Question

In: Accounting

Exercise 21-21 Overhead controllable and volume variances; overhead variance report LO P3 James Corp. applies overhead...

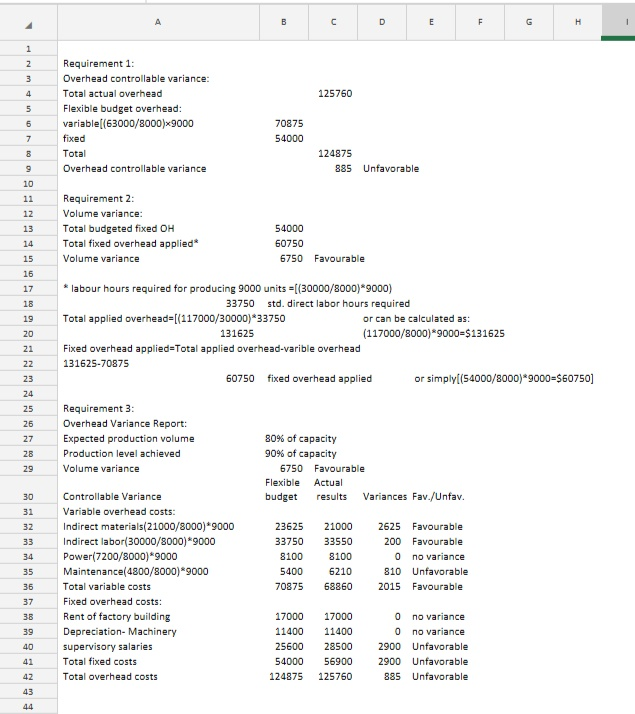

Exercise 21-21 Overhead controllable and volume variances; overhead variance report LO P3 James Corp. applies overhead on the basis of direct labor hours. For the month of May, the company planned production of 8,000 units (80% of its production capacity of 10,000 units) and prepared the following overhead budget: Operating Levels Overhead Budget 80% Production in units 8,000 Standard direct labor hours 30,000 Budgeted overhead Variable overhead costs Indirect materials $ 21,000 Indirect labor 30,000 Power 7,200 Maintenance 4,800 Total variable costs 63,000 Fixed overhead costs Rent of factory building 17,000 Depreciation—Machinery 11,400 Supervisory salaries 25,600 Total fixed costs 54,000 Total overhead costs $ 117,000 During May, the company operated at 90% capacity (9,000 units) and incurred the following actual overhead costs: Overhead Costs Indirect materials $ 21,000 Indirect labor 33,550 Power 8,100 Maintenance 6,210 Rent of factory building 17,000 Depreciation—Machinery 11,400 Supervisory salaries 28,500 Total actual overhead costs $ 125,760 1. Compute the overhead controllable variance. 2. Compute the overhead volume variance. 3. Prepare an overhead variance report at the actual activity level of 9,000 units.

Solutions

Related Solutions

Using the information in P25-2A compute the overhead controllable variance and the overhead volume variance Ayala...

Problem 21-3A Flexible budget preparation; computation of materials, labor, and overhead variances; and overhead variance report...

Exercise 08-12 Direct materials and direct labor variances LO P3 Reed Corp. has set the following...

Exercise 21-12 Direct materials and direct labor variances LO P2 Reed Corp. has set the following...

James Corp. applies overhead on the basis of direct labor hours. For the month of May,...

James Corp. applies overhead on the basis of direct labor hours. For the month of May,...

James Corp. applies overhead on the basis of direct labor hours. For the month of May,...

James Corp. applies overhead on the basis of direct labor hours. For the month of May,...

James Corp. applies overhead on the basis of direct labor hours. For the month of May,...

James Corp. applies overhead on the basis of direct labor hours. For the month of May,...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 2 weeks ago

ekkarill92 answered 2 weeks ago