Question

In: Economics

Imagine the New Zealand economy is initially at the potential level of output, but that due...

Imagine the New Zealand economy is initially at the potential level of output, but that due to a decrease in house prices, the level of consumption within the economy falls (because consumer confidence decreased).

(a) Show what effect this has on the New Zealand economy in the context of an AD-AS diagram.

(i) Label the original long-run equilibrium point "A". Label the short-run equilibrium outcome of the decrease in house prices "B"

(ii) Briefly explain what happens to output and the inflation rate.

(b) Explain and show on your diagram in part (a) what would happen

to output and the inflation rate in the long-run if the government

does nothing to accommodate this shock. Label this long-run outcome

"C".

(c) If the government accommodates this shock, what policies would

return the economy to the potential level of output? Explain how

these would work, and make sure you also explain what happens to

output and the inflation rate.

Solutions

Expert Solution

(a)

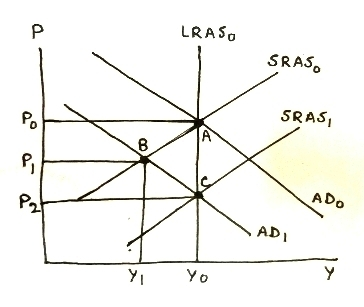

(i) In following graph, initial long-run equilibrium is at point A where AD0 (aggregate demand), LRAS0 (long-run aggregate supply) and SRAS0 (short-run aggregate supply) curves intersect, with long-run equilibrium price level P0 and real GDP (equal to Potential GDP) Y0.

(ii) Decrease in consumer confidence decreases consumption demand, in turn lowering aggregate demand. AD curve will shift to left, reducing price level (inflation) and reducing real GDP (output), causing a recessionary gap in short run.

In above graph, AD curve will shift leftward from AD0 to AD1, intersecting SRAS0 at point B with lower price level P1 and lower real GDP Y1, with recessionary gap being equal to (Y1 - Y0) in short run.

(b)

In long run without intervention, lower price level reduces input costs, so firms increase production, in turn increasing aggregate supply. SRAS shifts rightward, intersecting new AD curve at further lower price level but restoring original real GDP (output), eliminating the recessionary gap.

In above graph, SRAS0 shifts right to SRAS1, intersecting AD1 at point C with further lower price level P2 and restoring real GDP to potential GDP level Y0.

(c)

Government could accommodate this shock by increasing aggregate demand, using expansionary fiscal policy (increasing government spending and/or decreasing tax). As aggregate demand increases, AD curve will shift rightward, increasing price level and increasing real GDP (output).

Related Solutions

Assume that the economy is initially at the natural level of output. A permanent increase in...

2. Assume the economy is initially in a short-run equilibrium at a level of output below...

2. Macroeconomic Policy & Price Adjustment Curves: Suppose that the economy is initially at potential output....

Stabilization Policy: Suppose the economy is initially above potential output. If policymakers prefer price stability and...

Accommodative vs. Non-accommodative Monetary Policy: Suppose the economy is initially at potential output. A rapid increase...

Consider a large open economy. Imagine that initially the economy is bor- rowing from the rest...

Suppose an economy is Initially in equilibrium at potential GDP, Y*. Then the government decreases the...

Suppose an economy is Initially in equilibrium at potential GDP, Y*. Then the government decreases the...

Question 1 (New Zealand External Reporting Environment) Explain ONE potential benefit and ONE potential problem that...

An economy is initially in equilibrium at the natural level. The central bank increases the money...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

Rahul Sunny answered 1 month ago

Rahul Sunny answered 1 month ago