Question

In: Economics

The coronavirus is currently wreaking havoc on the world economy. There are many reasons for this,...

-

The coronavirus is currently wreaking havoc on the world economy. There are many reasons for this, so let’s simplify by focusing on just one. Suppose the primary effect of the coronavirus is to create “uncertainty”, which leads investors to increase their demand for “liquidity” (i.e., it increases the demand for money relative to other assets). Use the DD-AA model to show how this would affect the US economy. What happens to US output and the value of the dollar? US policymakers are currently debating whether to respond by cutting interest rate or increasing government spend- ing. Which of these policy responses would Canada favor? Which would China favor? (Hint: The Canadian dollar floats against the US dollar, whereas the RMB is pegged to the US dollar).

Solutions

Expert Solution

COVID-19 OR Corona virus is disrupting the economy. It reduces labour supply, prevents the globaly suppy of goods,reduces demaqnd for US goods and services. It increases volatility in the financial markets.

to its credit the Federal Reservevhas desperately cut its interest rates. A 30% crash in oil prices on recent days sent shockwaves through global financial markets already reeling from corona virus woes. The US dollar dropped half a percent against its international pees.A major corona virus epidemic in the US might be like a big sound that shuts down most economic activity and social interactions. The stock market volatility is driven by uncertainty.

DD-AA MODEL

IT CONSISTS OF THREE MARKET MODELS

1) FOREX market

2)Goods and Service market

3)Money market

AA curve represents asset market equilibrium derived from the money market and foreign exchange markets and DD curve representing goods market equilibrium.

It shows us to learn how changes in macroeconomic policy.

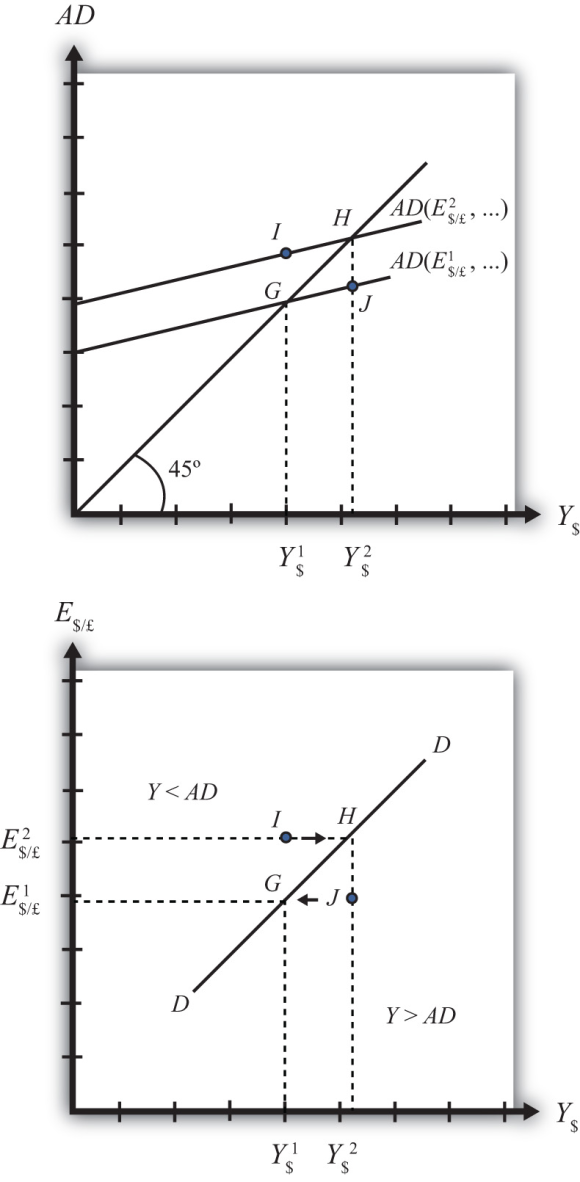

the AD function with exchange rate E$/ 1

INTERSECTS THE 450 line at point G which determines the equilibrium

level of GNP given by Y$1. E$/

1

INTERSECTS THE 450 line at point G which determines the equilibrium

level of GNP given by Y$1. E$/ rises

from E$/

rises

from E$/ 2

. A depreciation of the US dollar with respect to British pound.

Dollar depreciation foreign goods and service relatively more

expensive and domestic goods relatively cheaper. AD shifts up to

the point H. If the economy were at apont above the DD curve, I.

where AD is greater than aggregate supply(Y) and GNP ncreases. it

continue until economy reaches AD=Y AT POINT H. Now consider point

J right of the demand cuve.where Y less than AD. gnp falls it

continue until AD=Y. DD curve depicts the relationship between

changes in one EXOGENOUS VARIABLE like CORONA VIRUS abd one

ENDOGENOUS VARIABLE interset rate which is cut by the US GOVT. The

Exogenous variable assume to change is the EXCHANGE RATE. The

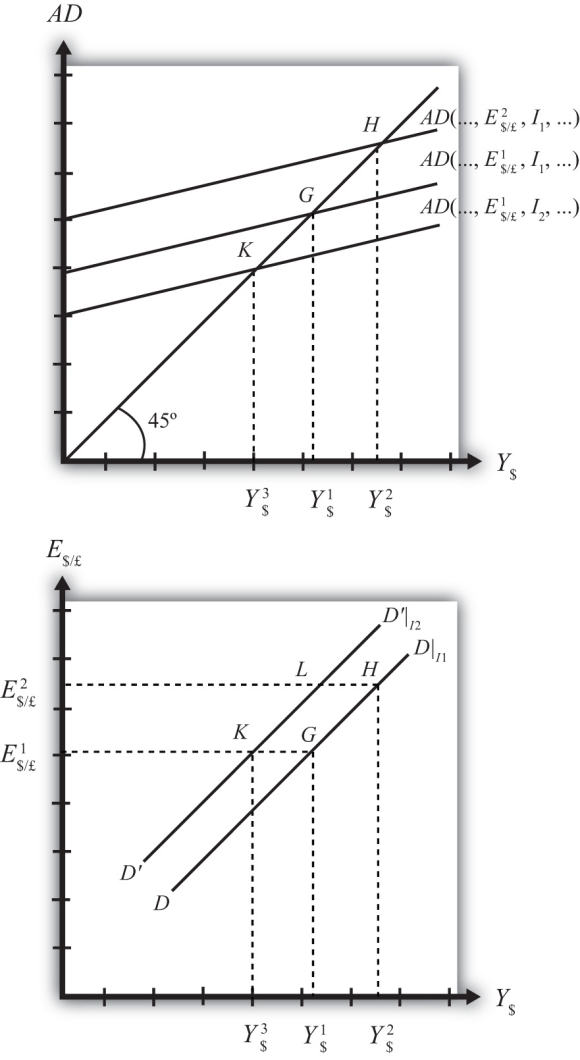

ENDOGENOUS variable affected is the GNP. FOR EXOGENOUS VARIABLE dd

curve shifts , INVESMENT DEMAND falls, shifts from I1 to I2.

2

. A depreciation of the US dollar with respect to British pound.

Dollar depreciation foreign goods and service relatively more

expensive and domestic goods relatively cheaper. AD shifts up to

the point H. If the economy were at apont above the DD curve, I.

where AD is greater than aggregate supply(Y) and GNP ncreases. it

continue until economy reaches AD=Y AT POINT H. Now consider point

J right of the demand cuve.where Y less than AD. gnp falls it

continue until AD=Y. DD curve depicts the relationship between

changes in one EXOGENOUS VARIABLE like CORONA VIRUS abd one

ENDOGENOUS VARIABLE interset rate which is cut by the US GOVT. The

Exogenous variable assume to change is the EXCHANGE RATE. The

ENDOGENOUS variable affected is the GNP. FOR EXOGENOUS VARIABLE dd

curve shifts , INVESMENT DEMAND falls, shifts from I1 to I2.

DD curve effects from an decrease in investment demand. change in any exogenous variable that reduces aggregate demand. decreases govt demand , increases tax, decreases tranfer payments.

Related Solutions

Public attitudes about the economy have turned bleak in much of the world as the coronavirus...

The Virus has been blamed for causing much economic havoc in the world and in the...

The Virus has been blamed for causing much economic havoc in the world and in the...

The economic impact of Coronavirus continues to destroy many economies in the world. Rising unemployment, loss...

Q3: The world are going through hard times due to coronavirus. Shops, restaurants, and many businesses...

The recent outbreak of novel coronavirus (COVID-19) has changed the world as we know it. Many...

After the Coronavirus affected the whole world, the grading system of Schrute University, like many universities,...

We all know that COVID-19 is wrecking havoc in the world today but recent debates on...

We all know that COVID-19 is wrecking havoc in the world today but recent debates on...

explain the 2019-2020 Economy of the US and/or World. Discuss issues such as: What is currently...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

Rahul Sunny answered 1 year ago

Rahul Sunny answered 1 year ago