Question

In: Finance

Your task is to determine the WACC for a given firm using what you know about...

Your task is to determine the WACC for a given firm using what you know about WACC as well as data you can find through research. Your deliverable is a brief report in which you state your determination of WACC, describe and justify how you determined the number, and provide relevant information as to the sources of your data. Select a publicly traded company that has debt or bonds and common stock to calculate the current WACC. One good source for financial data for companies as well as data about their equity is Yahoo! Finance. By looking around this site, you should be able to find the market capitalization (E) as well as the β for any publicly traded company. There are not many places left where data about corporate bonds is still available. One of them is the Finra Bonds website. To find data for a particular company’s bonds, find the Quick Search feature, then be sure to specify corporate bonds and type in the name of the issuing company. This should give you a list of all of the company’s outstanding bond issues. Clicking on the symbol for a given bond issue will lead you to the current amount outstanding and the yield to maturity. You are interested in both. The total of all bonds outstanding is D in the above formula. If you like, you can use the YTM on a bond issue that is not callable as the pre-tax cost of debt for the company. Assumptions: As you recall, the formula for WACC is: rWACC = (E/E+D) rE + D/(E+D) rD (1-TC) The formula for the required return on a given equity investment is: ri= rf + βi * (RMkt-rf) RMkt-rf is the Market Risk Premium. For this project, you may assume the Market Risk Premium is 5% unless you can develop a better number. rf is the risk free rate. The risk free rate is normally the yield on US Treasury securities such as a 10-year treasury. For this assignment, please use 3.5%. You may assume a corporate tax rate of 40%. Use the company Johnson and Johnson

Solutions

Expert Solution

Formula for WACC:

rWACC = (E/E+D) rE + D/(E+D) rD (1-TC)

Formula for required return on equity:

ri= rf + βi * (RMkt-rf)

As per Yahoo!Finance:

Given Rf = 3.5% and market risk premium =5%

Hence, required rate of return = 3.5 + 0.68*5 = 6.9%

Market capitalization = 348981 million

Market price = 131.15

No.of shares (market cap/market price) = 348981/131.15 = 2660.93 million

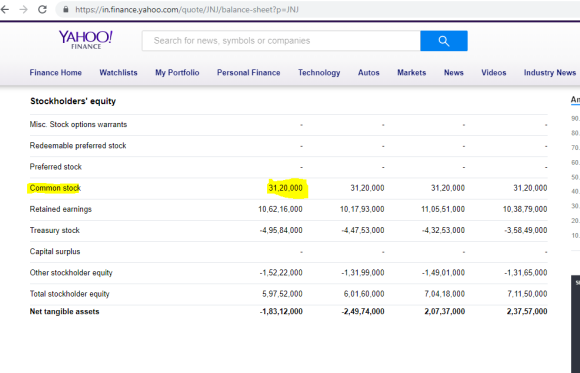

Book value of equity = 3120 million

As per below,

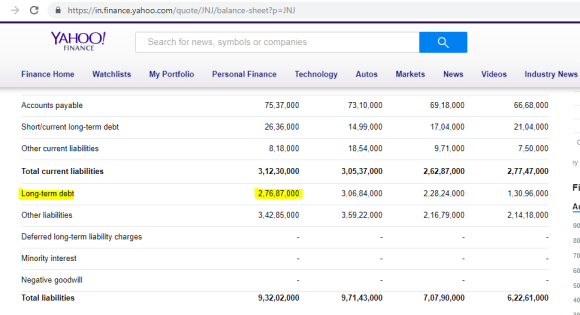

Book value of debt = 27687 million

Cost of debt = Interest expense /Long term debt = 1005/27687 = 3.63%

Post tax cost of debt = 3.63(1-.4) = 2.18%

*Couldn't find market weight of Long term Debt

Hence, we have made the calculations as per book value weights.

| Company Name: | Johnson & Johnson | ||

| Debt/Bonds | Common stock | Total | |

| Rate of return after tax | 2.18% | 6.900% | |

| Market Weights | 348981 million | ||

| Book value weights | 27687 million | 3120 million | 30807 |

| weight percentage | 0.90 | 0.10 | |

WACC = 2.18*0.9 + 6.9*.1 = 2.66% = ANSWER

Related Solutions

Your task is to determine the WACC for a given firm using what you know about WACC, as well as data you can find through research.

Your task is to determine the WACC for a given firm using what you know about WACC as well as data you can find through research

Determine the WACC for Nike Inc. using what you know about WACC as well as data...

He also wants to know the WACC and has given you the following information about your...

He also wants to know the WACC and has given you the following information about your...

Your task is to determine the WACC for a healthcare organization. Your deliverable is a brief...

You have been given the task of calculating the WACC of ABC Inc. You will use...

You have been given the task of calculating the WACC of ABC Inc. You will use...

1: Your first task is to determine whether your firm is in a competitive industry.

Using Java please You are given an array of integers arr. Your task is to count...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

jeff jeffy answered 2 years ago

jeff jeffy answered 2 years ago