Question

In: Math

A number of restaurants feature a device that allows credit card users to swipe their cards...

A number of restaurants feature a device that allows credit card users to swipe their cards at the table. It allows the user to specify a percentage or a dollar amount to leave as a tip. In an experiment to see how it works, a random sample of credit card users was drawn. Some paid the usual way, and some used the new device. The percent left as a tip was recorded and listed below. Using a = 0.05, what can we infer regarding users of the device?

| Usual | Device |

| 12.4 | 12.0 |

| 14.2 | 15.2 |

| 11.7 | 9.9 |

| 11.4 | 12.2 |

| 11.9 | 14.9 |

| 11.4 | 13.4 |

| 10.6 | 12.1 |

| 12.1 | 13.0 |

| 14.2 | 10.3 |

| 15.9 | 13.2 |

| 13.9 |

| a. |

There is statistically significant evidence to conclude that users of the device leave larger tips than customers who pay in the usual manner. |

|

| b. |

There is statistically significant evidence to conclude that users of the device leave smaller tips than customers who pay in the usual manner. |

|

| c. |

There is statistically significant evidence to conclude that users of the device and customers who pay in the usual manner do not differ in the percentage value of their tips. |

|

| d. |

There is insufficient statistical evidence to make any conclusions from this data. |

Solutions

Expert Solution

A number of restaurants feature a device that allows credit card users to swipe their cards at the table. It allows the user to specify a percentage or a dollar amount to leave as a tip. In an experiment to see how it works, a random sample of credit card users was drawn. Some paid the usual way, and some used the new device. The percent left as a tip was recorded and listed below. Using a = 0.05, what can we infer regarding users of the device?

|

a. |

There is statistically significant evidence to conclude that users of the device leave larger tips than customers who pay in the usual manner. |

|

|

b |

There is statistically significant evidence to conclude that users of the device leave smaller tips than customers who pay in the usual manner. |

|

|

Answer: c |

There is statistically significant evidence to conclude that users of the device and customers who pay in the usual manner do not differ in the percentage value of their tips. |

|

|

d |

There is insufficient statistical evidence to make any conclusions from this data. |

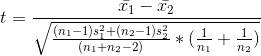

= 0.1100

DF = n1+n2-2 =19

Table value of t with 19 DF at 0.05 level = 2.0930

Rejection Region: Reject Ho if t < -2.0930 or t > 2.0930

Calculated t = 0.1100, not in the rejection region

The null hypothesis is not rejected.

|

Pooled-Variance t Test for the Difference Between Two Means |

|

|

(assumes equal population variances) |

|

|

Data |

|

|

Hypothesized Difference |

0 |

|

Level of Significance |

0.05 |

|

Population 1 Sample |

|

|

Sample Size |

11 |

|

Sample Mean |

12.7 |

|

Sample Standard Deviation |

1.6143 |

|

Population 2 Sample |

|

|

Sample Size |

10 |

|

Sample Mean |

12.62 |

|

Sample Standard Deviation |

1.7178 |

|

Intermediate Calculations |

|

|

Population 1 Sample Degrees of Freedom |

10 |

|

Population 2 Sample Degrees of Freedom |

9 |

|

Total Degrees of Freedom |

19 |

|

Pooled Variance |

2.7693 |

|

Standard Error |

0.7271 |

|

Difference in Sample Means |

0.0800 |

|

t Test Statistic |

0.1100 |

|

Two-Tail Test |

|

|

Lower Critical Value |

-2.0930 |

|

Upper Critical Value |

2.0930 |

|

p-Value |

0.9135 |

|

Do not reject the null hypothesis |

|

Related Solutions

Recording credit card and debit card sales Restaurants do a large volume of business with credit and debit cards. Suppose Summer,

Credit Cards Credit card numbers follow patterns. Cards must have 13 - 16 digits (inclusive) Card...

Credit Card Number Check. The last digit of a credit card number is the check digit,...

Credit Card Number Check. The last digit of a credit card number is the check digit,...

Credit Card Number Check. The last digit of a credit card number is the check digit,...

Phoenix Restaurants accepts credit and debit cards as forms of payment. Assume Phoenix had $12,000 of credit and debit card sales on June 30, 2017.

2. TurboCard credit card company offers a loyalty program to its credit card users whereby the...

An individual has Centurion Card from American Express (credit cards). The credit card is most valuable...

FINDtwo different credit card applications (e.g., online, at restaurants, etc.). COMPAREthe two credit card offers by...

Credit card usage in the United States is substantial. Many startup companies use credit cards as...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

milcah answered 1 month ago

milcah answered 1 month ago