Question

In: Accounting

Hank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late...

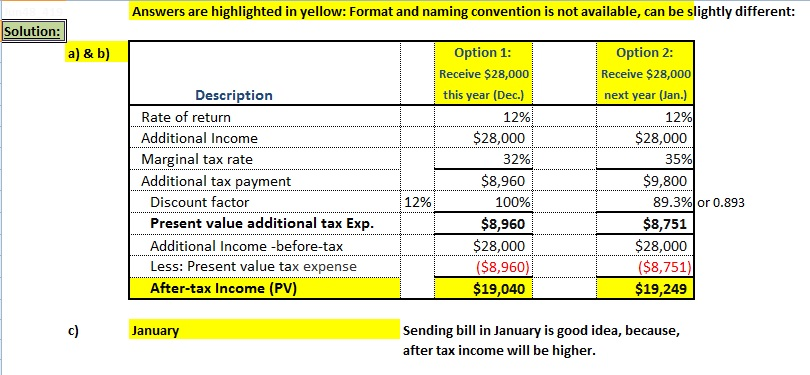

Hank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December, he performed $28,000 of legal services for a client. Hank typically requires his clients to pay his bills immediately upon receipt. Assume his marginal tax rate is 32 percent this year and will be 35 percent next year, and that he can earn an after-tax rate of return of 12 percent on his investments. Use Exhibit 3.1.

a. What is the after-tax income if Hank sends his client the bill in December?

b. What is the after-tax income if Hank sends his client the bill in January? (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.)

EXHIBIT 3-1 Present Value of a Single Payment at Various Annual

Rates of Return

4% 5% 6% 7%

8% 9% 10% 11%

12%

Year 1 .962 .952

.943 .935 .926 .917

.909 .901 .893

Year 2 .925 .907

.890 .873 .857 .842

.826 .812 .797

Year 3 .889 .864

.840 .816 .794 .772

.751 .731 .712

Year 4 .855 .823

.792 .763 .735 .708

.683 .659 .636

Year 5 .822 .784

.747 .713 .681 .650

.621 .593 .567

Year 6 .790 .746

.705 .666 .630 .596

.564 .535 .507

Year 7 .760 .711

.665 .623 .583 .547

.513 .482 .452

Year 8 .731 .677

.627 .582 .540 .502

.467 .434 .404

Year 9 .703 .645

.592 .544 .500 .460

.424 .391 .361

Year 10 .676 .614

.558 .508 .463 .422

.386 .352 .322

Year 11 .650 .585

.527 .475 .429 .388

.350 .317 .287

Year 12 .625 .557

.497 .444 .397 .356

.319 .286 .257

Year 13 .601 .530

.469 .415 .368 .326

.290 .258 .229

Year 14 .577 .505

.442 .388 .340 .299

.263 .232 .205

Year 15 .555 .481

.417 .362 .315 .275

.239 .209 .183

c. Should Hank send his client the bill in December or January?

-

December

-

January

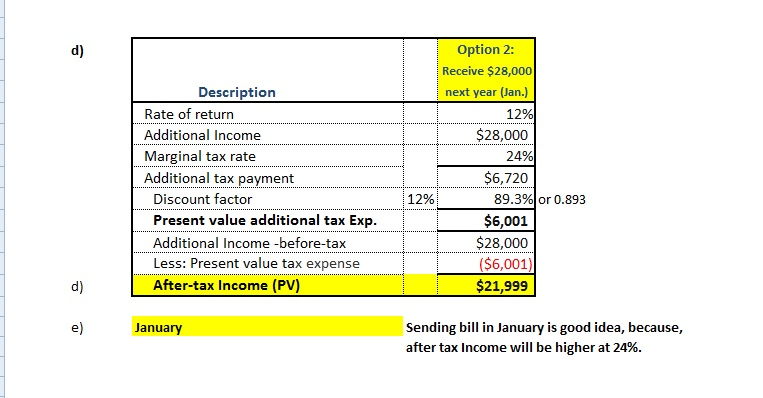

d. What is the after-tax income if Hank expects his marginal tax rate to be 24 percent next year and sends his client the bill in January? (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.)

e. Should Hank send his client the bill in December or January if he expects his marginal tax rate to be 32 percent this year and 24 percent next year?

Solutions

Related Solutions

Hank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late...

Manny, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late...

Sal, a calendar-year taxpayer, uses the cash-basis method of accounting for his sole proprietorship. In late...

Reese, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship. In late...

Isabel, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship. In late...

Reese, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship. In late...

1. Manny, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In...

Garrison Printing Company, a sole proprietorship owned by Jim Garrison (a calendar-year taxpayer, cash-basis taxpayer) has...

José, a cash method taxpayer, is a partner in J&T Accounting Services, a calendar year partnership....

Step's Music Lessons Inc. is a calendar-year taxpayer using the accrual method of accounting.

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago