Question

In: Accounting

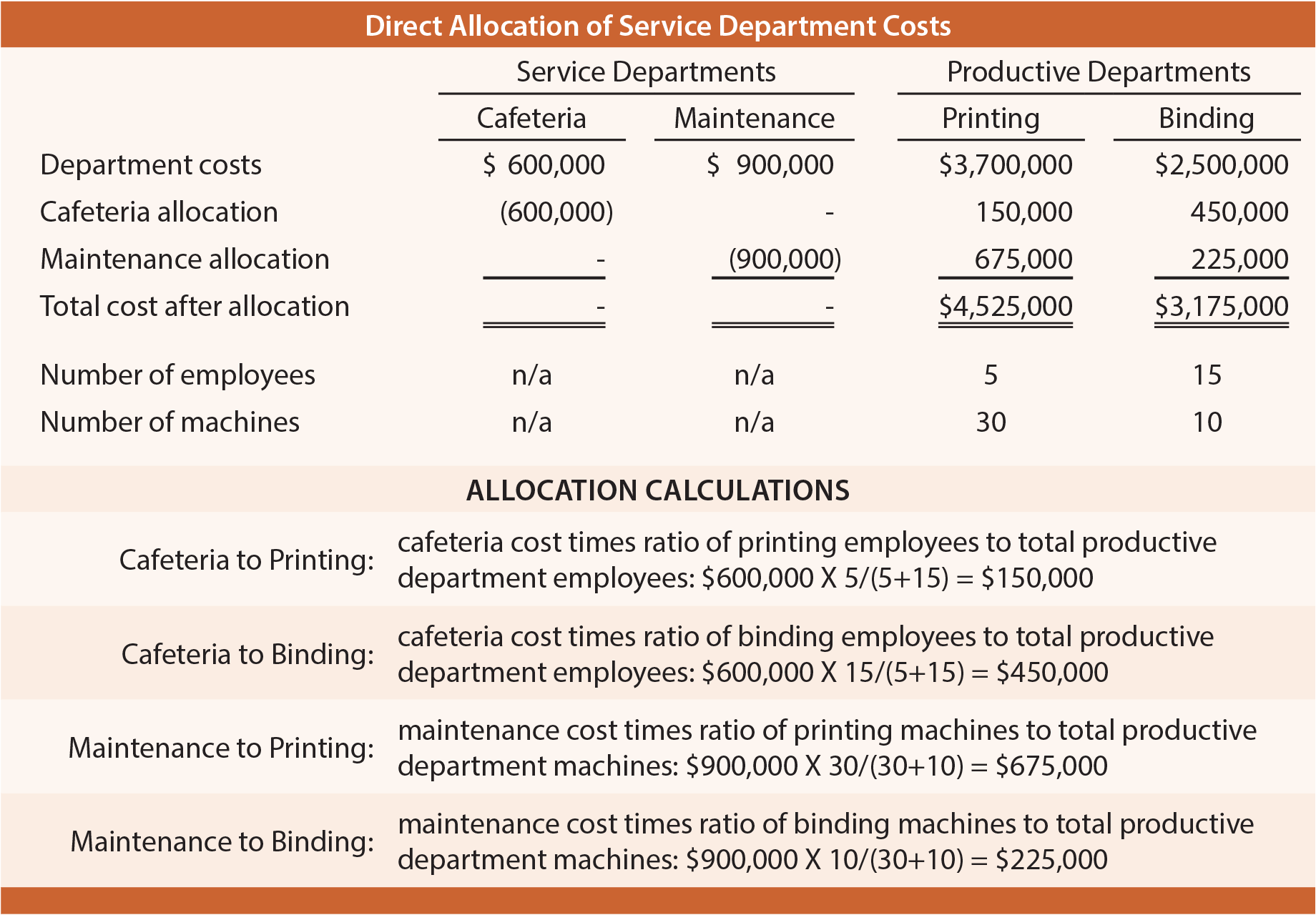

Service Department and Joint Cost Allocation. I need to create a spreadsheet that Allocates service department...

Service Department and Joint Cost Allocation.

I need to create a spreadsheet that Allocates service department costs using the direct method.

The use of any data will suffice.

Solutions

Related Solutions

GAAP requires the allocation of joint costs but does not require the allocation of service department...

GAAP requires the allocation of joint costs but does not require

the allocation of service department costs.

True or False

TrueFalse

Support Department and Joint Cost Allocation All firms have support or service departments to support production...

Support Department and Joint Cost Allocation

All firms have support or service departments to support

production activities. As addressed in earlier modules, those costs

must be allocated to product costs. Sometimes a single

manufacturing process produces an output that can then be further

manufactured into several other products. The costs of the initial

manufacturing process must be allocated to the subsequent

products.

Module 06: Critical Thinking Assignment

CRITICAL THINKING ASSIGNMENT

Complete the following three questions using Microsoft Excel. No

other...

Why does support department cost allocation matter to service businesses (such as colleges and universities)? Please...

Why does support department cost allocation matter to service

businesses (such as colleges and universities)? Please explain the

importance. Also, identify three businesses, companies, or

non-profit organizations that you think would use support

department cost allocation. Name the company and their

corresponding support departments.

Why does support department cost allocation matter to service businesses (such as colleges and universities)? Please...

Why does support department cost allocation matter to service

businesses (such as colleges and universities)? Please explain the

importance. Also, identify three businesses, companies, or

non-profit organizations that you think would use support

department cost allocation. Name the company and their

corresponding support departments.

Question 4: Service department cost allocation Inns Battery Company has two service departments: Maintenance and Personnel....

Question 4: Service department cost

allocation

Inns Battery Company has two service departments: Maintenance

and Personnel. Maintenance Department costs are allocated on the

basis of budgeted maintenance-hours. Personnel Department costs are

allocated based on the number of employees. Data on budgeted

maintenance-hours and number of employees are as follows:

Support Departments

Production Departments

Maintenance Department

Personnel Department

A

B

Budgeted costs

$180,000

$30,000

$80,000

$120,000

Budgeted maintenance-hours

n/a

240

720

240

Number of employees

20

n/a

60

120

Required:

4a....

1.) Pepper Department store allocates its service department expenses to its various operating (sales) departments. The...

1.) Pepper Department store allocates its service department

expenses to its various operating (sales) departments. The

following data is available for its service departments:

Expense

Basis

for allocation

Amount

Rent

Square feet of floor space

$31,000

Advertising

Amount of dollar sales

$44,000

Administrative

Number of employees

$66,000

The following information is available for its three operating

(sales) departments:

Department

Square

Feet

Dollar

Sales

Number

of

employees

A

3,700

$301,000

13

B

4,100

$321,000

15

C

4,300

$448,000...

Solexx Corporation allocates its service department overhead costs to producing departments. This information is for the...

Solexx Corporation allocates its service department overhead

costs to producing departments. This information is for the month

of June:

Service Departments

Maintenance

Utilities

Overhead costs incurred

$

486,000

$

657,000

Service provided to departments

Maintenance

—

5

%

Utilities

10

%

—

Producing—A

20

40

Producing—B

70

55

Totals

100

%

100

%

Required:

What is the amount of maintenance and utilities department costs

distributed to producing departments A and B for June using (1) the

direct method, (2) the...

I need to create an online service displaying latest Kp index. Where I can take the...

I need to create an online

service displaying latest Kp index.

Where I can take the data?

The data should be in machine-readable format, i.e. text files,

XML, or CGI gateways, for instance. No graphical plots!

I found this:

http://www.swpc.noaa.gov/wingkp/wingkp_list.txt

Is Est. Kp what I need? I compared the data with plots covering

several last days and found that kp values in this file are lower

that on the charts.

The best method of joint cost allocation is the physical units method because it recognizes the...

The best method of joint cost allocation is the physical units

method because it recognizes the relative value of each product

produced.

True

False

Solexx Corporation allocates its service department overhead costs to producing departments. This information is for the month of Ju

Solexx Corporation allocates its service department overhead costs to producing departments. This information is for the month of June:

Service Departments Maintenance Utilities Overhead costs incurred $513,000 $ 708,000

Service provided to departments Maintenance 5% Utilities 10% Producing-A 20 40 Producing-B 70 55 Totals 100% 100%

Required: What is the amount of maintenance and utilities department costs distributed to producing departments A and B for June using (1) the direct method, (2) the step method (maintenance department first), and (3)...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

ADVERTISEMENT

ekkarill92 answered 2 years ago

ekkarill92 answered 2 years ago