Question

In: Economics

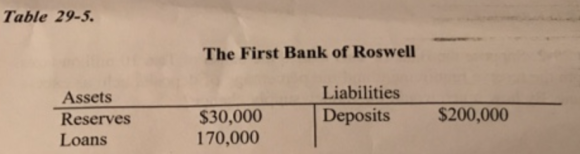

Refer to Table 29-5. If the bank faces a reserve requirement of 6 percent, then the bank

8. Refer to Table 29-5. If the bank faces a reserve requirement of 6 percent, then the bank

- a. is in a position to make a new loan of $12,000.

- b is in a position to make a new loan of $18,000

- c. has excess reserves of $12,000.

- d. None of the above is correct.

9. Refer to Table 29-5. If the bank faces a reserve requirement of 8 percent, then the bank

- a. is in a position to make a new loan of \(\$ 14,000\).

- b. has fewer reserves than are required.

- c. has excess reserves of \(\$ 16,400\).

- d. None of the above is correct.

10. Refer to Table 29-5. Suppose the bank faces a reserve requirement of 10 percent. Starting from the situation as depicted by the T-account, a customer deposits an additional \(\$ 60,000\) into his account at the bank. If the bank takes no other action it will

- a. have \(\$ 64,000\) in excess reserves.

- b. have \(\$ 4,000\) in excess reserves.

- c. be in a position to make new loans equal to \(\$ 6,000\)

- d. None of the above is correct.

Solutions

Expert Solution

8.

Reserve requirement = 200,000 * 0.06 = $12,000

Excess reserve = Actual reserve - reserve requirement

= 30,000 - 12,000

= $18,000

Thus, the bank can make a new loan of the excess reserve amount, i.e., $18,000.

9.

Reserve requirement = 200,000 * 0.08 = $16,000

Excess reserve = $30000 - 16,000 = $14,000

Thus, the bank can make a new loan of $14,000.

10.

Now Actual reserve = 30,000 + 60,000 = 90,000

Reserve requirement = (200,000 + 60,000) * 0.10 = 26,000

Excess reserve = 90,000 - 26,000 = 64,000

8. Ans: is in a position to make a new loan of $18,000.

9. Ans: is in a position to make a new loan of $14,000.

10. Ans: have $64,000 in excess reserve.

Related Solutions

15. If a bank faces a reserve requirement of 8 percent and has a reserve ratio...

If the reserve requirement is 5 percent, a bank desires to hold no excess reserves, and...

Assume that $1.4 million is deposited into a bank with a reserve requirement of 15 percent....

5. Assume that the reserve requirement is 5 percent. All other things being equal: Will the...

Suppose that the Central Bank decided to increase percent of Reserve Requirement Ratio (RRR) from 10%...

1). Suppose everything else equal; a) the Central Bank raises the reserve requirement to 20 percent,...

The T-Account for a Bank is given below. The reserve requirement is 5%. Assets Liabilities $100,000...

#29 If the legal reserve requirement is 10% and the marginal propensity to consume is 80%,...

1. Bangladesh Bank increased the Cash Reserve Requirement (CRR) from 5.5% to 6% on December 15,...

Suppose a bank has $1 million in deposits, a reserve requirement of 10%, and bank reserves...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

Dr. OWL answered 5 years ago

Dr. OWL answered 5 years ago