Question

In: Finance

A saver wants $100,000 after ten years and believes that it is possible to earn an...

A saver wants $100,000 after ten years and believes that it is possible to earn an annual rate of 8 percent on invested funds.

a) What amount must be invested each year to accumulate $100,000 if (1) the payments are made at the beginning of each year or (2) they are made at the end of each year?

b) How much must be invested annually if the expected yield is only 5 percent?

Please show step-by-step how to solve within excel

Solutions

Expert Solution

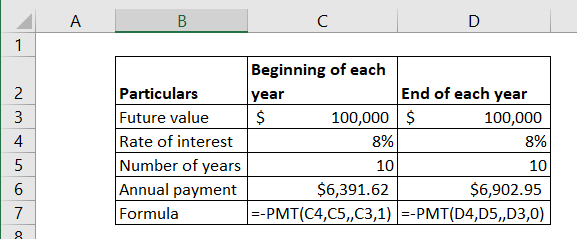

(a)

Annual payment required if payment at beginning of year is $6,391.61 and payment is $6,902.95 if payment is at end of each year. Lesser amount is payable for beginning of year payments because time value of money is higher for payments made at earliest.

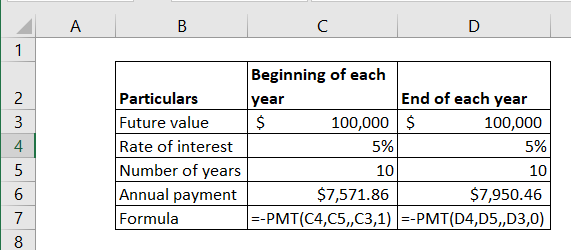

(b)

Annual payments when interest rate is 5%:

Excel formulas are shown in the screenshot. Higher annual payments are due to lower interest rate in the second scenario.

Please rate. Comment before negatively rating the answer. Thank you.

Related Solutions

3. A saver wants $100,000 after ten years and believes that it is possible to earn...

At 20 years old, Josh is an avid saver. He wants to put an equalamount...

At 20 years old, Josh is an avid saver. He wants to put an equal amount...

Assume an investment costing $24,869 will earn $10,000 a year for ten years. If the discount...

A researcher believes that in recent years women have been getting taller. Ten years ago, the...

Equipment that is purchased for $12,000 now is expected to be sold after ten years for...

Cornerstone Exercise 16.4 (Algorithmic) After-Tax Profit Targets Olivian Company wants to earn $600,000 in net (after-tax)...

Cornerstone Exercise 16.4 (Algorithmic) After-Tax Profit Targets Olivian Company wants to earn $300,000 in net (after-tax)...

After-Tax Profit Targets Olivian Company wants to earn $300,000 in net (after-tax) income next year. Its...

After-Tax Profit Targets Olivian Company wants to earn $300,000 in net (after-tax) income next year. Its...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

jeff jeffy answered 1 month ago

jeff jeffy answered 1 month ago