Question

In: Accounting

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $68,300. Meg works part time at the same university. She earns $33,300 a year. The couple does not itemize deductions. Other than salary, the Comers’ only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules,Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount.)

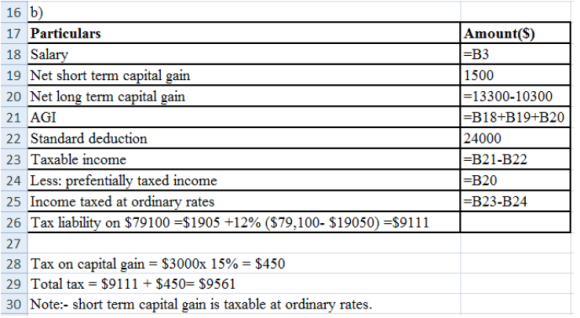

b. What is the Comers’ tax liability for 2020

if they report the following capital gains and losses for the

year?

| Short-term capital gains | $ | 1,500 | |

| Short-term capital losses | 0 | ||

| Long-term capital gains | 13,300 | ||

| Long-term capital losses | (10,300 | ) | |

Total tax liability: ???

I found $9,301, but that is not the correct answer apparently.

Solutions

Expert Solution

ANSWER

WORKING

================

DEAR STUDENT,

IF YOU HAVE ANY QUERY PLEASE ASK ME IN THE COMMENT BOX,I AM HERE TO HELP YOU.PLEASE GIVE ME POSITIVE RATING..

****************THANK YOU****************

Related Solutions

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have...

Matt and Meg Comer are married and file a joint tax return. They do not have...

1. Matt and Meg Comer are married and file a joint tax return. They do not...

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago