Question

In: Accounting

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company’s balance sheet as of June 30th is shown below:

| Beech Corporation Balance Sheet June 30 |

|

| Assets | |

| Cash | $ 90,000 |

| Accounts receivable | 136,000 |

| Inventory | 62,000 |

| Plant and equipment, net of depreciation | 210,000 |

| Total assets | $ 498,000 |

| Liabilities and Stockholders’ Equity | |

| Accounts payable | $ 71,100 |

| Common stock | 327,000 |

| Retained earnings | 99,900 |

| Total liabilities and stockholders’ equity | $ 498,000 |

Beech’s managers have made the following additional assumptions and estimates:

1. Estimated sales for July, August, September, and October will be $210,000, $230,000, $220,000, and $240,000, respectively.

2. All sales are on credit and all credit sales are collected. Each month’s credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the accounts receivable at June 30 will be collected in July.

3. Each month’s ending inventory must equal 30% of the cost of next month’s sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July.

4. Monthly selling and administrative expenses are always $60,000. Each month $5,000 of this total amount is depreciation expense and the remaining $55,000 relates to expenses that are paid in the month they are incurred.

5. The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30. The company does not plan to issue any common stock or repurchase its own stock during the quarter ended September 30.

| (1) CASH COLLECTIONS SCHEDULE | ||||

| July | August | Sept | quarter | |

| From acc Receivable | ||||

| From July sales | ||||

| From august sales | ||||

| from Sept sales | ||||

| Total Monthly Cash Collection | ||||

| (2) MERCHANDIZE PURCHASE SCHEDULE | ||||

| July | August | Sept | quarter | |

| Budgeted COGS | ||||

| Desired ending Inv | ||||

| Total needs | ||||

| Beginning Inventory (Less) | ||||

| Required Purchases | ||||

| (2-b) MERCHANDIZE PAYMENT SCHEDULE | ||||

| July | August | Sept | quarter | |

| From account payable | ||||

| From July purchases | ||||

| From August purchases | ||||

| From Sept purchases | ||||

| Total cash disbursment | ||||

| (3) INCOME STATEMENT | ||||

| July | August | Sept | TOTAL | |

| Estimated Sales | ||||

| Less: COGS | ||||

| Gross Profit | ||||

| Less | ||||

| Net Profit | ||||

4) Prepare Balance sheet as of Sept 30:

Solutions

Expert Solution

Concepts and reason

Budgeting: It is establishing future financial goals for a business entity and creating plans to achieve the goals. It includes forecasting and preparing budgets for different business activities to be performed by an organization during a future period. Budget: It is a written plan of business activity to be executed in the future and expressed in quantitative terms. A business entity prepares a budget for almost all the activities. Therefore, several budgets are prepared for a period. Financial Statements: Financial statements are the reports prepared by the entity to present the entity's financial information. There are four financial statements prepared: the income statement, balance sheet, statement of changes in equity, and cash flow statement. Financial statements provide information about the financial position of the company to internal and external users. Following are the financial statements that the businesses need to prepare:

- Statement of income/loss

- Statement of change in equity

- Balance sheet/Statement of financial position

- Statement of cash flows

An income statement is also known as the statement of profit and loss or statement of earnings. The income statement reports a company's revenues and expenses. It reports the result of a company for a period in terms of profit or loss. Statement of changes in equity reports the total changes in shareholders' equity during a period of time. Shareholder's equity primarily includes share capital and retained earnings. A statement of financial position reports, assets, liabilities, and shareholders' equity. It is commonly known as a balance sheet. The balance sheet satisfies the accounting equation, that is:

Assets \(=\) Liabilities \(+\) Shareholders' Equity

It is known as the balance sheet as it balances the accounting equation. Statement of Cash flow: A cash flow statement reports the cash flows in a business, that is, the cash receipts and cash payment of a business for a specific period. The cash flow statement reflects the effect of various operating, investing, and financing activities on the cash and cash equivalents. Accounting Cycle: Accounting begins when a transaction takes place and ends when the transaction is recorded in the books of accounts. This process keeps on repeating itself and is therefore known as the accounting cycle. The accounting cycle is as follows:

- The first step in the accounting cycle is identifying the transactions that have occurred.

- The second step is a recording of transactions using journal entries.

- The next step is posting the journal entries to the respective ledger accounts.

This process of identifying, recording, and posting are performed throughout the accounting process. Further steps in the accounting cycle are performed at the end of the accounting period. The next steps are as follows:

- Preparation of unadjusted trial balance to confirm that the total debits are equal to the total credits.

- Recording adjusting journal entries.

- Preparation of adjusting journal entries and posting them to the ledger accounts

- Preparing the adjusted trial balance

- Preparation of financial statements, income statement, statement of changes in equity, balance sheet, and cash flow statement.

Fundamentals

Cash collected during a month is the sum of the amount received from account receivables and cash sales during a month, cash collected by sales in the current month, and previous months. Payment Schedule is a statement of amounts to be paid based on purchases made in the current month and during previous months.

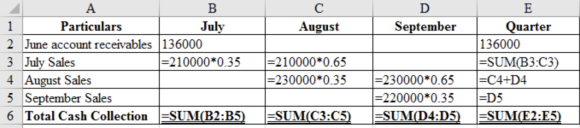

Prepare schedule for cash collections as follows:

$$ \begin{array}{|l|r|r|r|r|} \hline {\text { Particulars }} & \text { July } & \text { August } & \text { September } & \text { Quarter } \\ \hline \text { June account receivables } & \$ 136,000 & & & \$ 136,000 \\ \hline \text { July Sales } & \$ 73,500 & \$ 136,500 & & \$ 210,000 \\ \hline \text { August Sales } & & \$ 80,500 & \$ 149,500 & \$ 230,000 \\ \hline \text { September Sales } & & & \$ 77,000 & \$ 77,000 \\ \hline \text { Total Cash Collection } & \$ 209,500 & \$ 217,000 & \underline{\$ 226,500} & \underline{\$ 653,000} \\ \hline \end{array} $$

Formulas for the above are as follows:

Part 1

$$ \begin{array}{|l|r|r|r|r|} \hline {\text { Particulars }} & \text { July } & \text { August } & \text { September } & \text { Quarter } \\ \hline \text { June account receivables } & \$ 136,000 & & & \$ 136,000 \\ \hline \text { July Sales } & \$ 73,500 & \$ 136,500 & & \$ 210,000 \\ \hline \text { August Sales } & & \$ 80,500 & \$ 149,500 & \$ 230,000 \\ \hline \text { September Sales } & & & \$ 77,000 & \$ 77,000 \\ \hline \text { Total Cash Collection } & \$ 209,500 & \$ 217,000 & \underline{\$ 226,500} & \underline{\$ 653,000} \\ \hline \end{array} $$

All sales are credit sales and the sales are collected \(35 \%\) in the month of sale and \(65 \%\) in the month following the sale. Thus, the sales in the month of June are collected @ \(35 \%\) in June itself and \(65 \%\) are collected in July. In the same way, August and September sales are also collected.

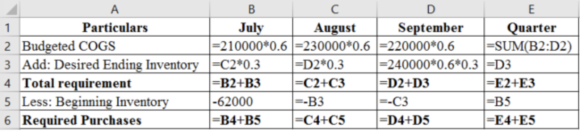

Prepare the merchandize purchase schedule as follows:

$$ \begin{array}{|l|c|c|c|c|} \hline {\text { Particulars }} & \text { July } & \text { August } & \text { September } & \text { Quarter } \\ \hline \text { Budgeted COGS } & \$ 126,000 & \$ 138,000 & \$ 132,000 & \$ 396,000 \\ \hline \text { Add: Desired Ending Inventory } & \$ 41,400 & \$ 39,600 & \$ 43,200 & \$ 43,200 \\ \hline \text { Total requirement } & \$ 167,400 & \$ 177,600 & \$ 175,200 & \$ 439,200 \\ \hline \text { Less: Beginning Inventory } & (\$ 62,000) & (\$ 41,400) & (\$ 39,600) & (\$ 62,000) \\ \hline \text { Required Purchases } & \$ 105,400 & \$ 136,200 & \$ 135,600 & \$ 377,200 \\ \hline \end{array} $$

Formulas for the above calculations are as follows:

Part 2

$$ \begin{array}{|l|c|c|c|c|} \hline {\text { Particulars }} & \text { July } & \text { August } & \text { September } & \text { Quarter } \\ \hline \text { Budgeted COGS } & \$ 126,000 & \$ 138,000 & \$ 132,000 & \$ 396,000 \\ \hline \text { Add: Desired Ending Inventory } & \$ 41,400 & \$ 39,600 & \$ 43,200 & \$ 43,200 \\ \hline \text { Total requirement } & \$ 167,400 & \$ 177,600 & \$ 175,200 & \$ 439,200 \\ \hline \text { Less: Beginning Inventory } & (\$ 62,000) & (\$ 41,400) & (\$ 39,600) & (\$ 62,000) \\ \hline \text { Required Purchases } & \$ 105,400 & \$ 136,200 & \$ 135,600 & \$ 377,200 \\ \hline \end{array} $$

Purchases are made by the requirement of the current month and next month’s sales. The required ending inventory is equal to the amount of next month’s cost of sales. Thus add the desired ending inventory to the budgeted cost of goods sold. Then deduct the beginning inventory from the total requirement to arrive at the number of required purchases.

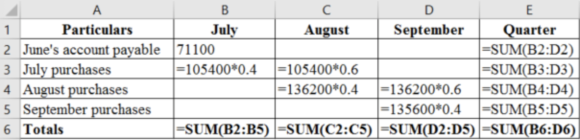

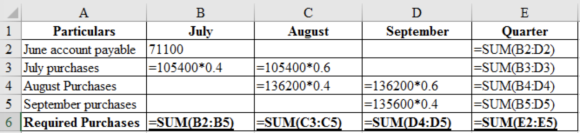

Prepare merchandize payment schedule as follows:

$$ \begin{array}{|l|c|c|c|c|c|} \hline {\text { Particulars }} & \text { July } & \text { August } & \text { September } & \text { Quarter } \\ \hline \text { June's account payable } & \$ 71,100 & & & \$ 71,100 \\ \hline \text { July purchases } & \$ 42,160 & \$ 63,240 & & \$ 105,400 \\ \hline \text { August purchases } & & \$ 54,480 & \$ 81,720 & \$ 136,200 \\ \hline \text { September purchases } & & & \$ 54,240 & \$ 54,240 \\ \hline \text { Totals } & \$ 113,260 & \$ 117,720 & \$ 135,960 & \$ 366,940 \\ \hline \end{array} $$

Formulas for the above calculations are as follows:

Part 2-b

$$ \begin{array}{|l|c|c|c|c|c|} \hline {\text { Particulars }} & \text { July } & \text { August } & \text { September } & \text { Quarter } \\ \hline \text { June's account payable } & \$ 71,100 & & & \$ 71,100 \\ \hline \text { July purchases } & \$ 42,160 & \$ 63,240 & & \$ 105,400 \\ \hline \text { August purchases } & & \$ 54,480 & \$ 81,720 & \$ 136,200 \\ \hline \text { September purchases } & & & \$ 54,240 & \$ 54,240 \\ \hline \text { Totals } & \$ 113,260 & \$ 117,720 & \$ 135,960 & \$ 366,940 \\ \hline \end{array} $$

Calculation of various amounts in the schedule for payments is as follows:

Note: Cash payment of $55,000 ($60,000 - $5,000) per month has not been included in the payment schedule here as this schedule is prepared concerning merchandise payments.

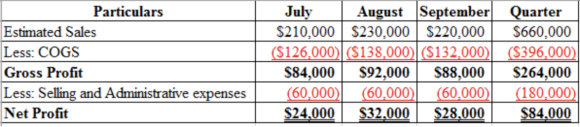

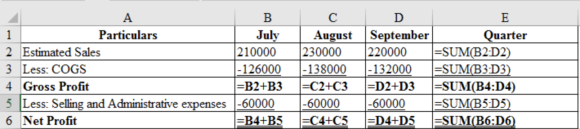

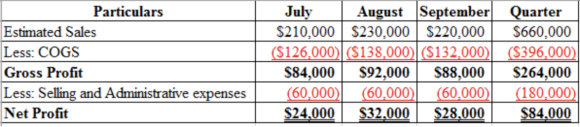

Prepare income statement as follows:

Formulas for the above calculation are as follows:

Part 3

Deduct the estimated cost of goods sold (COGS) from the estimated sales to arrive at the gross profit. Then deduct the selling and administrative expenses from the gross profit to arrive at the net profit.

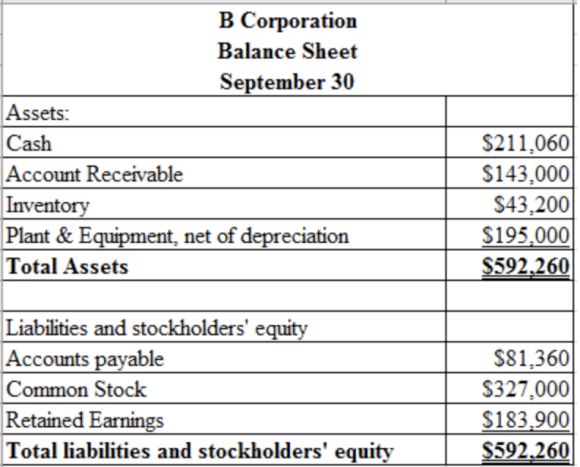

Prepare the balance sheet as follows:

Thus, the total of assets and liabilities and stockholders’ equity is $592,260 each.

Part 4

The total of assets and liabilities and stockholders’ equity is $592,260 each.

Add the net profit earned in the quarter to the beginning retained earnings to arrive at the ending retained earnings. That is $183,900 ($99,900 + $84,000). Accounts receivables are 65% of September month’s sales. Cash balance adds sales collections received and deduct the purchases made by cash.

Related Solutions

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year.

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year.

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year.

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter...

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter...

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter...

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter...

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter...

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter...

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

Dr. OWL answered 5 years ago

Dr. OWL answered 5 years ago