Question

In: Accounting

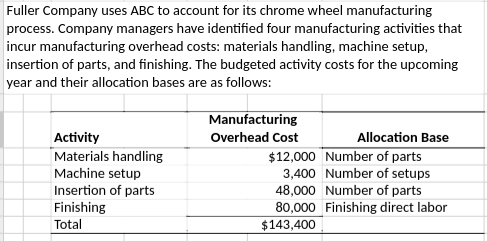

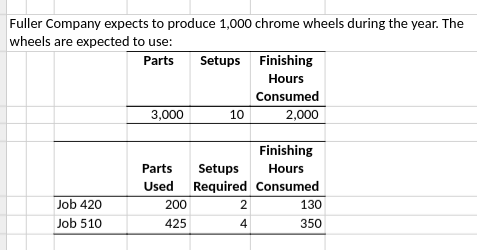

fuller company uses abc to account for its chrome wheel manufacturing process

Solutions

Expert Solution

Requirement 1: Compute cost allocation rate for each activity

Formula: \( \frac{\texttt{Manufacturing overheads}}{\texttt{Allocation base}} \)

| Manufacturing Overheads | Allocation Base | Activity Cost Allocation Rate | |||

| Material handling | $12,000 | 3000 | parts | $4 | per part |

| Machine Setups | $3,400 | 10 | setups | $340 | per setup |

| Insertion of Parts | $48,000 | 3000 | parts | $16 | per part |

| Finishing | $80,000 | 2000 | direct labor hours | $40 | per hour |

| Total | $143,400.00 | ||||

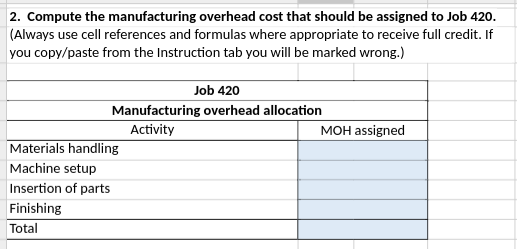

Requirement 2:

Formula:\( {\texttt{Activity cost allocation rate}}\times {\texttt{Allocation base}} \)

| Requirement 2: Compute manufacturing overhead cost for the JOB 420 | |||||

| Activity | Activity Cost Allocation Rate | Allocation base | MOH Assigned | ||

| Material handling | $4 | per part | 200 | Parts | $800 |

| Machine Setups | $340 | per setup | 2 | Setups | $680 |

| Insertion of Parts | $16 | per part | 200 | Parts | $3,200 |

| Finishing | $40 | per hour | 130 | direct labor hours | $5,200 |

|

Total |

$9,880 | ||||

|

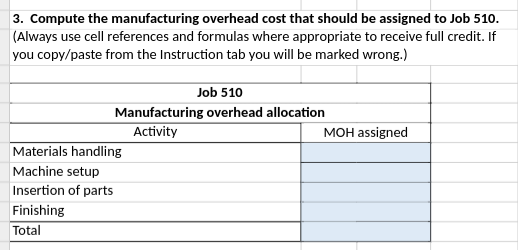

Requirement 3: Formula:\( {\texttt{Activity cost allocation rate}}\times {\texttt{Allocation base}} \)

Compute manufacturing overhead cost for the JOB 510 |

|||||

| Activity Cost Allocation Rate | Allocation base | MOH Assigned | |||

| Material handling | $4 | per part | 425 | Parts | $1,700 |

| Machine Setups | $340 | per setup | 4 | Setups | $1,360 |

| Insertion of Parts | $16 | per part | 425 | Parts | $6,800 |

| Finishing | $40 | per hour | 350 | direct labor hours | $14,000 |

| Total | $23,860 | ||||

1. Cost allocation rate for each activity is calculated.

2. Manufacturing overhead cost assigned to the JOB 420 is $9880

3. Manufacturing overhead cost assigned to the JOB 420 is $23860

Related Solutions

East Horizon uses ABC to account for its chrome wheel manufacturing process. Company managers have identified...

East Horizon uses ABC to account for its chrome wheel

manufacturing process. Company managers have identified four

manufacturing activities that incur manufacturing overhead costs:

materials handling, machine setup, insertion of parts, and

finishing. The budgeted activity costs for the upcoming year and

their allocation bases are as follows:

Total Budgeted

Manufacturing

Activity

Overhead Cost

Allocation Base

Materials handling. . . .

$8,700

Number of parts

Machine setup. . . . . . .

4,650

Number of setups

Insertion of parts....

6/ The Work in Process Inventory account of a manufacturing company that uses an overhead rate...

6/ The Work in Process Inventory account of a manufacturing

company that uses an overhead rate based on direct labor cost has a

$4,050 debit balance after all posting is completed. The cost sheet

of the one job still in process shows direct material cost of

$1,910 and direct labor cost of $730. Therefore, the amount of the

applied overhead is:

Multiple Choice

$2,140.

$2,640.

$1,410.

$730.

$3,320.

7/ Adams Manufacturing

allocates overhead to production on the basis of direct...

The work in process inventory account of a manufacturing company that uses and overhead rate based...

The work in process inventory account of a manufacturing company

that uses and overhead rate based on direct labor cost has a $9,873

debit balance after all posting is completed. The cost sheet of the

one job still in process shows direct material cost of $3,300 and

direct labor cost of $2,100. Therefore, the company's overhead

application rate is:

A. 64% of direct labor cost

B. 136% of direct labor cost

c. 157% of direct labor cost

D. 213% of...

ZETA Ltd is a manufacturing company that uses material QUEE in its manufacturing process. On an...

ZETA Ltd is a manufacturing company that uses material QUEE in

its manufacturing process. On an annual basis, ZETA Ltd uses

127,690 units of material QUEE in production. The material is

bought form a wide range of suppliers at an average price of K38

per unit. Because supply for material QUEE is uncertain, ZETA Ltd

maintains safety inventory that is sufficient to satisfy usage for

12 days. The material is consumed at an even rate and the cost of

placing...

Fuller Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory...

Fuller Corporation uses the weighted-average method in its

process costing system. This month, the beginning inventory in the

first processing department consisted of 700 units. The costs and

percentage completion of these units in beginning inventory

were:

Cost

Percent

Complete

Materials costs

$

12,700

85%

Conversion

costs

$

10,900

30%

A total of 9,800 units were started and 8,800 units were

transferred to the second processing department during the month.

The following costs were incurred in the first processing

department...

A manufacturing company for car batteries uses lead in its manufacturing process. Workers are encouraged to...

A manufacturing company for car

batteries uses lead in its manufacturing process. Workers are

encouraged to shower, shampoo, and change

clothes before going home to eliminate the transfer of lead to

their children, but there is still concern that children are being

exposed by their parents. A study is carried out to determine

whether workers carry lead dust home. 33 of the workers children

were selected as subjects, and a blood tests for each child

determines the level of...

SCS Co. uses activity-based costing in their manufacturing process. The company produces two products, ABC and...

SCS Co. uses activity-based costing in their manufacturing

process. The company produces two products, ABC and XYZ. SCS has

provided their costing department the following information from

this year’s budget relating to the production of these two

products:

ABC

XYZ

Units to be produced

4,000

6,000

Machine-hours expected

100

200

Direct labor-hours expected

200

300

Materials handling (number of moves)

60

70

Machine setups (number of setups)

20

15

The following costs are expected to be incurred throughout the

year,...

Jackson Ltd. uses an automated process in its manufacturing operations. On September 1, the company had...

Jackson Ltd. uses an automated process in its manufacturing

operations. On September 1, the company had 15,000 units in

beginning work in process which were 60% complete with respect to

conversion. During the month of September, it started 100,000 into

production. On September 30, there were 20,000 units in process,

which were 30% complete with respect to conversion.

Direct materials are added at the beginning of the process, and

no units are spoiled in production. The beginning inventory had

direct...

Champion Manufacturing Company uses the FIFO method in its process costing system. The records of Champion...

Champion Manufacturing Company uses the FIFO

method in its process costing system. The records of

Champion Manufacturing Company for the month of May show the

following costs in Department A:

Beginning Inventory $ 80,500

Direct Materials 270,000

Direct Labor 357,000

Overhead (150% of Direct Labor Cost) 535,500

Total $1,243,000

The beginning inventory for May consisted of 10,000 units which

were 80% complete as to direct materials and 60% complete as to

labor and overhead. A total of 100,000 units was...

ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC charges...

ABC Company uses a Materials Inventory account to record both

direct and indirect materials. ABC charges direct materials to WIP,

while indirect materials are charged to the Factory Overhead

account. During the month of April, the company has the following

cost information:

Total materials (direct and indirect) purchased

$

90,000

Indirect materials issued to production

30,000

Total materials issued to production

110,000

Beginning materials inventory

50,000

The debit to the Factory Overhead account is:

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

ADVERTISEMENT

Navya Chandra answered 5 years ago

Navya Chandra answered 5 years ago