Question

In: Accounting

you are evaluating an investment that requires $2,000 upfront and pays $500 at the end of...

you are evaluating an investment that requires $2,000 upfront and pays $500 at the end of each of the first 2 years and an additional lump sum of $1000 at the end of year 2. What would happen to the IRR if the annual payment at the end of the first year go down from $500 to $300 and the annual payment at the end of the second year stays at $500?

Solutions

Expert Solution

|

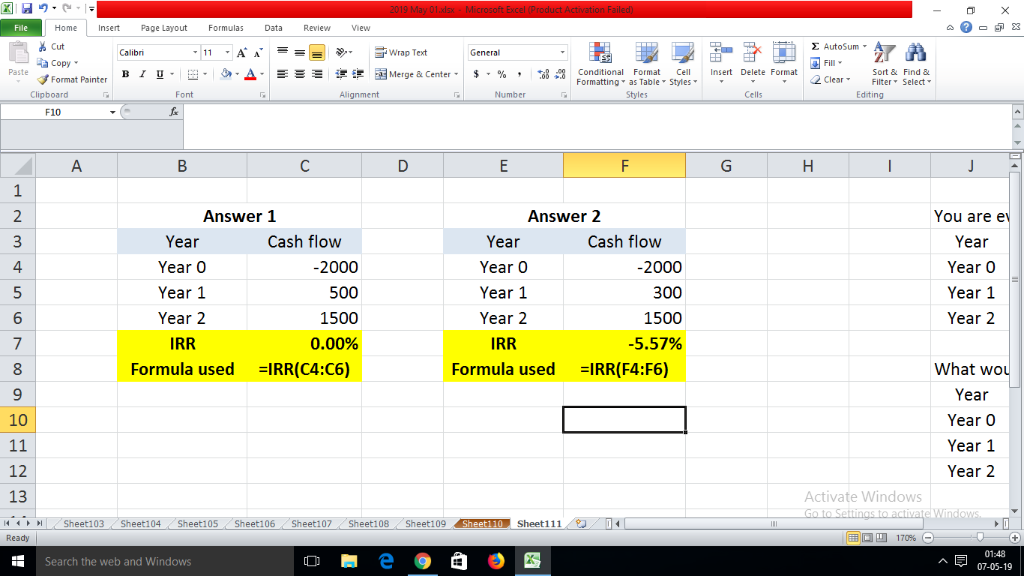

You are evaluating an investment that requires $2,000 upfront and pays $500 at the end of each of the first 2 years and an additional lump sum of $1000 at the end of year 2 (For Year 2 = 500 + 1000 = 1500) |

|

| Year | Cash flow |

| Year 0 | -2000 |

| Year 1 | 500 |

| Year 2 | 1500 |

|

What would happen to the IRR if the annual payment at the end of the first year go down from $500 to $300 and the annual payment at the end of the second year stays at $500? |

|

| Year | Cash flow |

| Year 0 | -2000 |

| Year 1 | 300 |

| Year 2 | 1500 |

| Answer 2 | |

| Year | Cash flow |

| Year 0 | -2000 |

| Year 1 | 300 |

| Year 2 | 1500 |

| IRR | -5.57% |

Related Solutions

An investor invests $500. The investment pays $100 at the end of year 2, $200 at...

You are evaluating a project that requires an investment of $99 today and garantees a single...

-Suppose that you are evaluating the following investment opportunity. At the end of the the next...

If you deposit $500 per month into an investment account that pays interest at a rate...

you have found an investment fund that will earn you $500 at the end of each...

An investment pays $20,000 at the end of year 2, $30,000 at the end of year...

An investment pays $20,000 at the end of year 2, $30,000 at the end of year...

Your firm is considering two investment projects, each of which requires an upfront expenditure of $48...

At the end of every year an investor pays £2,000 towards additional voluntary contributions to build...

Investment A is an annuity that pays $1,230 at the end of eachyear for 10...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

ekkarill92 answered 4 months ago

ekkarill92 answered 4 months ago