Question

In: Statistics and Probability

Koshu Corporation

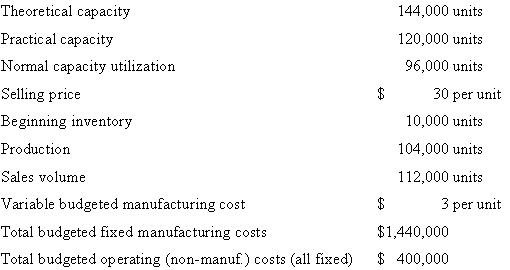

Denominator-level choices, changes in inventory levels, effect on operating income. Koshu Corporation is a manufacturer of computer accessories. It uses absorption costing based on standard costs and reports the following data for 2009:

There are no price spending, or efficiency variances. Actual operating costs equal budgeted operating costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator level, the budgeted production cost per unit is also the cost per unit of beginning inventory..

1. What is the production-volume variance in 2009 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization?

2. Prepare absorption costing—based income statements for Koshu Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels.

3. Why is the operating income under normal capacity utilization lower than the other two scenarios?

4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with the difference in fixed manufacturing overhead included in inventory.

Solutions

Expert Solution

Denominator-level choices, changes in inventory levels, effect on operating income.

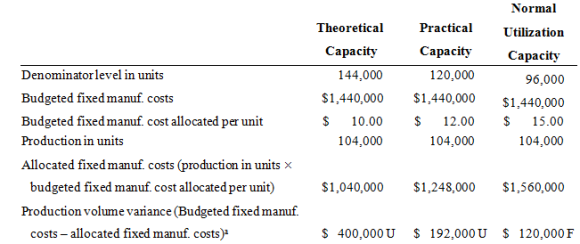

1.

aPVV is unfavorable if budgeted fixed manuf. costs are greater than allocated fixed costs

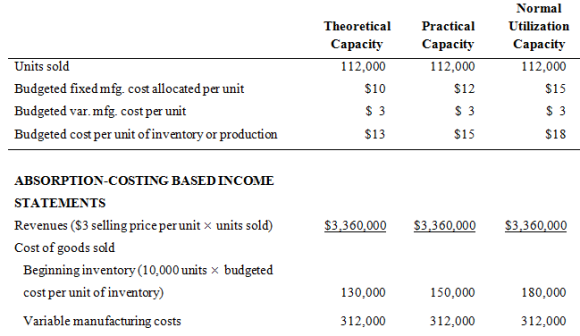

2.

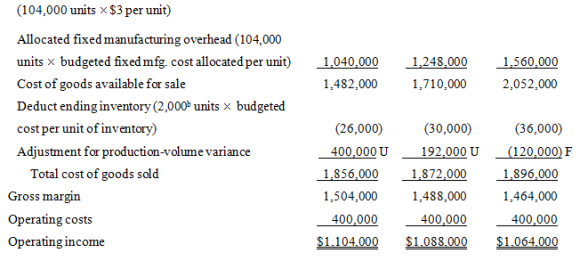

bEnding inventory = Beginning inventory + production – sales = 10,000 + 104,000 – 112,000 = 2,000 units

2,000 x $13; 2,000 x $15; 2,000 x $18

3.

Koshu’s 2009 beginning inventory was 10,000 units; its ending inventory was 2,000 units. So, during 2009, there was a drop of 8,000 units in inventory levels (matching the 8,000 more units sold than produced). The smaller the denominator level, the larger is the budgeted fixed cost allocated to each unit of production, and, when those units are sold (all the current production is sold, and then some), the larger is the cost of each unit sold, and the smaller is the operating income. Normal utilization capacity is the smallest capacity of the three, hence in this year, when production was less than sales, the absorption-costing based operating income is the smallest when normal capacity utilization is used as the denominator level.

4.

|

Reconciliation |

|||

|

Theoretical Capacity Operating Income – Practical Capacity Operating Income |

$16,000 |

||

|

Decrease in inventory level during 2009 |

8,000 |

||

|

Fixed mfg cost allocated per unit under practical capacity – fixed mfg. cost allocated per unit under theoretical capacity ($12 – $10) |

$2 |

||

|

Additional allocated fixed cost included in COGS under practical capacity = 8,000 units × $2 per unit = |

$16,000 |

||

More fixed manufacturing costs are included in inventory under practical capacity, so, when inventory level decreases (as it did in 2009), more fixed manufacturing costs are included in COGS under practical capacity than under theoretical capacity, resulting in a lower operating income.

More fixed manufacturing costs are included in inventory under practical capacity, so, when inventory level decreases (as it did in 2009), more fixed manufacturing costs are included in COGS under practical capacity than under theoretical capacity, resulting in a lower operating income.

Related Solutions

Portsmouth Corporation, a British corporation, is a wholly owned subsidiary of Salem Corporation, a U.S. corporation....

9) Padhy Corporation owns 80% of Abrams Corporation, Abrams Corporation owns 60% of Bacud Corporation, and...

KDHK Corporation ( A “C” Corporation) KDHK is a private, not for profit, corporation that owns...

35.Wayne Corporation owns 80% of Marple Corporation. Wayne Corporation also owns 45% of Tiger Corporation and...

In the documentary “The Corporation”, the standard metaphor for a corporation is that of an apple...

Hastings Corporation is interested in acquiring Vandell Corporation. Hastings Corporation estimates that if it acquires Vandell...

Which corporation is eligible to make the S election? A- Foreign corporation. B- A one-shareholder corporation....

Consider a C corporation. The corporation earns $5 per sharebefore taxes. After the corporation has...

Alpha Corporation and Beta Corporation are identical in every way except their capital structures. Alpha Corporation,...

U Corporation is considering the acquisition of E Corporation. E Corporation has 1,020,000 shares of stock,...

- 1. A corporation has 71,376 shares of $24 par stock outstanding that has a current market...

- Agatha Agate Inc. began business on January 1, 2013. At December 31, 2013, it had a...

- what determines when it is a good time for a company to raise or lower the...

- An inorganic soil has a liquid limit of 35 and a plastic limit of 31. The...

- Write a C program which adds up all the numbers between 1 and 50. Use any...

- Write a JavaScript program to implement the Least-Squares Linear Regression algorithm shown below, for an arbitrary...

- Discuss different steps and approaches involved in estimating time? Please explain in brief the different steps...

Raffay answered 3 years ago

Raffay answered 3 years ago