Question

In: Finance

) Assume that you have successfully completed the R&D phase of a new product development project;...

) Assume that you have successfully completed the R&D phase of a new product development project; this phase took several years and cost an estimated $14.75 million but resulted in a successful prototype product. You and your company are now ready to start the market development and research phase of your new product development project. It is estimated that the market development and research phase of this project will take two years and cost $11.5M per year. There is an eighty percent probability that the market development and research phase will indicate that a viable market exists for your new product.

Before your company can begin the market development and research phase, however, a long-time rival announced that it plans to market a similar product in one year that will directly compete with your newly developed product. Your company feels that there is a 60 percent probability that your new product will be superior to your competitor’s product.

If your company’s product is superior to your competitor’s product and the market development phase indicates that a viable market exists, you will earn a net profit of $10 million per year for ten years. If your product is inferior to your competitor’s product, you will terminate the project. Assuming a discount rate of 14 percent, calculate the expected NPV of your new product assuming that you proceed immediately with the marketing development and research phase.

In analyzing this problem, you should make the following assumptions. First, if you learn that your competitor’s product is better than your product after one year of market development, you will terminate the project and not incur the market development cost ($11.5M) for the second year. Second, assume that all cash flows occur at the end of the year.

Compare your results to the case when you decide to wait for one year (to learn more about your competitor’s product) before proceeding with the market development and research phase. If you postpone the market development phase by a year, however, and your product is superior to your competitor’s project (and a viable market exists), it will only have a nine year life span. What do you think is your best strategy? Why?

Solutions

Expert Solution

R&D Phase cost - $14.75 million

Market and Development Phase Cost – $11.5 million for next 2 years

each

Probability of a viable market – 80%

Probability of your product being superior than competition =

60%

If viable market and product superior – Net profit = $10 million

for 10 years.

If product inferior – project terminated

Discount Rate – 14%

Assumptions –

- If at the end of 1 year you get to know product is inferior, project will be terminated after 1 year, without incurring cost in 2nd year.

- All cash flow occurs at the end of year.

Remember that R&D cost is a sunk cost and hence need not be

considered in the process of decision making.

Case 1: Product Inferior probability = 1 – product superior

probability = 1 – 60% = 40%

Case 2: Product Superior, but market unviable probability = Product

superior probability*(1 – market viable) = 60%*(1 – 80%) = 60%*20%

= 12%

Case 3: Product Superior and market also viable probability =

Product Superior Probability*Viable Market Probability = 60%*80% =

48%

Case 1: There is a 40% chance that product is inferior and then

project will have just 1 cashflow of -11.5 million at the end of

1st year.

Case 2: Of the remaining 60%, (1-80%) chance( total chance of this

scenario = 60%*20% = 12%), that market is not viable, in this case

there will be 2 cashflows of -11.5 million in year1 and year2

Case 3: Finally there is a chance of 60%*80% = 48% that project is

superior as well as viable and will have net profit of $10 million

for 10 years.

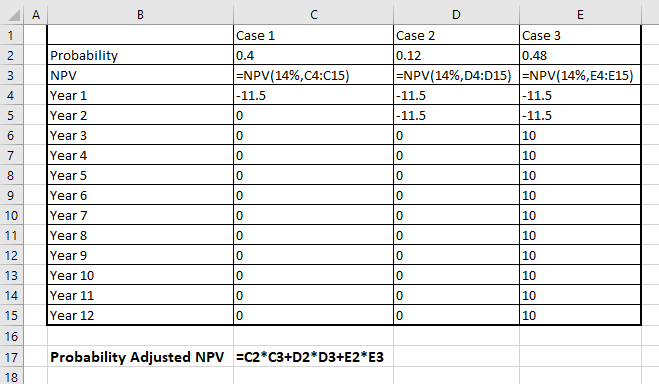

Cashflows as explained above, are entered in an excel sheet and

"NPV" formula is used to calculate the NPV of project in 3

different scenarios.

Probability adjusted NPV = Probability of case1*NPV of case1 +

Probability of case2*NPV of case2 + Probability of case3*NPV of

case3

Formulas look like below in excel -

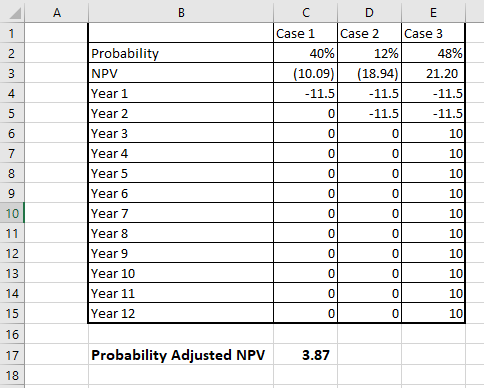

Values look like below in excel -

Hence, NPV of this project is +ve $3.87 million, and company should

go ahead with the project.

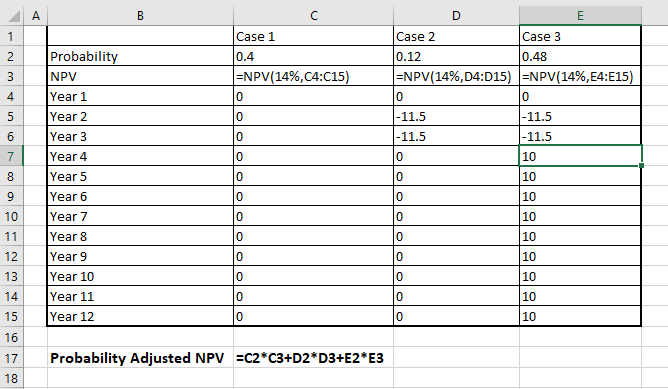

Now, what happened if company waits for 1 more year,

cashflows will look like below -

1. It will become 0 for all 3 cases in year 1

2. In case product is not viable(case1), there will be no expense

in year2 onwards in case1

3. For case2 that product is superior but market unviable, year2

and year3 will have a negative cashflow of 11.5 million and 0

onwards.

4. In case3, year2 and year3 will have same cashflow as case2, but

year4 to year12(9 years) will have a positive cashflow of 10

million.

Formulas in excel will look like below -

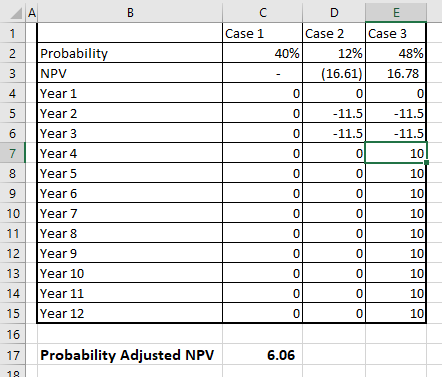

values in excel will look like below -

Hence, final NPV in this case is $6.06 million, which is

higher than the previous case, so company must wait for 1 year

before starting its market viability studies.

Related Solutions

The R&D department is planning to bid on a large project for the development of a...

You and your new partner have successfully built a prototype of your personal tax product and...

"Research and development (R & D) is a process intended to create new or improved technology...

NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department....

NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department....

NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department....

NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department....

NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department....

NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department....

NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

jeff jeffy answered 1 month ago

jeff jeffy answered 1 month ago