Question

In: Finance

An Australian multinational company is planning a project in the UK. The costs and expected cash...

An Australian multinational company is planning a project in the UK. The costs and expected cash flows for the project are as follows:

Project 1:

|

Year 0 |

Year 1 |

Year 2 |

Year 3 |

|

−£8,000,000 |

£2,440,000 |

£3,335,000 |

£3,590,000 |

Exchange rate:

|

Year 0 |

Year 1 |

Year 2 |

Year 3 |

|

A$1.9550/£ |

A$1.8502/£ |

A$2.0251/£ |

A$2.2004/£ |

The company uses a discount rate of 10% for all projects. Is the project acceptable for cash flows assessed in Australian Dollar (A$)? Also, determine payback period of the project for cash flows converted to Australian Dollar (A$).

Solutions

Expert Solution

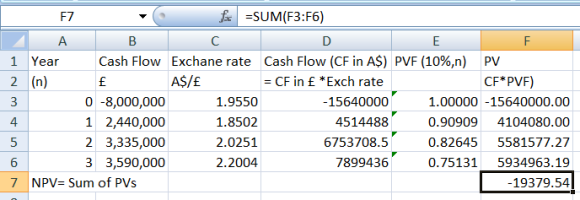

NPV is -A$19,379.54 (negative) when cash flows are assessed in Australian Dollar. Since NPV is negative, the project is not acceptable.

Details of calculation as follows:

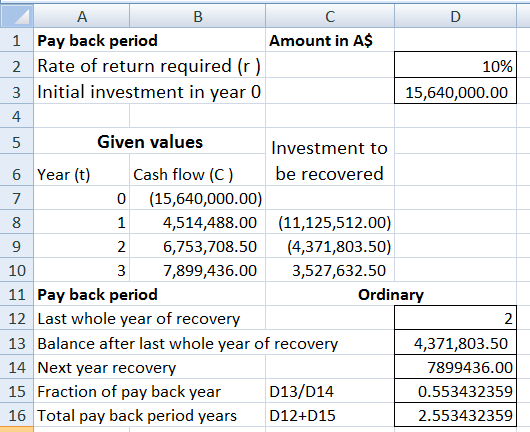

Pay back period (ordinary) for cash flows converted to Australian Dollar= 2.55 years. Calculation as follows:

Related Solutions

Assume an expected appreciation of the Australian currency. Take the perspective of an Australian multinational corporation...

A company is considering a project that costs $150,000 and is expected to generate cash flows...

ABC, Inc is planning the purchase of new equipment that costs $149,331. The project is expected...

ABC, Inc is planning the purchase of new equipment that costs $149,331. The project is expected...

4. A project with fixed costs of 320,000 and operating cash flow of 160,000 was expected...

Perth International Co., an Australian multinational company, forecasts 66 million Australian dollars (A$) earnings next year...

1. Perth International Co., an Australian multinational company, forecasts 69 million Australian dollars (A$) earnings next...

1. Perth International Co., an Australian multinational company, forecasts 66 million Australian dollars (A$) earnings next...

Perth International Co., an Australian multinational company, forecasts 66 million Australian dollars (A$) earnings next year...

Q1. Perth International Co., an Australian multinational company, forecasts 68 million Australian dollars (A$) earnings next...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

jeff jeffy answered 3 years ago

jeff jeffy answered 3 years ago