Question

In: Economics

Suppose that the U.S. government reduces the tariff on imported coffee, and a reputable study is...

Suppose that the U.S. government reduces the tariff on imported coffee, and a reputable study is published indicating that coffee drinkers have lower rates of colon cancer. What will the combined impact be on the equilibrium price and quantity of coffee? Explain your reasoning and show graphically the impact of these effects.

I sent the work I had to my professor, and he sent back this question: Keep in mind that in the short run assets are fixed. What impact does this have on supply?

This is the work I have so far, but I feel like I'm missing something due to the question he sent me (note: he won't help me more than that): Reasoning: If the tariff on imported coffee reduces, more coffee will be bought (and thus, more coffee is imported) by companies in order to gain a bigger profit; therefore, supply will shift to the right (most likely, supply would increase more than demand because of the reduced tariff + bigger profit companies can make) . Companies can sell the coffee at the same price since they did not have to pay as large a tariff to import it. Lower import cost with unchanged prices will make for a bigger profit. These are both proven by “more product will be bought the lower its price”. In addition, people will demand and buy more coffee when they see that a reputable study says coffee drinkers are at less risk for colon cancer. This shifts demand and moves the quantity equilibrium.

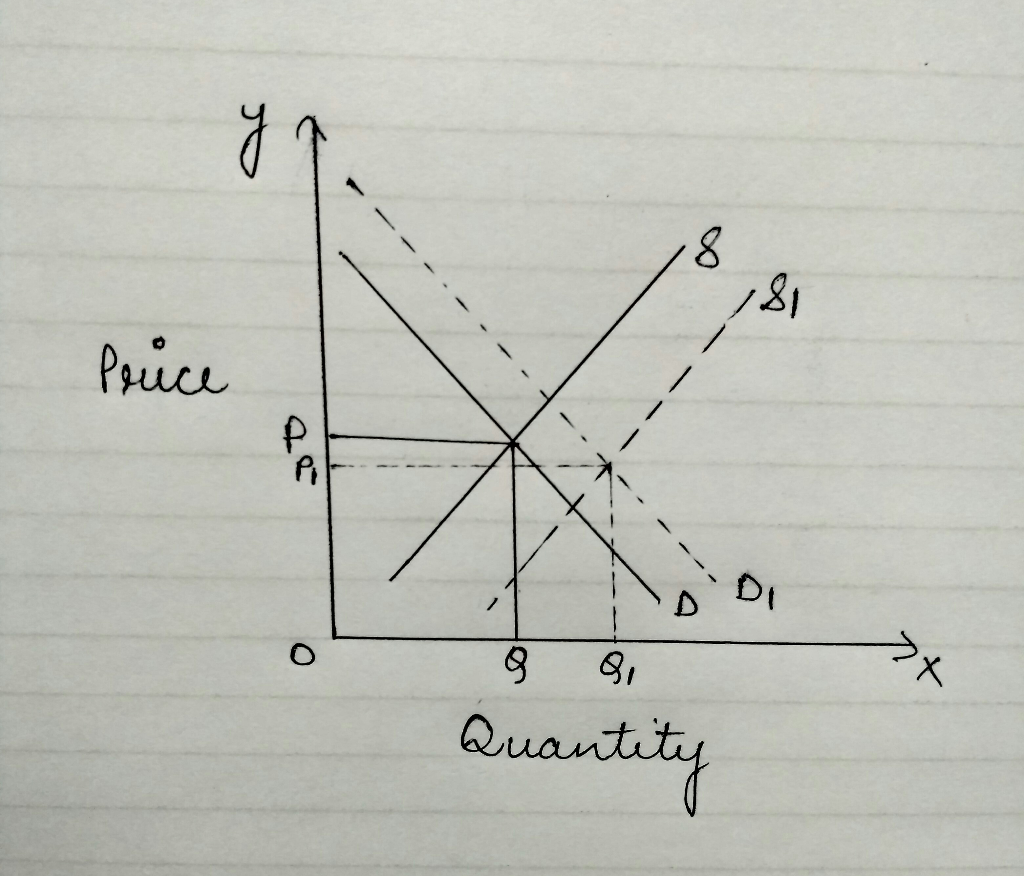

The orange and blue lines show the supply and demand of the coffee before the tariff is reduced. The thinner orange and blue lines (S1 and D1) show supply and demand after the tariff is reduced. Dashed lines show equilibrium between price and quantity. Q0 and P0 show the equilibrium before tariff is reduced. Q1 and P1 show the equilibrium after tariff is reduced. The end result is supply and demand both go through an increase (demand and supply move to the right), the price stays steady, and the quantity demanded equilibrium changes.

Solutions

Expert Solution

The reasoning you gave is absolutely correct. The supply curve will shift forward due to increase in supply because of the deceased tariff rates and the demand curve will shift forward because people will demand more and more coffee after the reputable study published that coffee drinker s have lower rates of colon cancer.

Graphical representation:

Here, the supply curve shifted forward from S to S1 and the demand curve shifted forward from D to D1. This lead to a change in the equilibrium and the equilibrium price changed from P to P1 (decreased) and the equilibrium quantity changed from Q to Q1 (increased).

Also, one point o be noted is the change is supply might not be equal to the change in demand so the price might not remain steady and might lower down.

NOTE: IF YOU ARE SATISFIED WITH MY ANSWER PLEASE PROVIDE RATING. THANK YOU AND HAVE A NICE DAY. :))

Related Solutions

Analyse how imported tariff by US on imported steel , almiuum and ather product from chine...

Suppose the government reduces taxes by $20 billion and that the MPC is .75

When the U.S. Government imposes a tariff on imports, 1. what happens to the price of...

Suppose the U.S. is considering raising the tariff on Chinese steel. The steel industry is the...

Suppose that the Malaysian government is considering whether to impose an import tariff or quota to...

Suppose that instead of tariff, a quota is imposed, explain the disadvantages in terms of government...

C. “If the nominal tariff is 40% on imported textile and 15 % on important leather...

Suppose that in the market for coffee, the government decides to impose a tax on the...

32. Suppose that in the market for coffee, the government decides to impose a tax on...

You are a pork producer in Indiana. We now have a tariff on imported steel from...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

Rahul Sunny answered 4 weeks ago

Rahul Sunny answered 4 weeks ago