Question

In: Accounting

Prepare the journal entries for these transactions. 1) Dur Company purchased equipment on January 2, 2013,...

Prepare the journal entries for these transactions.

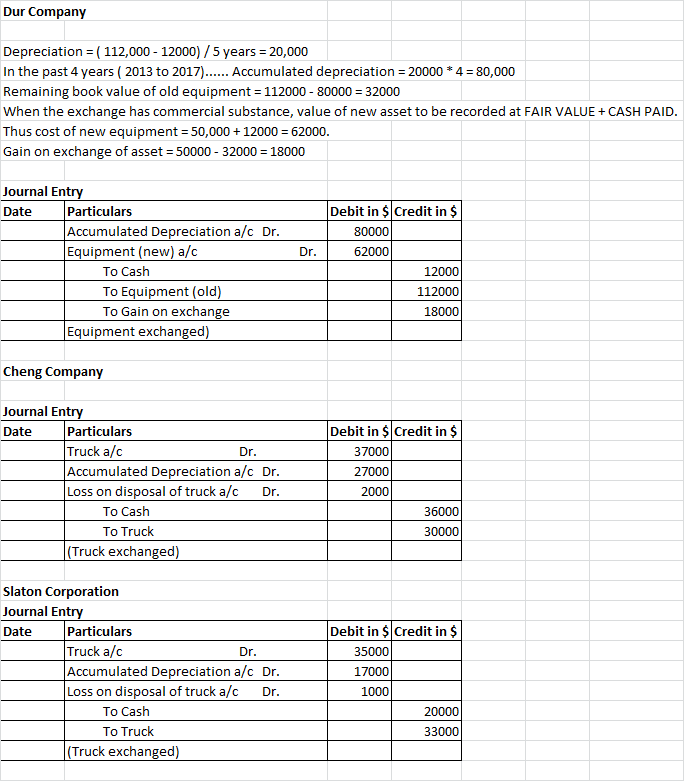

1) Dur Company purchased equipment on January 2, 2013, for $112,000. The equipment had an estimated useful life of 5 years with an estimated salvage value of $12,000. Dur uses straight-line depreciation on all assets. On January 2, 2017, Dur exchanged this equipment plus $12,000 in cash for newer equipment. The old equipment has a fair value of $50,000. (Assume that the exchange has commercial substance.)

2) Same transaction except (The exchange lacks commercial substance).

3) Cheng Company traded a used truck for a new truck. The used truck cost $30,000 and has accumulated depreciation of $27,000. The new truck is worth $37,000. Cheng also made a cash payment of $36,000. Prepare Cheng's entry to record the exchange. (The exchange lacks commercial substance.)

4) Slaton Corporation traded a used truck for a new truck. The used truck cost $20,000 and has accumulated depreciation of $17,000. The new truck is worth $35,000. Slaton also made a cash payment of $33,000. Prepare Slaton's entry to record the exchange. (The exchange lacks commercial substance.)

Solutions

Related Solutions

Prepare journal entries to record each of the January through March transactions 1. The company paid...

Prepare journal entries for the transactions

Required: 1. Prepare journal entries to record each of these transactions for 2017. 2. Prepare a...

Required: 1. Prepare journal entries to record each of these transactions for 2017. 2. Prepare a...

Prepare journal entries for each of the transactions and adjustments Chapati Company started business on January...

Prepare journal entries to record the following transactions for Cosmotown for 2013. The Town records encumbrances...

Prepare journal entries for these transactions for Year 1 and Year 2 and post them to...

Prepare journal entries to adjust the books of McGarrett Corp. at December 31, 2013. -Purchased Machine...

Prepare journal entries to adjust the books of McGarrett Corp. at December 31, 2013. -Purchased Machine...

Prepare journal entries to record the transactions for TC Company Listed below are the transactions of...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago