Question

In: Finance

Use the following information for the next 2 questions: Grasshopper Inc. is considering a 5-year project...

Use the following information for the next 2 questions:

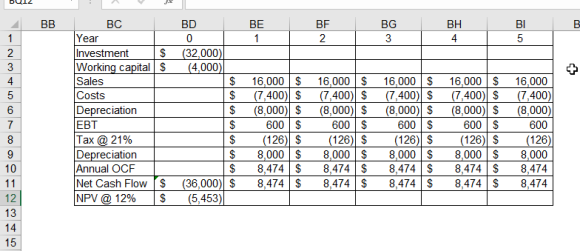

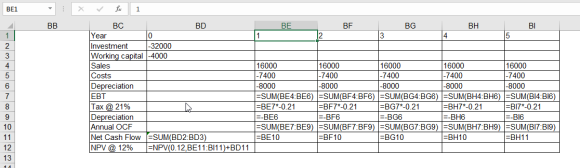

Grasshopper Inc. is considering a 5-year project amid the pandemic shutdown. They need to buy a new IT system for $32,000. The new system also requires an increase in net working capital of $4,000.

Grasshopper expects $16,000 in sales and $7,400 annual operating expenses. Annual depreciation is $8,000.

If the firm's tax rate is 21% and its cost of capital is 12%,

59) How much is their annual OCF?

Question 59 options:

|

$8,474 |

|

|

$600 |

|

|

$8,599 |

|

|

$5,277 |

What is the NPV of this project assuming the same CF for 5 years?

Question 60 options:

A) 2,547

B)-5,453

C)-1,453

D)1,423

Solutions

Expert Solution

59) How much is their annual OCF?

$8474 Option A

60. What is the NPV of this project assuming the same CF for 5 years?

-$5453 Option B

Please dont forget to upvote

Related Solutions

Use the following information to answer the next 5 questions. Your corporation is considering investing in...

Questions 4-8 USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (5) QUESTIONS: Pitchfork, Inc. sold merchandise...

USE THE FOLLOWING INFORMATION FOR THE NEXT 2 INDEPENDENT QUESTIONS: Tremaine Inc. has three product...

USE THE FOLLOWING INFORMATION FOR THE NEXT 2 QUESTIONS Cornell Products has the following information available...

Use the following information for the next two questions. You are creating a cash flow project...

Use the following information for the next four questions: Question 16: The Umbrella Corporation is considering...

Use the following information to answer the next four questions. Carson Co. is considering buying a...

Use the following information to answer the next 5 questions The following balances were taken from...

USE THE FOLLOWING INFORMATION FOR THE NEXT 3 QUESTIONS Pearson Inc. produces and sells a variety...

Use the information in the table above for the following 5 questions. A capital investment project...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

jeff jeffy answered 3 years ago

jeff jeffy answered 3 years ago