Question

In: Finance

Banks sometimes quote interest rates in the form of “add-on interest.” In this case, if a...

Banks sometimes quote interest rates in the form of “add-on interest.” In this case, if a 1-year loan is quoted with an interest rate of 14.5% and you borrow $1,000, then you pay back $1,116. But you make these payments in monthly installments of $93 each.

a. What is the true APR on this loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Use a financial calculator or Excel.)

b. What is the effective annual rate on the loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Solutions

Expert Solution

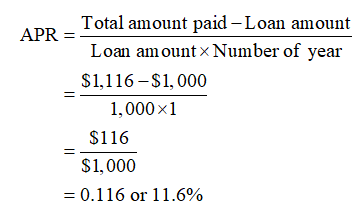

a.

The true APR on loan is calculated below:

b.

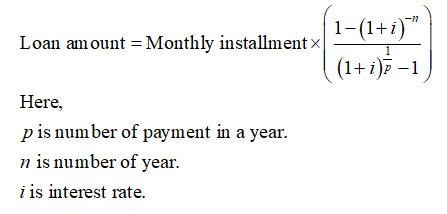

The below expression can be used to calculate effective annual rate:

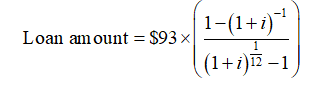

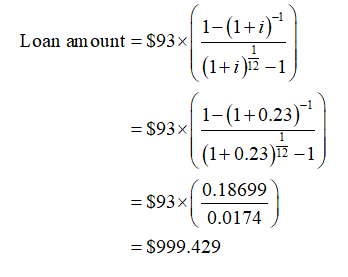

Substitute $93 for monthly payment, 1 for n and 12 for p,

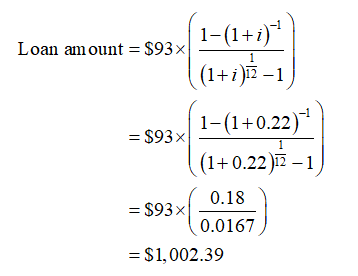

Try i = 22%, Calculate the loan amount and check if it is equal to $1,000.

Try i = 23%, Calculate the loan amount and check if it is equal to $1,000.

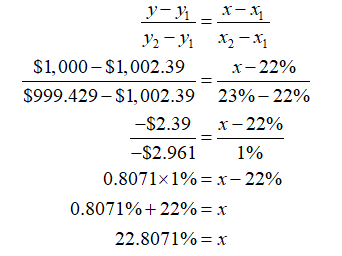

Interest rate should lies in between 22% and 23%.

Using interpolation, the effective annual interest rate is calculated below:

So, effective annual rate should be 22.8071%.

Related Solutions

Interest rates are important to financial institutions, like banks, since an increase in interest rates ________...

What is the commercial banks’ interest rates risk? ( 20 marks) Explain how the commercial banks...

1. Interest rates can fall to zero, but this does not mean that banks will be...

Why the simultaneous targeting of the money supply and interest rates is sometimes impossible to achieve?...

1. At the beginning of the COVID-19 pandemic, interest rates declined at the central banks but...

In focus on interest rate risk, can you explain why banks offer higher interest rates on...

How does adverse selection hurt banks? Why wouldn’t banks just charge higher interest rates for loans?...

In order to reduce the possibility of adverse selection, banks should raise the interest rates charged...

Required: Banks, credit card companies, and other lenders, state interest rates that are compounded with a...

Select any TWO (2) commercial banks in Malaysia. Based on the current interest rates offered by...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago