Question

In: Finance

You are considering two investment options. In option A, you have to invest $4500 now and...

You are considering two investment options. In option A, you have to invest $4500 now and $1000 three years from now. In option B, you have to invest $3500 now, $1000 a year from now, and $1000 three years from now. In both options, you will receive four annual payments of $2000 each (you will get the first $2000 payment a year from now). Which of these two options would you choose based on AE criterion? Assume the interest rate is 10%.

Note: find the AE for both projects. Include the annual revenues in AE calculations. Show your calculations.

Solutions

Expert Solution

Solution :

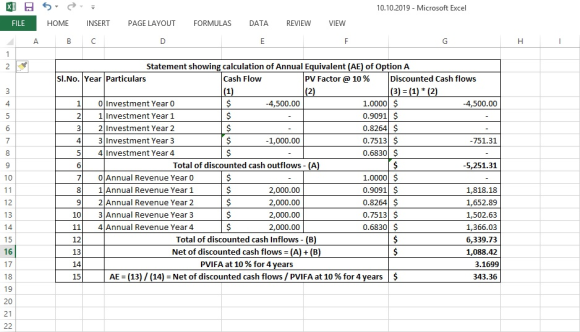

The Annual Equivalent of Option A = $ 343.36

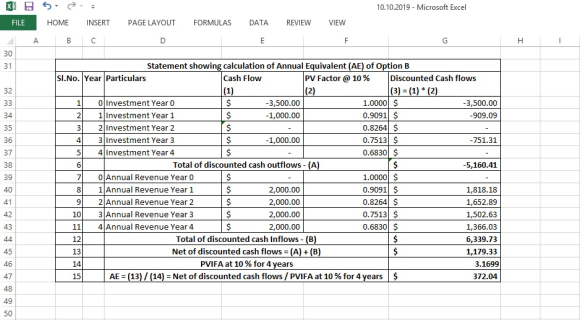

The Annual Equivalent of Option B = $ 372.04

Since the Annual Equivalent of Option B at $ 372.04 is higher, the Option B should be chosen.

Thus based on AE Criterion Option B should be chosen.

Please find the attached screenshots of the excel sheet containing the detailed calculation for the solution.

Related Solutions

You are considering two investment options. In option A, you have to invest $6,000 now and...

A company is considering two investment options: Option 1: An investment of $45,000 today, and another...

You are considering three investment options (and, of course, you could choose not to invest). You...

Katie has $220,000 to invest. there are three possible investment options: The first option is a...

You have plenty of cash to invest. You are considering an investment of $125,000 in a...

You are considering two options for a new digital printing machine. Option A will last you...

You are considering two lotery payment options: Option A pays $20000 today and option B pays...

Now that you have chosen your portfolio, the management is considering two alternative investment proposals. The...

(A) Pretend you are a private equity analyst with two investment options. Option (1) requires a...

You have just inherited $1,000,000 and are considering a number of investment options. Among the investment...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago