Question

In: Accounting

1- Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 156,100...

1-

Break-Even Sales Under Present and Proposed Conditions

Darby Company, operating at full capacity, sold 156,100 units at a price of $108 per unit during the current year. Its income statement is as follows:

| Sales | $16,858,800 | ||

| Cost of goods sold | 5,976,000 | ||

| Gross profit | $10,882,800 | ||

| Expenses: | |||

| Selling expenses | $2,988,000 | ||

| Administrative expenses | 1,800,000 | ||

| Total expenses | 4,788,000 | ||

| Income from operations | $6,094,800 |

The division of costs between variable and fixed is as follows:

| Variable | Fixed | |||

| Cost of goods sold | 60% | 40% | ||

| Selling expenses | 50% | 50% | ||

| Administrative expenses | 30% | 70% | ||

Management is considering a plant expansion program for the following year that will permit an increase of $1,296,000 in yearly sales. The expansion will increase fixed costs by $172,800, but will not affect the relationship between sales and variable costs.

Required:

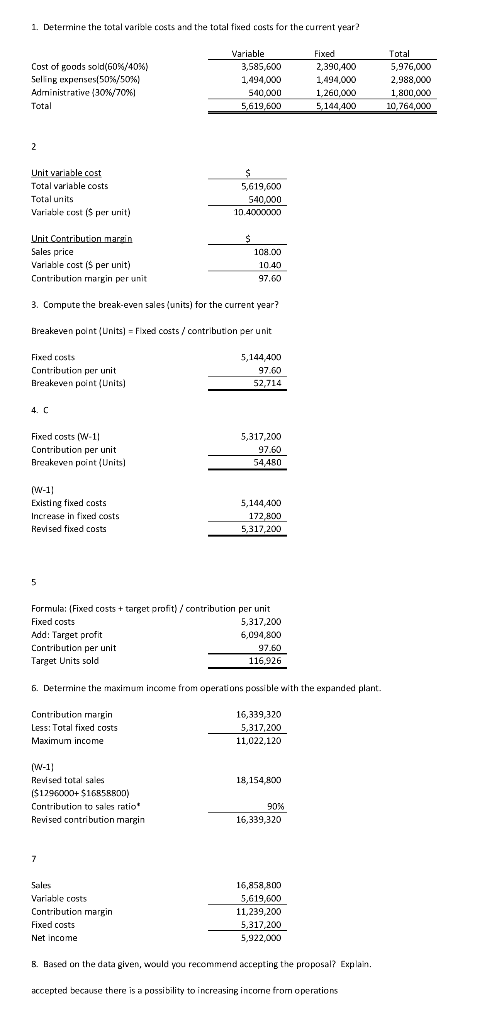

1. Determine the total variable costs and the total fixed costs for the current year.

| Total variable costs | $ |

| Total fixed costs | $ |

2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year.

| Unit variable cost | $ |

| Unit contribution margin | $ |

3.

Compute the break-even sales (units) for the current year.

units

4.

Compute the break-even sales (units) under the proposed program for

the following year.

units

5.

Determine the amount of sales (units) that would be necessary under

the proposed program to realize the $6,094,800 of income from

operations that was earned in the current year.

units

6.

Determine the maximum income from operations possible with the

expanded plant.

$

7. If

the proposal is accepted and sales remain at the current level,

what will the income or loss from operations be for the following

year?

$

8. Based on the data given, would you recommend accepting the proposal?

- In favor of the proposal because of the reduction in break-even point.

- In favor of the proposal because of the possibility of increasing income from operations.

- In favor of the proposal because of the increase in break-even point.

- Reject the proposal because if future sales remain at the current level, the income from operations will increase.

- Reject the proposal because the sales necessary to maintain the current income from operations would be below the current year sales.

Choose the correct answer.

2-

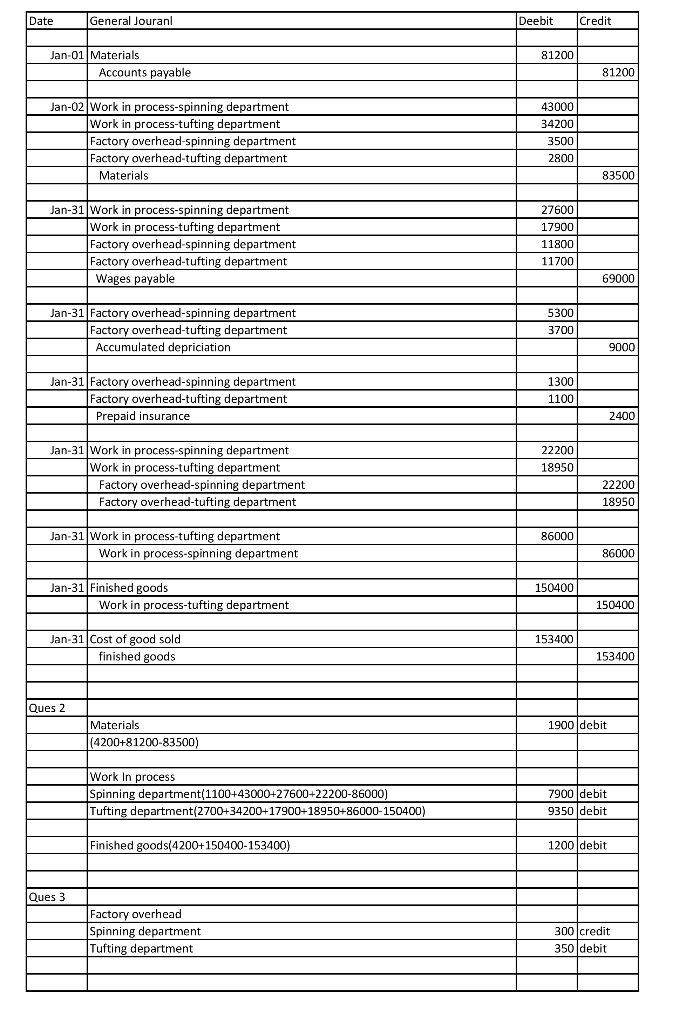

Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting Department, where carpet backing is added at the beginning of the process and the process is completed. On January 1, Port Ormond Carpet Company had the following inventories:

| Finished Goods | $6,200 |

| Work in Process-Spinning Department | 1,100 |

| Work in Process-Tufting Department | 2,700 |

| Materials | 4,200 |

Departmental accounts are maintained for factory overhead, and both have zero balances on January 1. Manufacturing operations for January are summarized as follows:

| Jan. | 1 | Materials purchased on account, $81,200 |

| 2 | Materials requisitioned for use: | |

| Fiber—Spinning Department, $43,000 | ||

| Carpet backing—Tufting Department, $34,200 | ||

| Indirect materials—Spinning Department, $3,500 | ||

| Indirect materials—Tufting Department, $2,800 | ||

| 31 | Labor used: | |

| Direct labor—Spinning Department, $27,600 | ||

| Direct labor—Tufting Department, $17,900 | ||

| Indirect labor—Spinning Department, $11,800 | ||

| Indirect labor—Tufting Department, $11,700 | ||

| 31 | Depreciation charged on fixed assets: | |

| Spinning Department, $5,300 | ||

| Tufting Department, $3,700 | ||

| 31 | Expired prepaid factory insurance: | |

| Spinning Department, $1,300 | ||

| Tufting Department, $1,100 | ||

| 31 | Applied factory overhead: | |

| Spinning Department, $22,200 | ||

| Tufting Department, $18,950 | ||

| 31 | Production costs transferred from Spinning Department to Tufting Department, $86,000 | |

| 31 | Production costs transferred from Tufting Department to Finished Goods, $150,400 | |

| 31 | Cost of goods sold during the period, $153,400 |

| Required: | |

| 1. | Journalize the entries to record the operations, using the dates provided with the summary of manufacturing operations. Refer to the Chart of Accounts for exact wording of account titles. |

| 2. | Compute the January 31 balances of the inventory accounts. |

| 3. | Compute the January 31 balances of the factory overhead accounts. |

Solutions

Related Solutions

1. Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 148,400...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 163,500 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 97,700 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 167,200 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 139,000 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 167,200 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 120,200 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 122,850 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 148,400 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 99,700 units...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ekkarill92 answered 4 weeks ago

ekkarill92 answered 4 weeks ago