Question

In: Finance

Assume that the price of Socates Motors stock will either rise to $50 or fall to...

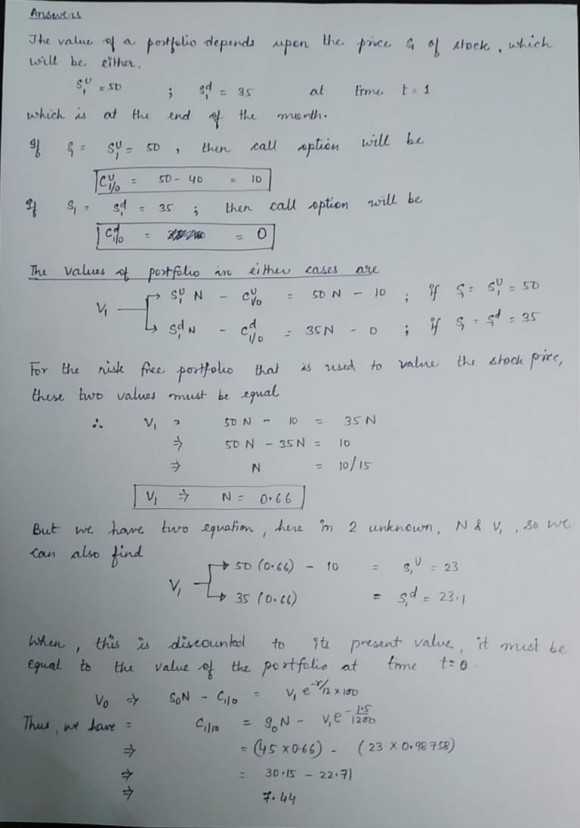

Assume that the price of Socates Motors stock will either rise to $50 or fall to $35 in one month and that the risk free rate for one month is 1.5%. How much is an option with a strike price of $40 worth if the current stock price if the current stock price is $45 instead of $40?

Solutions

Expert Solution

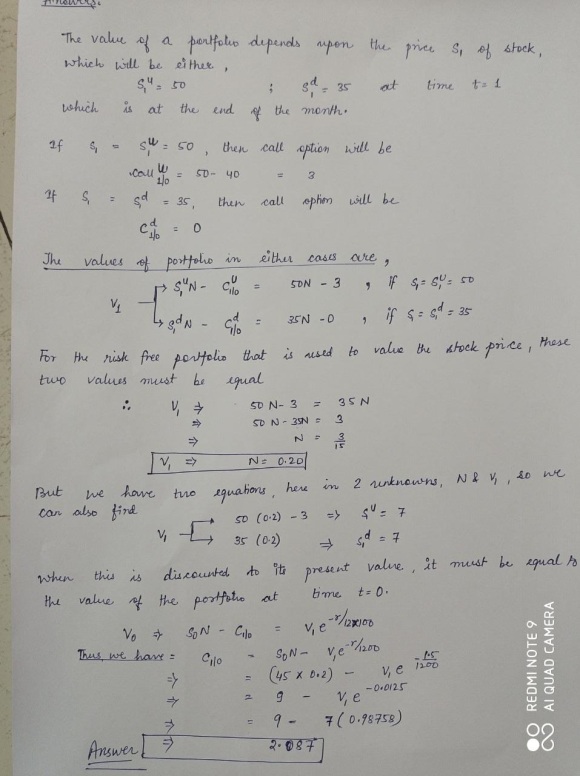

Sorry for making calculation error in solving the answer. Have

corrected the answer and have uploaded the new image with new call

value as = $ 7.44

Please find the correct answer .

Related Solutions

Imagine that google's stock price will either rise by one-third or fall by 25% over the...

Imagine that google's stock price will either rise by one-third

or fall by 25% over the next six months. Assume the 6 month

risk-free interest rate is 1%. Both the stock price and the

exercise price are $530.

1. Calculate the value of the 6 month call option using the

replicating portfolio method.

2. Calculate the value of the 6 month call option using the

risk-neutral method.

A stock currently sells for $50. In six months it will either rise to $60 or...

A stock currently sells for $50. In six months it will either

rise to $60 or decline to $45. The continuous compounding risk-free

interest rate is 5% per year.

a) Find the value of a European call option with an exercise

price of $50.

b) Find the value of a European put option with an exercise

price of $50, using the binomial approach.

c) Verify the put-call parity using the results of Questions 1

and 2.

The current price of a stock is $50. In 1 year, the price will be either...

The current price of a stock is $50. In 1 year, the price will

be either $65 or $35. The annual risk-free rate is 10%. Find the

price of a call option on the stock that has an exercise price of

$55 and that expires in 1 year. (Hint: Use daily compounding.)

The current price of a stock is $50. In 1 year, the price will be either...

The current price of a stock is $50. In 1 year, the price will

be either $65 or $35. The annual risk-free rate is 10%. Find the

price of a call option on the stock that has an exercise price of

$55 and that expires in 1 year. (Hint: Use daily compounding.)

Problem 2: A stock currently sells for $50. In six months it will either rise to...

Problem 2:

A stock currently sells for $50. In six months it will either

rise to $60 or decline to $45. The continuous compounding risk-free

interest rate is 5% per year.

Using the binomial approach, find the value of a European call

option with an exercise price of $50.

Using the binomial approach, find the value of a European put

option with an exercise price of $50.

Verify the put-call parity using the results of Questions 1 and

2.

Suppose AT&T’s current stock price is $100 and it is expected to either rise to 130...

Suppose AT&T’s current stock price is $100 and it is

expected to either rise to 130 or fall to 80 by next April (assume

6-months from today). Also assume you can borrow at the risk-free

rate of 2% per 6 months. Using the binomial approach, what would

you pay for a call option on AT&T that expires in 6-months and

has a strike price of $105? A strike price of $110?

A ?rm’s stock sells at $50. The stock price will be either $65 or $45 three...

A ?rm’s stock sells at $50. The stock price will be either $65

or $45 three months from now. Assume the 3-month risk-free rate is

1%.

a. What is the price of a European call with a strike price of

$50 and a maturity of three months?

b. What is the price of a European call with a strike price of

$55 and a maturity of three months?

c. What is the price of a European put with a strike...

Assume that the current stock price (S0) is £42, and that it either increases at a...

Assume that the current stock price (S0) is £42, and that it

either increases at a rate of 10% (u = 1:10) or it decreases at a

rate of 5% (d = 0:95) over a period of three months. Further assume

a European call option written on the stock, with a strike price

(K) equal to £40 and a time-to-maturity (T) equal to six months.

The risk-free interest is 10% pa.

(a) Draw a binomial tree showing the possible evolutions...

The probabilities that stock A will rise in price is 0.46 and that stock B will...

The probabilities that stock A will rise in price is 0.46 and

that stock B will rise in price is 0.54. Further, if stock B rises

in price, the probability that stock A will also rise in price is

0.16.

a. What is the probability that at least one of

the stocks will rise in price? (Round your answer to 2

decimal places.)

b. Are events A and B mutually

exclusive?

Yes because P(A | B) =

P(A).

Yes because...

A stock price is currently $50. A stock price is currently $50. Over each of the...

A stock price is currently $50. A stock price is currently $50.

Over each of the next two three-month periods it is expected to go

up by 6% or down by 5%. The risk-free interest rate is 5% per annum

with continuous compounding. Use two-period binomial models to

value the six-month options on this stock. Remember to show

detailed calculations of the option value at each node.

(a) What is the value of a six-month European call option with a...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- MINIMUM MAIN.CPP CODE /******************************** * Week 4 lesson: * * finding the smallest number * *********************************/...

- Do you think President Eisenhower had a successful presidency?

- Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known...

- C PROGRAMMIMG I want to check if my 2 input is a number or not all...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

ADVERTISEMENT

jeff jeffy answered 3 years ago

jeff jeffy answered 3 years ago