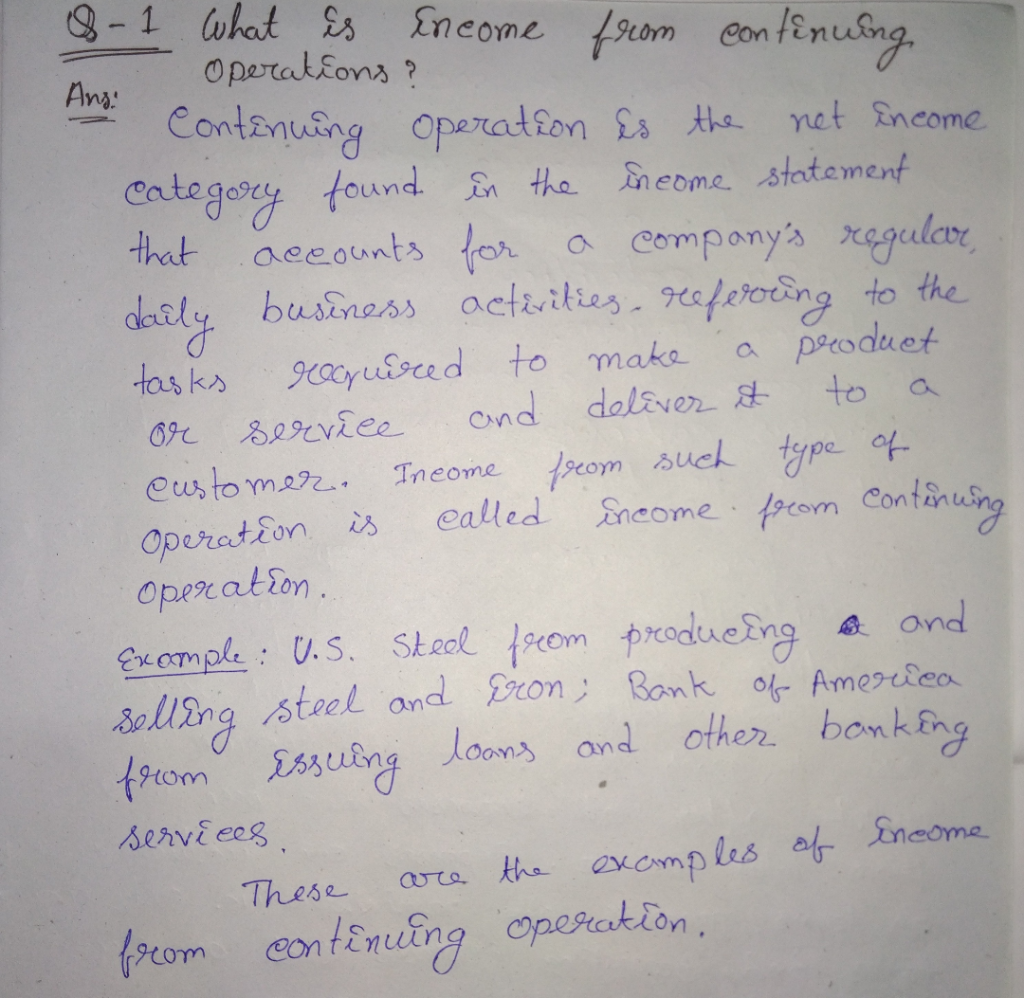

Question 1: What is income from continuing operations?

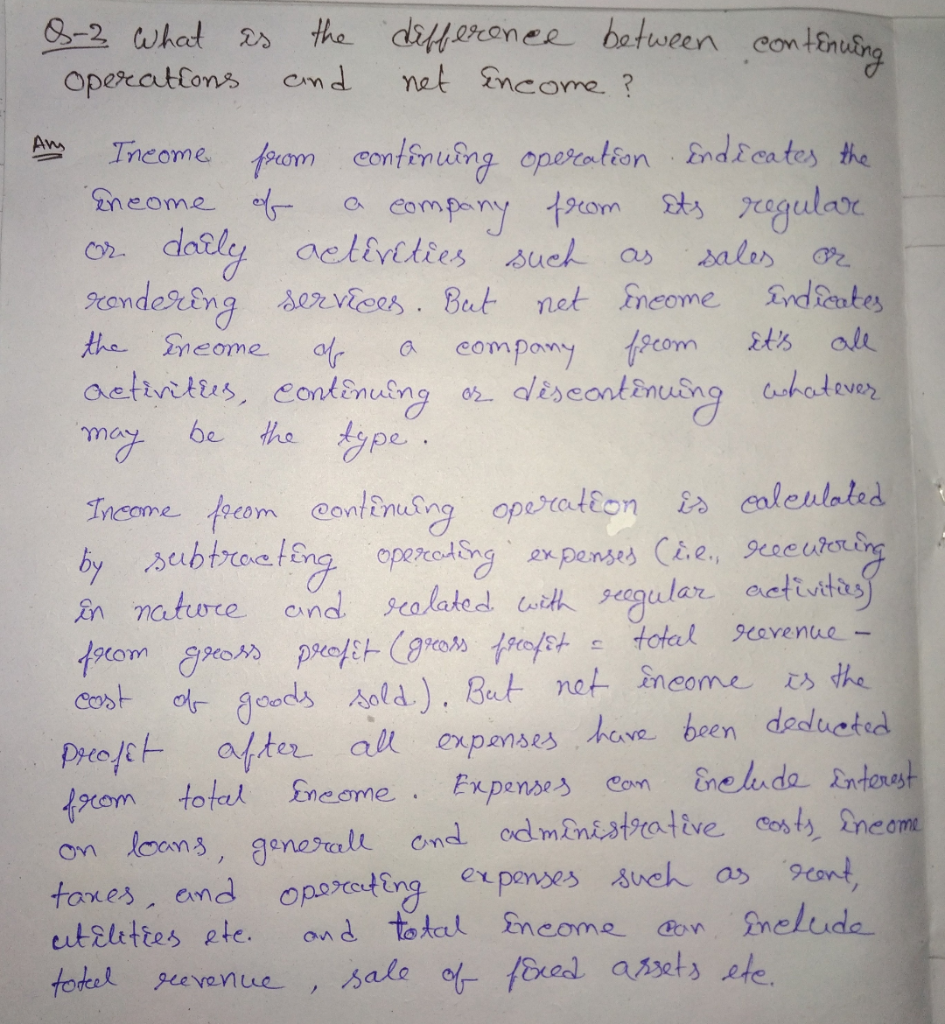

Question 2: What is the difference between continuing operations and net income?

Solutions

Related Solutions

Presented below is information related to equipment owned by a company at December 31, 2017. ...

Presented below is information related to equipment owned by a

company at December 31, 2017.

Cost

$5,600,000

Accumulated depreciation to

date

640,000

Expected future net cash

flows

4,000,000

Fair

value

2,720,000

Assume that the company will continue

to use this asset in the future. As of December 31, 2017, the

equipment has a remaining useful life of 4 years.

Using the attached T-account

template:

Prepare the journal entry (if any) to record the impairment of...

Presented below is information related to Kingbird Company. Date Ending Inventory (End-of-Year Prices) Price Index December...

Presented below is information related to Kingbird

Company.

Date

Ending Inventory

(End-of-Year Prices)

Price

Index

December 31, 2017

$ 78,200

100

December 31, 2018

242,950

215

December 31, 2019

239,604

246

December 31, 2020

271,272

267

December 31, 2021

320,579

287

December 31, 2022

382,833

297

Compute the ending inventory for Kingbird Company for 2017 through

2022 using the dollar-value LIFO method.

Ending Inventory

2017

$enter a dollar amount

2018

$enter a dollar amount

2019

$enter a dollar amount

2020...

Presented below is information related to Metlock Company. Date Ending Inventory (End-of-Year Prices) Price Index December...

Presented below is information related to Metlock

Company.

Date

Ending Inventory

(End-of-Year Prices)

Price

Index

December 31, 2014

$ 83,800

100

December 31, 2015

176,802

158

December 31, 2016

175,320

180

December 31, 2017

197,535

195

December 31, 2018

238,140

210

December 31, 2019

286,452

218

Compute the ending inventory for Metlock Company for 2014 through

2019 using the dollar-value LIFO method.

Presented below is information related to Skysong Company. Date Ending Inventory (End-of-Year Prices) Price Index December...

Presented below is information related to Skysong Company. Date

Ending Inventory (End-of-Year Prices) Price Index December 31, 2017

$ 87,400 100 December 31, 2018 152,755 137 December 31, 2019

148,824 156 December 31, 2020 168,493 169 December 31, 2021 200,018

182 December 31, 2022 238,140 189 Compute the ending inventory for

Skysong Company for 2017 through 2022 using the dollar-value LIFO

method.

Ending Inventory 2017:

Ending Inventory 2018:

Ending Inventory 2019:

Ending Inventory 2020:

Ending Inventory 2021:

Ending Inventory 2022:

Presented below is information related to Marigold Company. Date Ending Inventory (End-of-Year Prices) Price Index December...

Presented below is information related to Marigold

Company.

Date

Ending Inventory

(End-of-Year Prices)

Price

Index

December 31, 2014

$ 83,600

100

December 31, 2015

261,723

231

December 31, 2016

258,456

264

December 31, 2017

292,006

286

December 31, 2018

349,580

308

December 31, 2019

421,399

319

Compute the ending inventory for Marigold Company for 2014 through

2019 using the dollar-value LIFO method.

Ending Inventory

2014

$

2015

$

2016

$

2017

$

2018

$

2019

$

Presented below is information related to Concord Company. Date Ending Inventory (End-of-Year Prices) Price Index December...

Presented below is information related to Concord Company. Date

Ending Inventory (End-of-Year Prices) Price Index December 31, 2017

$ 83,200 100 December 31, 2018 145,934 131 December 31, 2019

142,950 150 December 31, 2020 161,696 163 December 31, 2021 193,200

175 December 31, 2022 227,698 181 Compute the ending inventory for

Concord Company for 2017 through 2022 using the dollar-value LIFO

method.

Presented below is information related to equipment owned by ACtiv Company on December 31, 2018. ...

Presented below is information related to equipment owned by

ACtiv Company on December 31, 2018.

Cost

€10,000,000

Accumulated depreciation to

date

2,500,000

Value-in-use

6,000,000

Fair value less the cost of disposal 5,400,000

Assume that ACtiv will continue to use this asset in the future.

As of December 31, 2018, the equipment has a remaining useful of 4

years.

Instructions

(a) Prepare the journal entry

(if any) to record the impairment of the asset...

Presented below is information related to equipment owned by ALALI Company at December 31, 2010. ...

Presented below is information related to equipment owned by

ALALI Company at December 31, 2010.

Cost

SAR 7,000,000

Accumulated depreciation to

date

1,500,000

Value-in-use

5,000,000

Fair value less cost of

disposal

4,400,000

Assume that ALALI will continue to use this asset in the future.

As of December 31, 2010, the equipment has a remaining useful of 4

years.

Instructions

Prepare the journal entry (if any) to record the impairment of

the asset at December...

. Presented below is information related to equipment owned by ALALI Company at December 31, 2010....

. Presented below is information related to

equipment owned by ALALI Company at December 31, 2010.

Cost

SAR 7,000,000

Accumulated depreciation to

date

1,500,000

Value-in-use

5,000,000

Fair value less cost of

disposal

4,400,000

Assume that ALALI will continue to use this asset in the future.

As of December 31, 2010, the equipment has a remaining useful of 4

years.

Instructions

Prepare the journal entry (if any) to record the impairment of

the asset at...

Presented below is information related to equipment owned by Blossom Company at December 31, 2020. Cost...

Presented below is information related to equipment owned by

Blossom Company at December 31, 2020.

Cost

$11,070,000

Accumulated depreciation to date

1,230,000

Expected future net cash flows

8,610,000

Fair value

5,904,000

Blossom intends to dispose of the equipment in the coming year. It

is expected that the cost of disposal will be $24,600. As of

December 31, 2020, the equipment has a remaining useful life of 4

years.

Prepare the journal entry (if any) to record the impairment of

the...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ADVERTISEMENT

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago