Question

In: Accounting

The type of product a company produces affects the type of accounting system needed to determine...

The type of product a company produces affects the type of accounting system needed to determine product cost. The 2 most common types of costing systems are job-order costing and process costing. Respond to the following in a minimum of 175 words:

- Compare and contrast job-order and process costing systems. How can events in a job-order costing system affect financial statements? How can events in a process costing system affect financial statements? Provide specific examples for each type.

Solutions

Expert Solution

The job order costing is the optimal accounting method when costs and production specifications are not identical for each product or customer but the direct material and direct labor costs can easily be traced to the final product. Job order costing is often a more complex system and is appropriate when the level of detail is necessary, as discussed in Job Order Costing. Examples of products manufactured using the job order costing method include tax returns or audits conducted by a public accounting firm, custom furniture, or, in a comprehensive example, semitrucks. At the Peterbilt factory in Denton, Texas, the company can build over 100,000 unique versions of their semitrucks without making the same truck twice.

Process costing is the optimal costing system when a standardized process is used to manufacture identical products and the direct material, direct labor, and manufacturing overhead cannot be easily or economically traced to a specific unit. Process costing is used most often when manufacturing a product in batches. Each department or production process or batch process tracks its direct material and direct labor costs as well as the number of units in production. The actual cost to produce each unit through a process costing system varies, but the average result is an adequate determination of the cost for each manufactured unit. Examples of items produced and accounted for using a form of the process costing method could be soft drinks, petroleum products, or even furniture such as chairs, assuming that the company makes batches of the same chair, instead of customizing final products for individual customers.

Job order costing method effect the financial statements .

Financial Statement Impact Scenarios

How a job’s cost appears on the financial statements depends on its condition at the financial statement date. Considering the previous illustration:

- If the raw material had not yet started into production, its $10,000 cost would appear in the raw materials inventory category on the balance sheet.

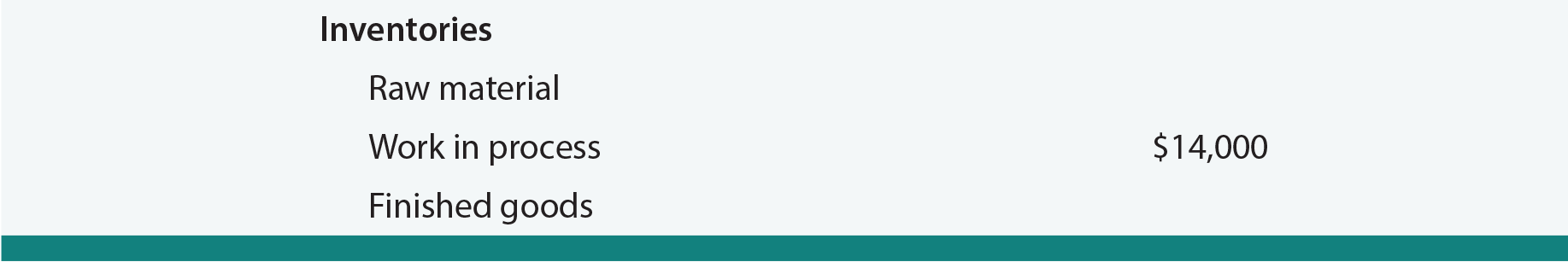

- If the material was in production but not complete, the total cost in the Work in Process account as of the balance sheet date would be aggregated and presented as work in process inventory on the balance sheet. For example, assume all of the raw material was in process, but only half of the necessary labor tasks had been performed; in this case, the Work in Process Inventory account would include $14,000 ($10,000 direct material + $1,500 labor + $2,500 applied overhead):

-

Related Solutions

The type of product a company produces affects the type of accounting system needed to determine...

*please type out the answer. The Hampton Company produces and sells a single product. The following...

Explain how the type of disease, Thalassemia affects the skeletal system. Is the disorder systemic or...

Bearkat Corporation is a manufacturing company that uses an actual costing system and produces one type...

Subject : Accounting Information System Question : The revenue cycle affects the bottom line of the...

Suppose that an accounting firm does a study to determine the time needed to complete one...

Suppose that an accounting firm does a study to determine the time needed to complete one...

suppose that an accounting firm does a study to determine the time needed to complete one...

Suppose that an accounting firm does a study to determine the time needed to complete one...

Friar Inc produces one product and the company uses a standard cost system and determines that...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago